JP Morgan Real Estate Income Trust (JPMREIT)

Jack of all trades, master of ____?

This is hardly a shocking statement: the larger the fund, the harder it is to consistently outperform. And when that fund spans multiple asset classes and market cycles, returns tend to drift toward beta (market-like performance) minus access and AUM fees.

So why do investors keep flocking to them?

In this case study, we’ll dissect the JP Morgan Real Estate Income Trust (JPMREIT), a non-traded REIT, and look at what’s working, what’s not, and what LPs should keep an eye on.

📚 If you invest in non-traded real estate funds, there’s one concept you must understand: how the fund values its assets. Most of these funds - JPMREIT included - use a discounted cash flow (DCF) model.

We’ll touch on the basics in today’s case study, but if you want a deeper dive into how DCF works (and why it matters so much), go read this:

Today, I want to walk through a few topics:

Liquidity (and if you missed the Bluerock story, here’s my take, plus the WSJ article where, shameless plug, both this publication and yours truly are quoted)

Source of distributions

Valuation methodology (your favorite, the discounted cash flow model!)

And finally, I’ll share my biggest concern about this REIT.

Background

Quick reminder: this is not financial advice, nor a solicitation to sell securities. All information is shared strictly for educational purposes.

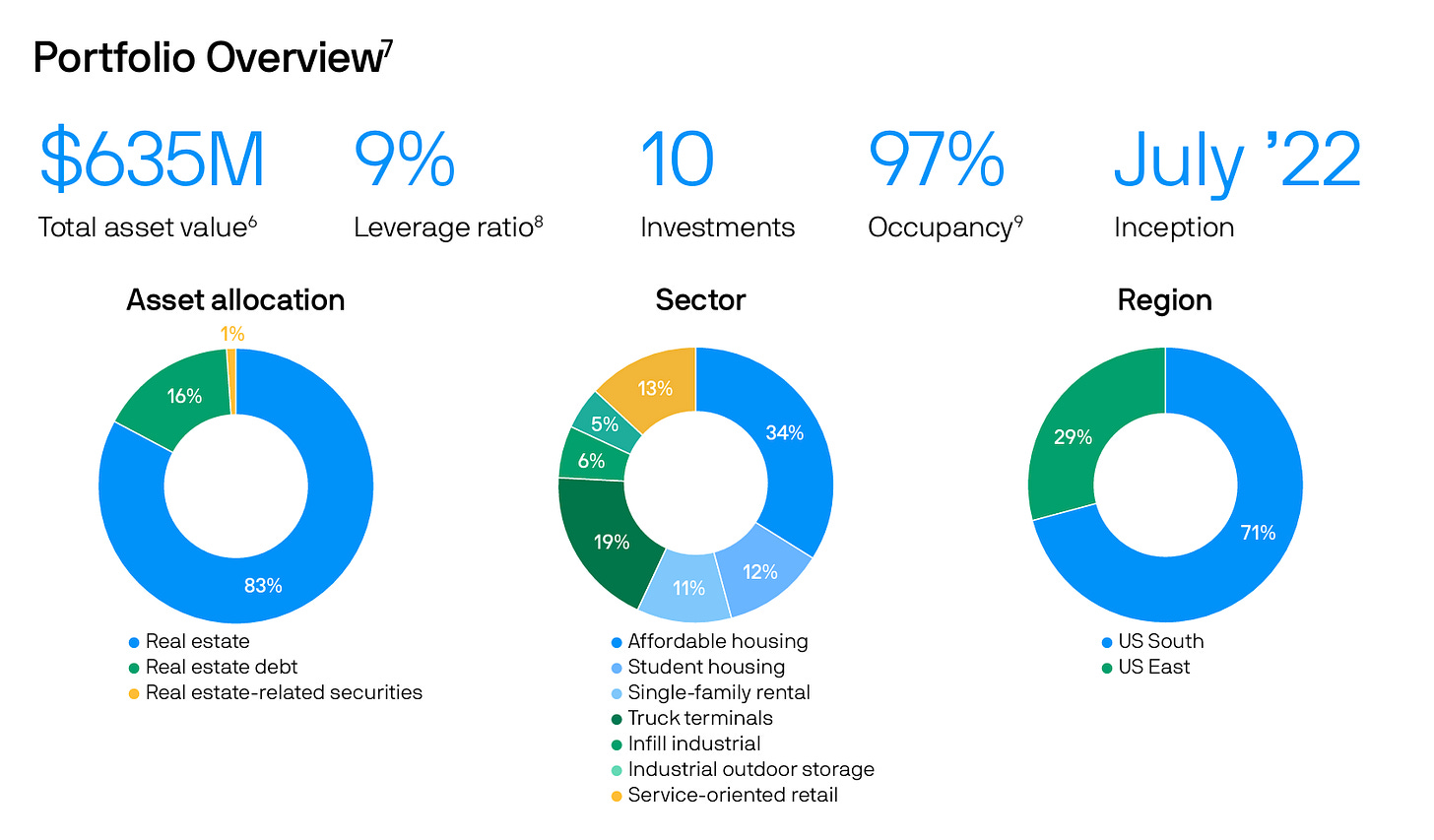

This externally managed REIT was launched in late 2021 and continues to acquire stabilized, income-producing assets across multiple property types.

