Non-Traded BDC Meets Mr. Market: OBDC II's Attempt to Merge with OBDC

Price ≠ NAV ≠ Value

To say the proposal was unpopular is an understatement.

Blue Owl executed a full 180 U-turn only days after announcing a merger between its two BDCs: the non-traded Blue Owl Capital Corp II (OBDC II) and its $17B publicly listed sibling, Blue Owl Capital Corp (OBDC).

Private assets migrating into public markets isn’t new. What was new (and what lit up headlines), was the size of the haircut OBDC II investors were poised to take if the deal went through.

Non-traded semi-liquid vehicles are very popular with retail investors. Many have the option to exit via listing on the public exchange, or merging with a publicly listed BDC.

BlueRock’s Total Income + is taking the first route: it’s set to start trading on a public exchange next month:

For you, investors, it’s important to understand the mechanics (and implications) of such mergers - because sometimes they reward legacy non-traded BDC investors, and other times they do not.

Here’s what we’ll cover today:

How this fund got to this point

What the proposed (and now cancelled) merger would have meant for BOCC II investors

Key signals to watch in your non-traded fund’s financials so you’re not surprised

📚 Need a refresher on interval funds?

Quick reminder: this is not financial advice, nor a solicitation to sell securities. All information is shared strictly for educational purposes. Do your own due diligence.

📚 How Non-Traded BDCs Work

Non-traded BDCs are built to hit the investor sweet spot: steady NAVs, steady income (mostly), and no daily price swings. But that stability comes with a tradeoff: you can’t sell whenever you want.

A non-traded BDC lends to private companies but doesn’t trade on an exchange. Because there’s no market to match buyers and sellers, the fund itself has to provide liquidity when investors want out.

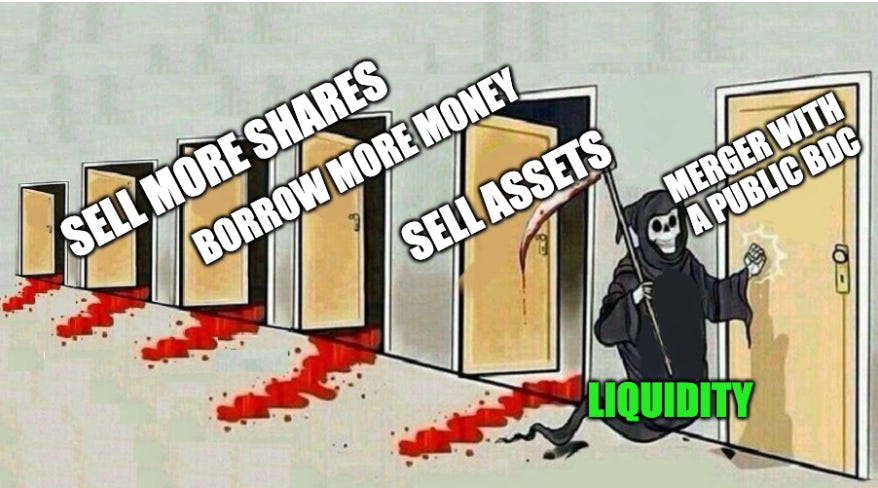

How You Get Money Out

Liquidity usually comes through one of three paths:

1. Tender Offers / Share Repurchases

The fund offers to buy back a fixed percentage of shares each quarter (often 5% of NAV). If requests exceed that limit, investors get prorated, and managers can gate redemptions at any time.

2. Public Listing

Some non-traded BDCs are designed from Day 1 with the goal of listing publicly.

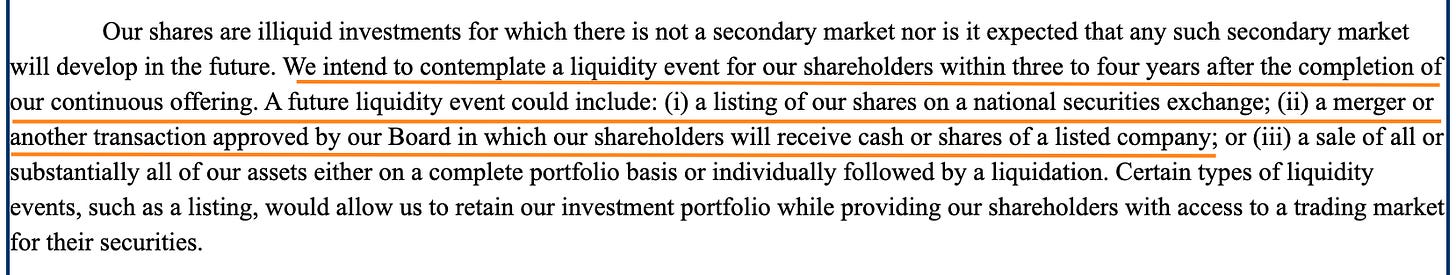

3. Merger With a Listed Sibling Fund

Another path to liquidity: merge a non-traded BDC into a related publicly listed BDC, giving investors exchange-traded shares overnight.

This is the route BOCC II attempted. Below is the disclosure from its annual report:

NAV vs Share Price

NAV is based on periodic appraisals (usually quarterly), not daily market trading. Non-traded BDCs sell and redeem shares at stated NAV.

