Non-Performing Loan Case Study

Turning a Busted LIHTC Deal Into a $3M Win

Today’s case study comes straight from the real world. This is a distressed debt workout, with real numbers, shared with us by Kyle O’Hehir, Managing Partner at Constitution Lending, in his own words. (This deal was done in 2022, with Kyle’s own capital).

Just a friendly reminder: this is for educational purposes only, not financial advice. This is not an endorsement, nor a solicitation to sell securities.

Hope you enjoy it!

—Leyla

Before we dive in:

Accredited Insight is a unique newsletter: we are the only voice offering a perspective from the LP seat. We cover what we see and what we learned in private markets, drawing on insights from hundreds of deals and numerous conversations with sponsors, LPs, and service providers.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click the button below and choose your preferred term:

Background

Following the pandemic, deal flow was terrible: I did an non-performing loan (NPL) deal in Q1 2020, and then nothing for over two years. Then this busted LIHTC deal popped up on my screener.

It was a 28-unit mixed-use building that was in foreclosure for $85K in unpaid sewer bills. And here’s the kicker: sewer liens carry the same super priority as tax liens, so the foreclosure threatened to wipe the mortgagee out.

I cold-emailed a guy at the servicer and asked if I could take this thing off their hands. To my delight they agreed, but there was a catch:

The loan was in a securitization, so I had to pay par plus (amount greater than loan balance). I had never paid over unpaid principal balance before, but I felt very strongly I could get the collateral.

