How to Use AI to Evaluate Industrial Real Estate Deals

5 prompts to analyze market trends, identify risks, and stress-test assumptions

This is a companion post to a fantastic article by Chad Griffiths - read that first if you haven’t already.

In this post, I’ll walk you through how I use AI to screen industrial real estate pitch decks quickly and effectively. You’ll see exactly how I:

Evaluate the market using AI (there is an excellent new tool for that!)

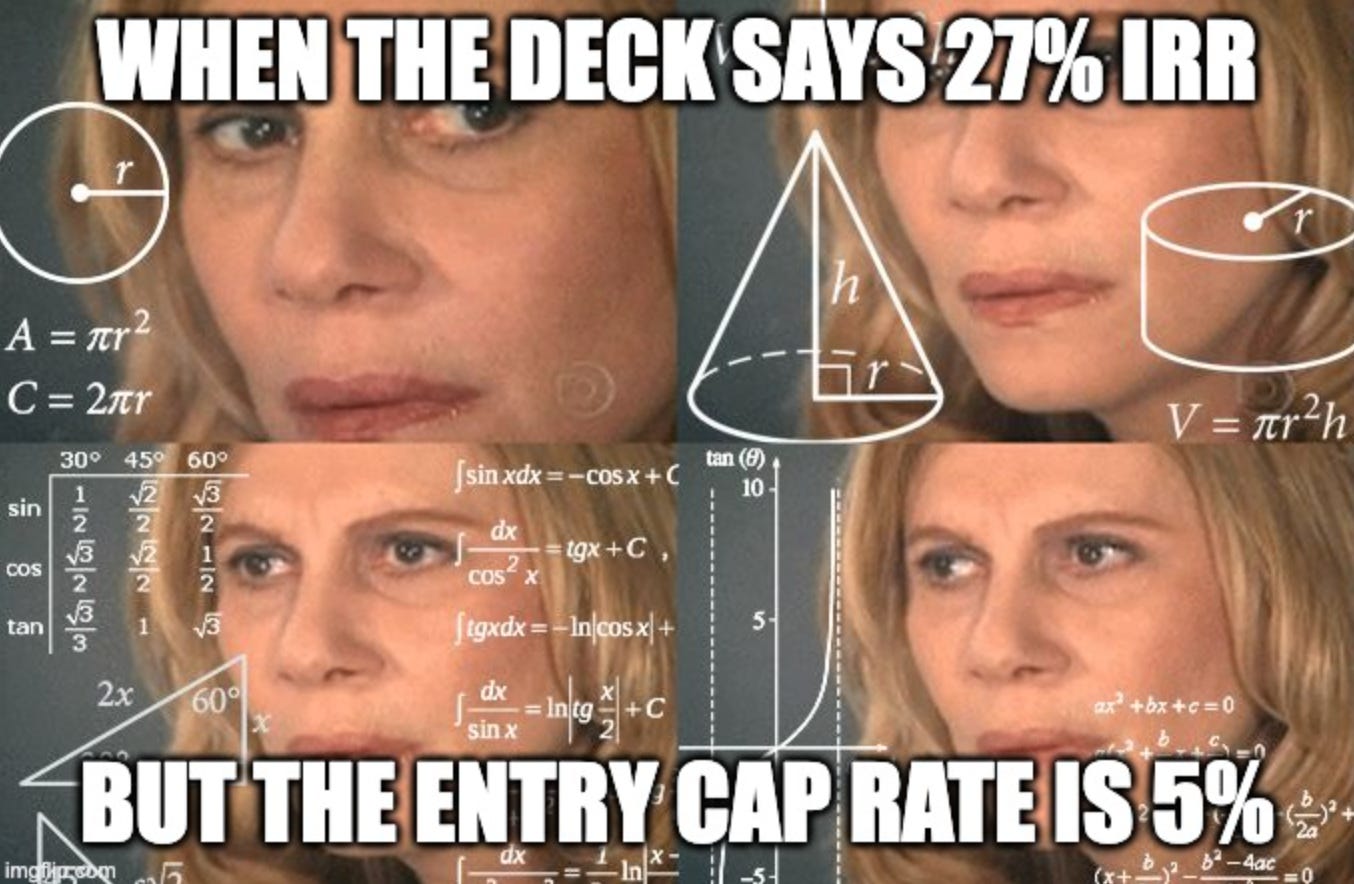

Extract and challenge underwriting assumptions

Build custom stress-test scenarios

Generate follow-up questions for sponsors

If you’re not using AI to do this already, this will save you hours.

👉 To find out the whys, the hows, and why I prefer NotebookLM, read this:

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or legal advice. Always conduct your own due diligence or consult a professional advisor before making investment decisions.

Step 1: Evaluate the Market (Don't Skip This)

Before you race off to NotebookLM with the pitch deck, HALT!

You need good market data. This is a critical step: without it, you won’t be able to challenge assumptions or spot aggressive underwriting (every step that follows needs this context). Lucky for us, there is a perfect tool for this (and it’s free):