⚠️ Publicly traded BDCs also report a quarterly NAV per share, but their share price moves with market sentiment. They can trade at discounts or premiums to NAV. If you think the market is overly pessimistic about a BDC trading below NAV, you may be able to buy the underlying assets at a discount.

As Buffett says, “Price is what you pay, value is what you get.” When it comes to publicly traded BDCs, we can tweak it slightly: “Price is what you pay, NAV is what the manager says it’s worth, value is what you actually get.”

The Background

Blue Owl Capital Corporation II (BOCC II) is a non-traded BDC formed in 2015 with a straightforward mandate: generate current income by lending to U.S. middle-market companies.

The portfolio is upper middle market direct lending: companies with ~$186M EBITDA on average, heavily first-lien (nearly 80%), almost entirely floating-rate, and spread across 30 industries. As of year-end 2024, the BDC held 182 portfolio companies with an average position size of $10.6M. Weighted average total yield was 10.2% at fair value as of 9/30/25.

❗️The vehicle wrapped its continuous public offering in 2021 after raising $1.39B.

This👆, friends, is important: the vehicle is no longer selling new shares.

Redemptions

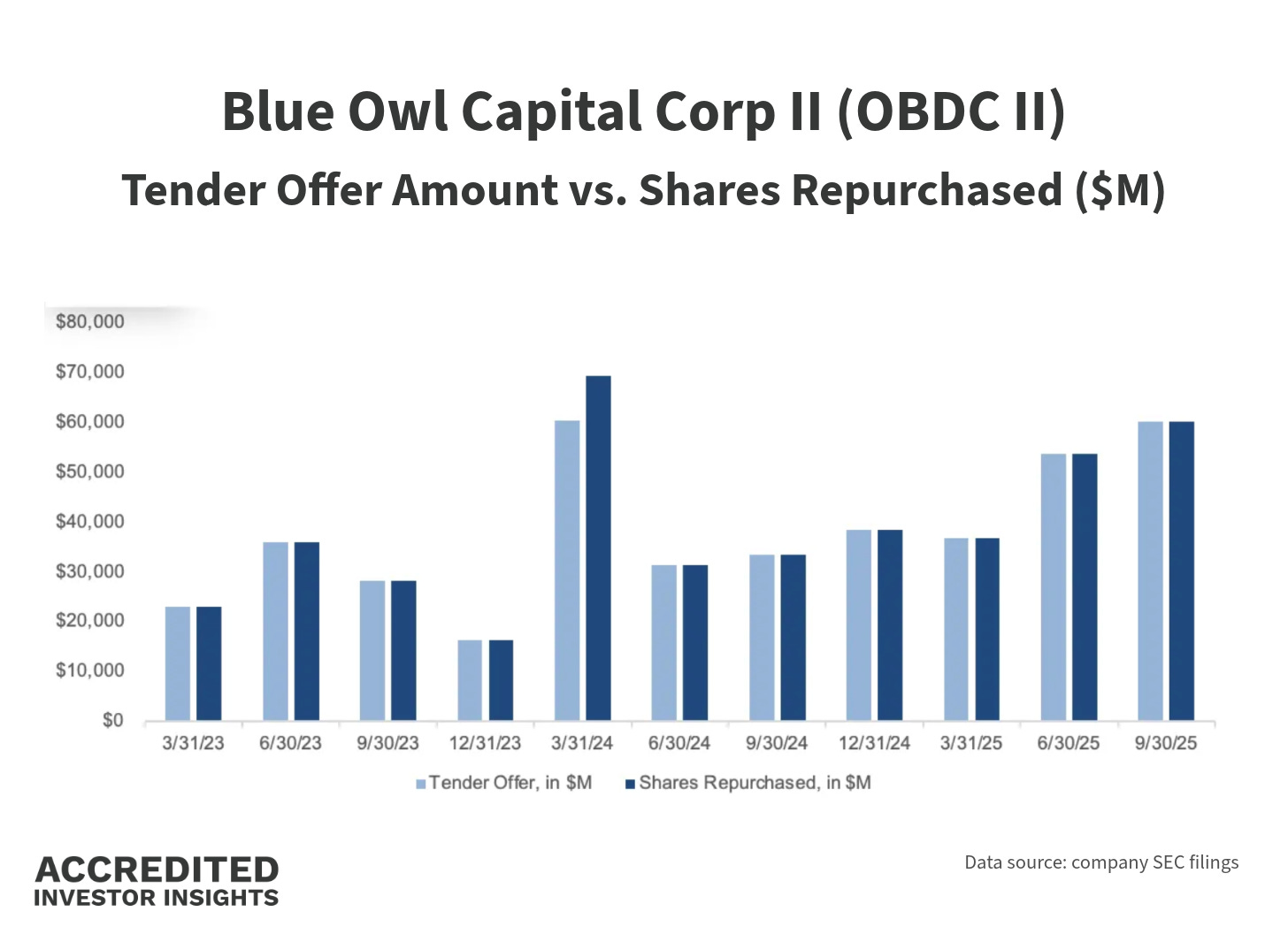

Before we even get to the proposed merger, we need to understand the issue the fund is facing: redemptions have been running at or near the fund’s quarterly limit for nearly three years.

Remember, non-traded BDCs typically offer to repurchase a set percentage of shares each quarter (often ~5% of NAV). When requests exceed that cap, investors get prorated, and anyone who doesn’t get filled gets pushed into a queue.

Where is the cash coming from to fund these redemptions?