It’s NAV... Until You Want Liquidity

Why illiquid assets belong in drawdown funds - and how to read property-level financials

Illiquid assets belong in drawdown funds.

There, I said it.

Yes, you can stuff illiquid assets into a semi-liquid vehicle and contort yourself to meet quarterly redemptions. Many funds do just fine, if they can keep raising capital (here’s an example), have a large liquidity sleeve (like this one), or carry minimal leverage.

But let’s be honest: any semi-liquid fund holding illiquid assets is exposed when investors want their money back. Liquidity works - until it doesn’t.

Today, we’ll do two things:

1️⃣ Look at a non-traded REIT working through a liquidity bottleneck - and what it means for remaining investors in the fund.

2️⃣ Walk through very basic property-level calculations from financial statements (embrace the suck, and find your inner Benjamin Graham, - it’s for your own good, I promise).

👉 As a bonus, I’ll show you a shortcut to assessing property-level debt (I used AI, Graham would be very jealous!)

🧼 The soapbox I’m not jumping on today is asset valuation.

You can read this excellent write-up instead. Many of the same dynamics apply here:

⚠️ Important: This content is for educational purposes only. It is not legal or investment advice, and should not be relied on as such.

Lightstone Value Plus REIT V

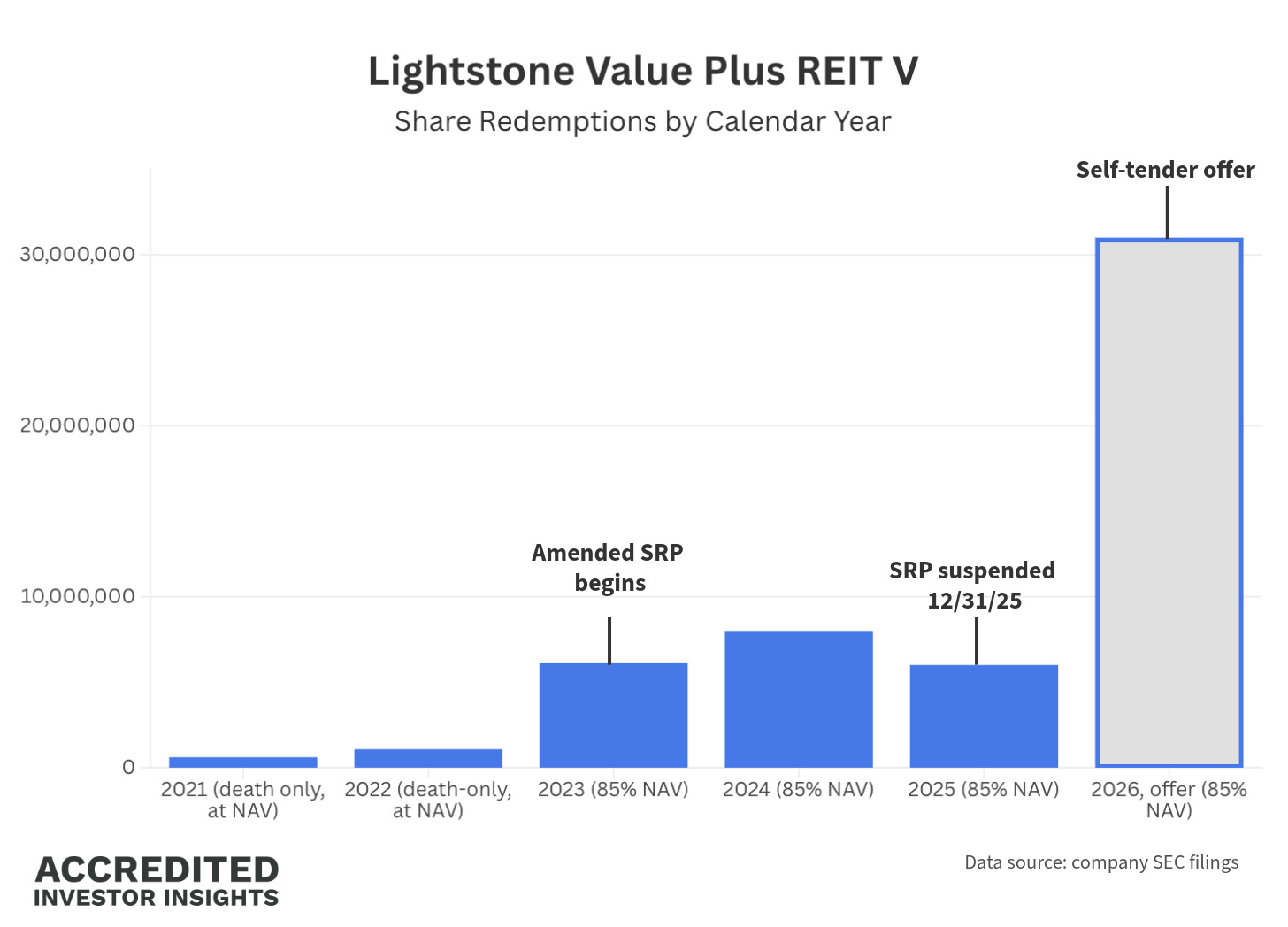

This fund has been wrestling with liquidity issues since 2019, when the Share Redemption Program (SRP) was suspended on December 13. It remained mostly closed until March 25, 2021, reopening only for redemptions due to a shareholder’s death.

In 2023, the fund amended the SRP and offered to purchase up to $8 million of shares annually at a 15% discount to NAV.

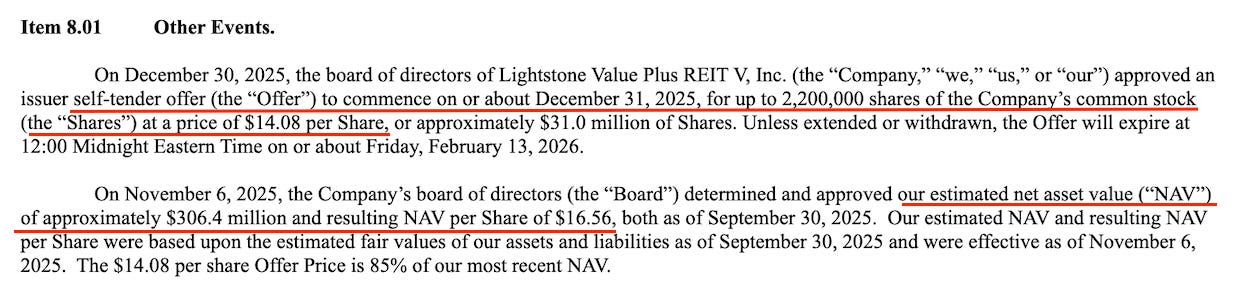

Then, on December 30, 2025, Lightstone announced a self-tender (again at a 15% discount to NAV) for up to approximately $31 million of shares.

NAV: $16.56

Tender price: $14.08

It’s NAV… until you want liquidity.

And if you want liquidity, it’s a discount to NAV.

This shouldn’t be surprising. The fund owns very illiquid assets: a multifamily portfolio.

👉 If you invest in CRE funds (or individual deals), you’ll want to read the entire series on how to read a pro forma. Here’s part 3:

Spoiler alert: the properties aren’t generating enough cash to meet redemption requests, even though the fund isn’t making regular distributions.

So How Does the Fund Meet Redemptions?

The short answer: