Imaginary Gains, Real Fees

🧮 How private funds turn paper profits into real fees (and why LPs need to read page 763 of the prospectus)

Happy Sunday!

Today’s case study is a bit unusual. It’s a totally fictional and wildly exaggerated secondary fund. CRE folks, don’t zone out just yet: NAV-based evergreen CRE vehicles are closer cousins to these than you think.

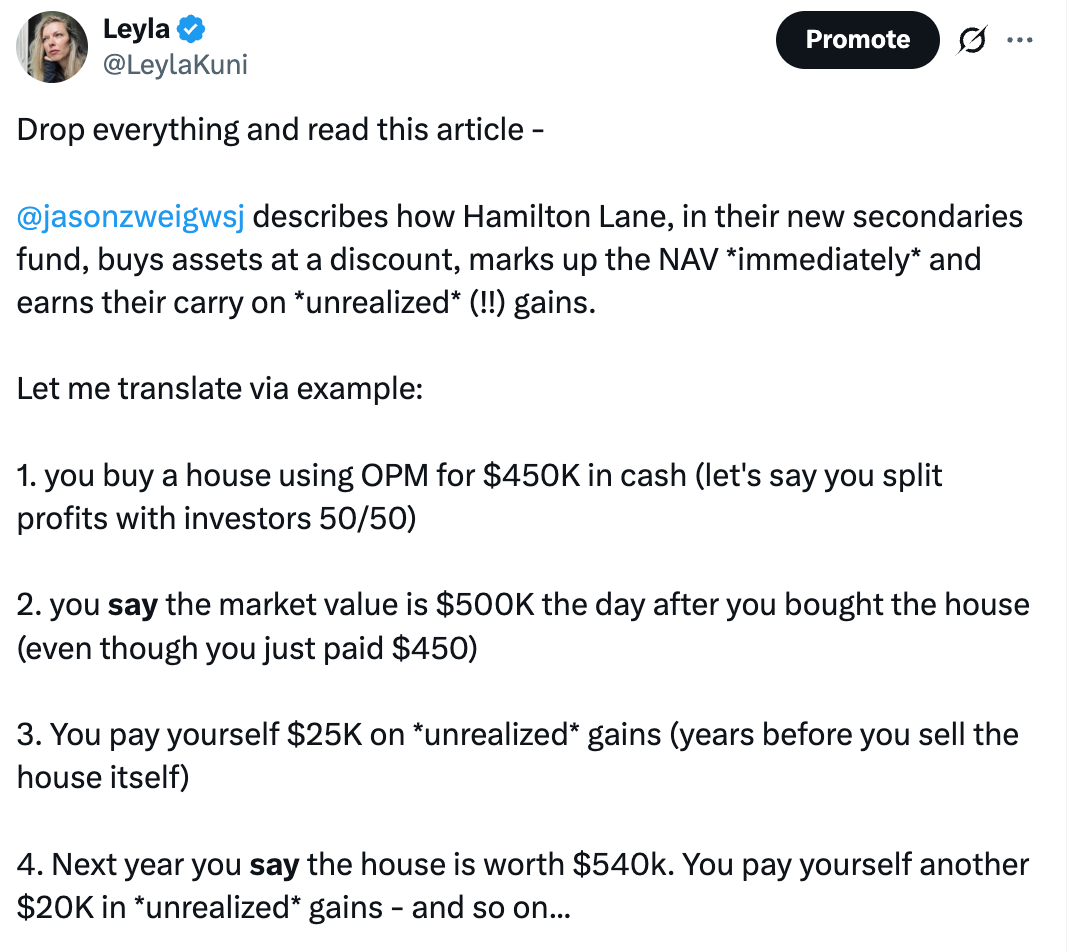

What inspired the case study is this Wall Street Journal article by Jason Zweig. I shared a simple analogy that caught fire on X/Twitter:

🍳 How the Sausage Is Made

Many of you and asked the same, excellent question:

“HOW THE HECK do they pay a promote if the assets aren’t sold??”

And since you would rather stab yourself with a fork than dive into the intricacies of GAAP statements, I thought I’d run with my analogy, and explain things in a simple fashion. (A deeper dive with Hamilton Lane financials is coming soon, stay tuned).

This is for educational purposes only—not financial advice. Numbers and details are purely fictional and hypothetical. Not a solicitation. Not a fund. Don’t ask me the sponsor’s name, fund already over-subscribed.

The Pitch

Awesome Secondary Fund buys private assets in the secondary market. Someone invested in these assets a few years ago, but now wants out. Awesome Fund steps in, negotiates a discount, and buys the stake.