♟️The Play

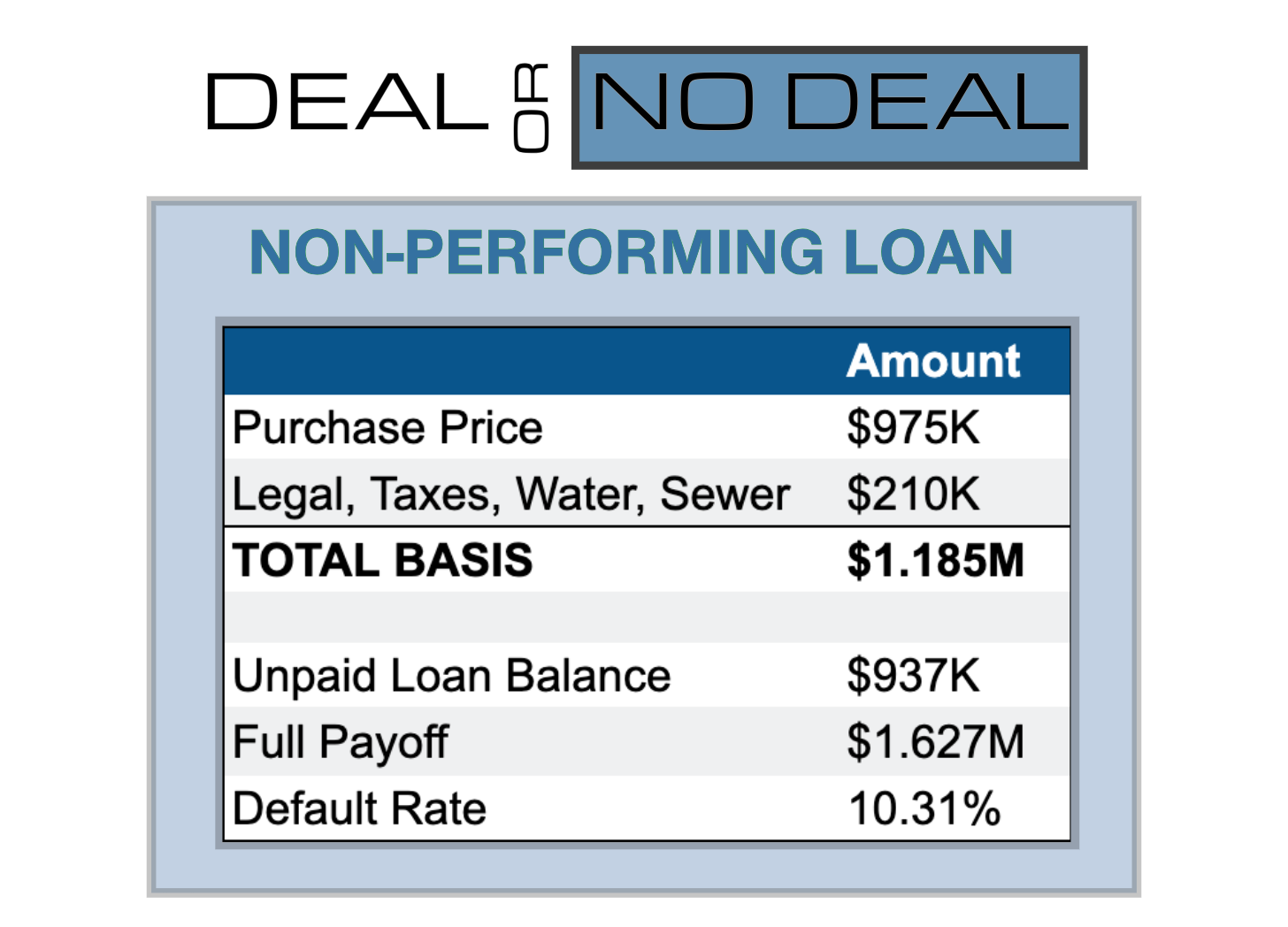

I ended up paying ~104% on the unpaid principal balance (paid $975K for $937K note).

Why?

Because I realized something everyone else missed: the note had been in maturity default for over 3 years.

