Sunday Digest: Private Markets Insights

Breaking Down Interval Funds, CRE Trends, and a Car Wash Bankruptcy

Happy Sunday!

I’m on a mission to democratize access to information for LPs. How’s that for a tag line?

Everything else (including the most obscure financial abominations) has been “democratized”, so why not the insights that actually matter? But I digress.

In today’s digest, we will cover three things:

1️⃣ Interval Funds: A short video featuring none other than Cathie Wood singing the praises of interval funds. Not sure what those are? Read this first:

2️⃣ Commercial Real Estate: A mixed bag this week—one lender in trouble, some optimism for office spaces, and the latest multifamily report.

Invest in CRE? You’ll love our series on how to read a pro forma.

3️⃣ Car Washes: private equity loves them, but one just went bankrupt. Let’s dig in.

Before we jump in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective from the LP seat. We cover both the good and the not so good—and often, useful resources, like we are sharing today —drawing on insights from hundreds of deals and numerous conversations with sponsors, LPs, and service providers.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click the button below and chose your preferred term: you can pay $10/month or $100 for a full year.

Sales pitch over, let’s get going.

1️⃣ Interval Funds

If you don’t already gag flinch when you hear “democratized access to XYZ,” you might start now.

Cathie Wood, CIO of ARK Invest, is bullish on interval funds, calling them “a better wrapper” for public and private funds. Check out the video (link in caption) for her take. You are welcome.

Private Credit

JP Morgan Chase is rolling out a private credit fund, according to WSJ:

”The bank filed a prospectus with the Securities and Exchange Commission Friday for the JPMorgan Credit Markets Fund. This will primarily invest in corporate loans and bonds, as well as structured investments and private funds.”

The fund will be structured as —🥁 drumroll, please — a closed-end interval fund.

2️⃣ Commercial Real Estate

Lender in Trouble

Ares Commercial Real Estate (ACRE) reported a Q4 net loss of $10.7M ($0.20 per share) and slashed its quarterly dividend to $0.15 (down from $0.25 in Q4 2024).

From their quarterly report: 96% of their riskiest loans are backed by office and residential/condo properties. Are we at all surprised?

Green Shoots for Office?

CBRE’s latest earnings release had some surprisingly positive signals:

Office leasing revenue surged across all global regions, with a 28% gain in the U.S. “While major gateway markets showed continued strength, other large markets like Dallas, Atlanta and Seattle grew even faster, and certain smaller Midwest markets picked up considerably.”

Companies are locking in long-term leases as return-to-office momentum picks up.

Property sales revenue in the U.S. jumped 37%, showing strength across all major asset classes.

Multifamily Report

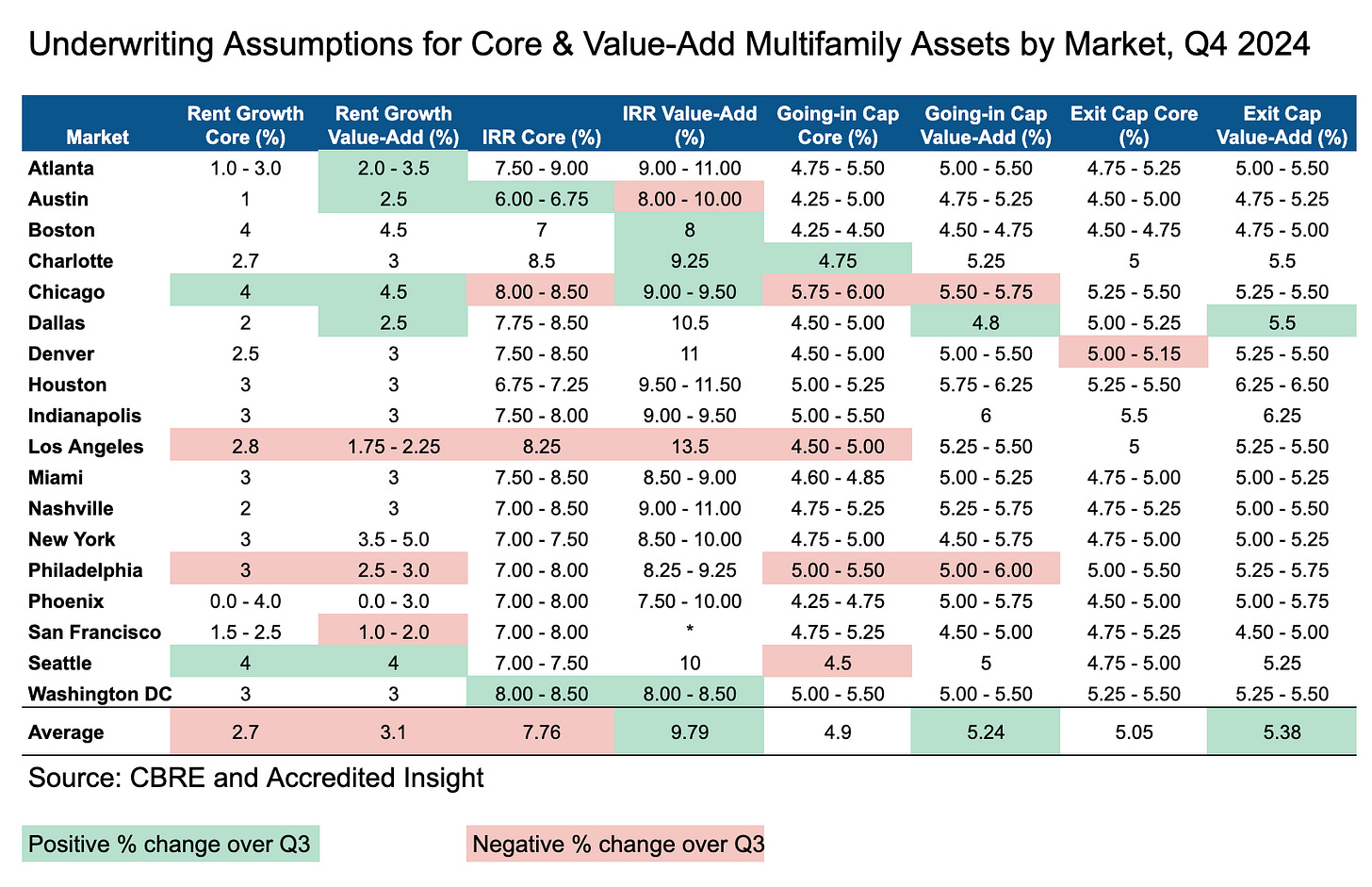

Q4 2024 CBRE’s multifamily underwriting survey is out. Lots of good data!

I compared cap rate assumptions to the prior quarter:

Red cells = cap rate decline (negative % change from Q3)

Green cells = cap rate increase

3️⃣ On Car Washes and Private Credit

Car washes are still a hot commodity with private equity.

However, a recent bankruptcy filing by Zips Car Wash has exposed cracks in private credit valuations (remember the PluralSight saga?), highlighting how funds can overstate loan values even as companies spiral toward default. I’m well aware we are beating a dead horse, but worth repeating:

Zips struggled for months with refinancing failures, labor shortages, and rising debt, yet private lenders still marked its loan above 90 cents on the dollar—giving investors a misleading sense of stability.

With that, thank you for reading (and supporting!). If you haven’t yet subscribed, now’s the perfect time:

Oyyyyyy Cathie Wood touting intervals now makes me nervous :-/