Is Your BDC's Distribution Yield Reliable?

Looking Past Distributions to Find True Cash Flow

BDC distribution yields are difficult to ignore - but it’s not the best measure of a fund’s strength. They often stand tall with a double-digit return promoted conspicuously by the fund. But there’s a catch: that distribution yield could be more vulnerable than you think unless you know what to look for. True strength lies in the cash flow and net investment income (NII) that sustain it.

Before you place that buy order for your next BDC let’s dive in and open the hood to see what’s really funding those payouts. Read this on a high-level overview of five key categories for screening BDCs:

Dividends and Distributions

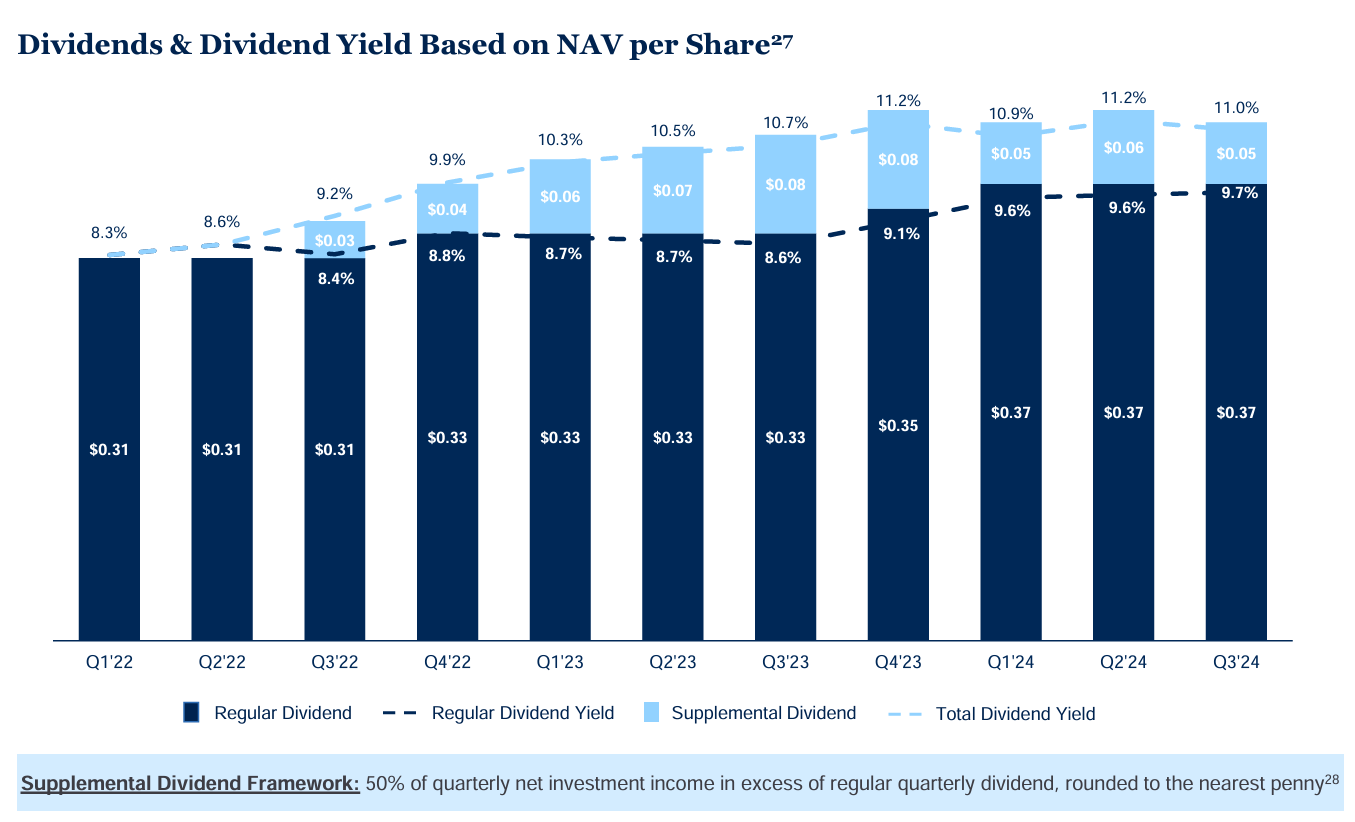

Below is the chart from Blue Owl’s quarterly earnings deck. This particular security, OBDC, throws off a distribution yield of 11%:

I’d like to draw your attention to two matters:

Dividends:

Dividend - a term used to describe fund payouts - has a particular connotation that the payout comes from the company’s profits. This isn’t always the case.Instead, I strongly prefer replacing dividend with the term “distribution”. That’s what it is, right? A company distributes funds to its investors from various sources, but it’s not necessarily a dividend. I would argue that investing is 90% psychological, so keep the research on your own terms rather than absorb the marketing material presented to you at face value.

Supplemental Distributions:

Note Blue Owls’ supplemental distribution, which you can see Blue Owl highlight in light blue in the chart above: it’s not a one-time occurrence. When such “supplemental distributions” are regular and recurring, they should be included in the coverage ratios. OBDC is not unique, by the way: each BDC in the industry issues a supplemental distribution for any additional income above a certain threshold.

IMPORTANT:

The data we analyze and provide to you will always include supplementary distributions in the coverage ratios when deemed regular and recurring. BDCs have set the precedent and income investors come to expect this. Unfortunately, BDC reporting doesn’t typically include supplemental distributions in the denominator of their coverage ratios.

Incorporate the term distribution rather than dividend into your analysis.

Remember that BDCs have to distribute 90% of their income. Some BDCs accrue material portions of the net investment income, with the expectation that it will receive the interest in cash from the borrower in the future. This can create some interesting dynamics as I’ll discuss later in the article.