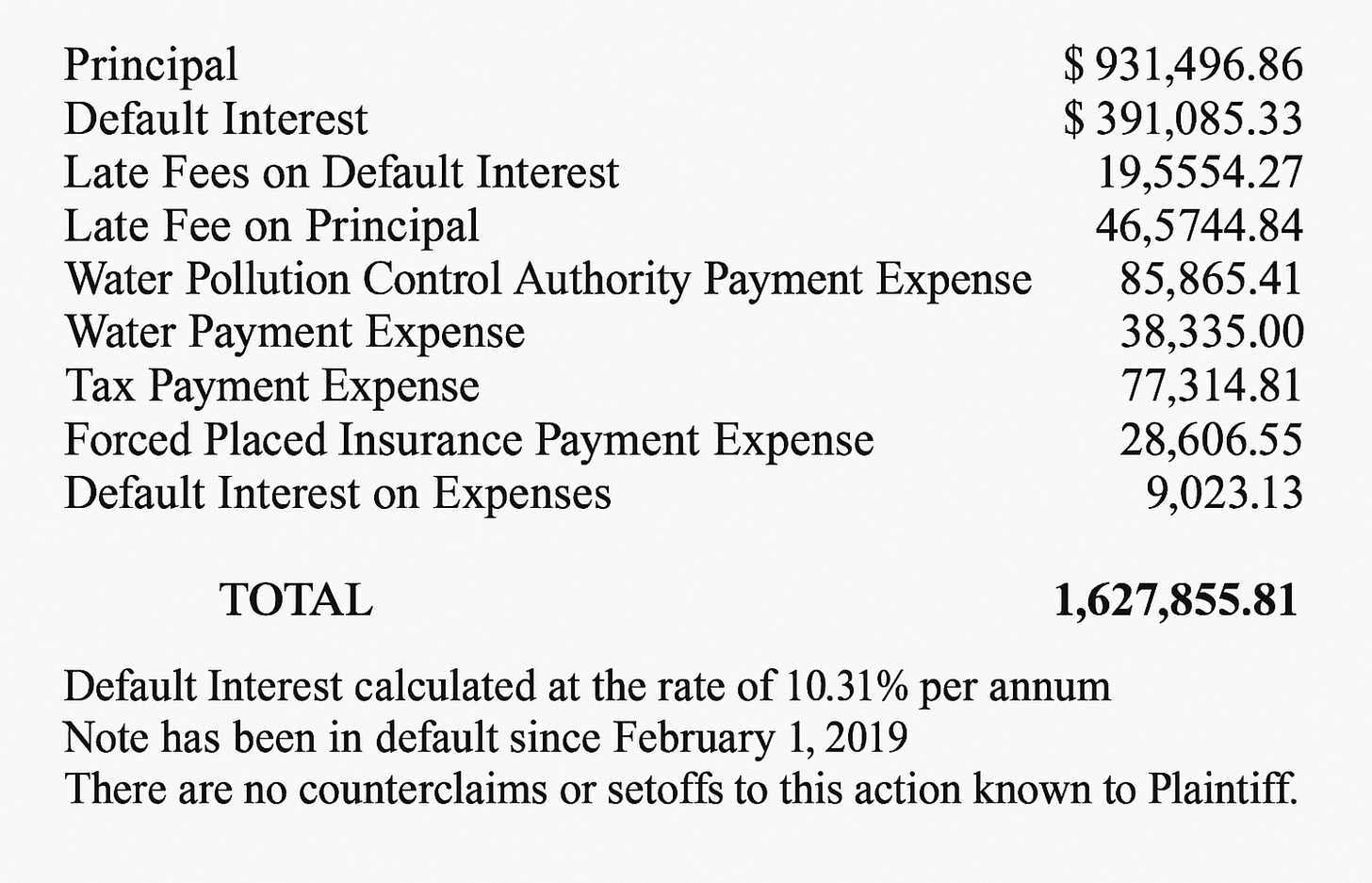

So while I paid $975K for it… The actual payoff was $1.627M.

Here’s the payoff breakdown from court filings:

🏢 The Asset

Something else was immediately clear: the third-party NYC-based property manager was mis-managing the building:

Rent roll: $20K/month

Collections: $15K/month

Rental arrears: $50K+

Evictions filed: Zero

Less than a month after buying the loan, the tax credit investor offered me a deed-in-lieu of foreclosure. Off to a great start!

Now I could file a foreclosure suit to wipe the junior liens and myself.

⚖️ The Foreclosure

Six months later, I had squeaky clean title. Even better: I foreclosed out the LIHTC affordability restrictions.

Leyla’s note: The Low-Income Housing Tax Credit (LIHTC) is a federal program that incentivizes private developers to build or preserve affordable rental housing by offering tax credits in exchange for long-term rent and income restrictions. Here’s a short YT video that describes how this program works.

The foreclosure worksheet summary:

Fair market value of property: $1.175M

Updated debt: $1.628M

Equity (negative): -$453K

Encumbrances junior to my lien: $1.366M

Foreclosure costs (legal/appraisal/title): ~$7.7K

💰The Outcome

Let’s break down the deal math:

But that’s just the debt side.

We got the property and turned it around.

Monthly rent collections grew from $15K → $40K

Spent a few hundred thousand in capex

Total stabilized basis: ~$1.5M

Underwrote to $4.5M stabilized value — ended up closer to $5M

Then we took out a 60% LTV loan on the $5M appraised value.

➡️ That refi returned our $1.5M basis, plus another $1.5M cash out.

So for those keeping score at home, the outcomes for this deal were:

Make $442K if the loan pays off or make $3M in an REO outcome.

This deal is a great example of my approach: I try to either win or win a lot.

On this deal, I got the real estate and won a lot.

About the Author

Kyle started investing in real estate to keep compliance people at his hedge fund day job happy. He left public markets to start his own firm in 2018 and did his first distressed credit deal soon after. He runs a lean Greenwich-based credit fund that leverages public data and AI to source asymmetric opportunities like the one presented for your enjoyment above.

You can follow him on X/Twitter and learn more about his fund here.

Thank you for reading! Have a wonderful week - and subscribe, if you haven’t yet.

This is a great breakdown, but a bit short. I still feel like I need someone to explain this to me like I'm 5

Great breakdown, thanks!