Shares aren’t traded on public exchanges (you must buy them through RIAs or broker-dealers) so investors can’t simply sell on the open market. Instead, liquidity comes through a discretionary monthly share repurchase program managed by the fund.

JPMREIT’s repurchase program allows redemptions of up to 2% of outstanding shares each month (and up to 5% quarterly) at the manager’s discretion.

But don’t let that offer lull you into a false sense of liquidity: the manager can pause or modify redemptions at any time, as many investors in other non-listed REITs have learned the hard way.

📚 Want to learn more about semi-liquid non-traded funds? Here’s a primer:

1. Liquidity and 2. Source of Distributions

You may have noticed the fund currently carries low leverage: just 9% debt to total asset value as of 12/31/24. But investors shouldn’t assume that will last. The prospectus sets a target leverage range of 45% to 60%, giving the fund flexibility to increase debt as market conditions and acquisition opportunities change. (This low starting point provides optionality, and will allow it to potentially enhance returns down the road.)

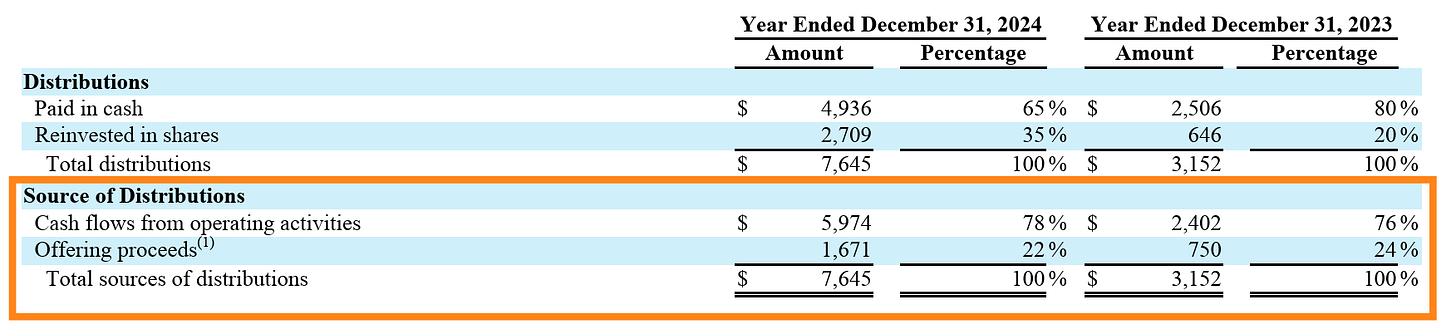

One of the first things I always check is the source of distributions. To its credit, this REIT clearly breaks down where the cash is coming from:

In 2024, cash flow from the underlying assets covered 78% of distributions. The remaining 22% came from issuing new shares. That’s not inherently a red flag, but personally, I prefer funds that generate enough cash to fully cover distributions. Here’s why: