WTF is ABF? Your Primer on Asset-Based Finance

What it is, what it isn’t, and why it’s showing up in private credit portfolios

For much of the past decade, institutional investors, family offices (and increasingly, retail investors) have chased yield and diversification through direct lending: loans originated to privately held companies.

That market is now maturing.

Spreads have compressed. Covenant protections have thinned. And the risk profile of “senior secured” corporate credit looks meaningfully different than it did five years six months ago.

But not to worry, my dear reader, a new frontier in private credit is gaining attention: Asset-Based Finance (ABF).

Why Now?

Asset-Based Finance is not new. Since the 1980s, it has been a core component of bank and insurance company balance sheets, financing everything from consumer credit and equipment leases to royalty streams.

Remember the RMBS/CMBS/MBS fiasco of 2008? Yes, all of those things fall under the umbrella of asset-based finance (we’ll come back to that).

👉 Speaking of collateralized securities in real estate. Have you read this?

So what has changed?

Regulatory pressure, higher capital requirements, and rising funding costs have pushed banks to retrench across asset-backed lending markets. According to Brookfield, private lenders today provide less than 5% of total asset-backed financing, leaving a substantial gap that private capital is now stepping in to fill.

Today’s article breaks down the mechanics of Asset-Based Finance and what LPs need to know before allocating: how these deals are structured, the risks and benefits for LPs, and what to focus on before committing capital.

❓“Leyla, why are you inflicting this brain damage upon us?”

(No, not because I want to ruin your family dinner.)

💡But because we should expect to see more ABS assets migrating onto the balance sheets of private lenders, and I have a case study on an evergreen asset-backed credit fund in the works.

👉 Remember CLOs? They’re part of ABF too.

📚 Sources and further reading are included at the end of the post.

ABS vs ABF

Quick side note (I’m lying. They are never quick.)

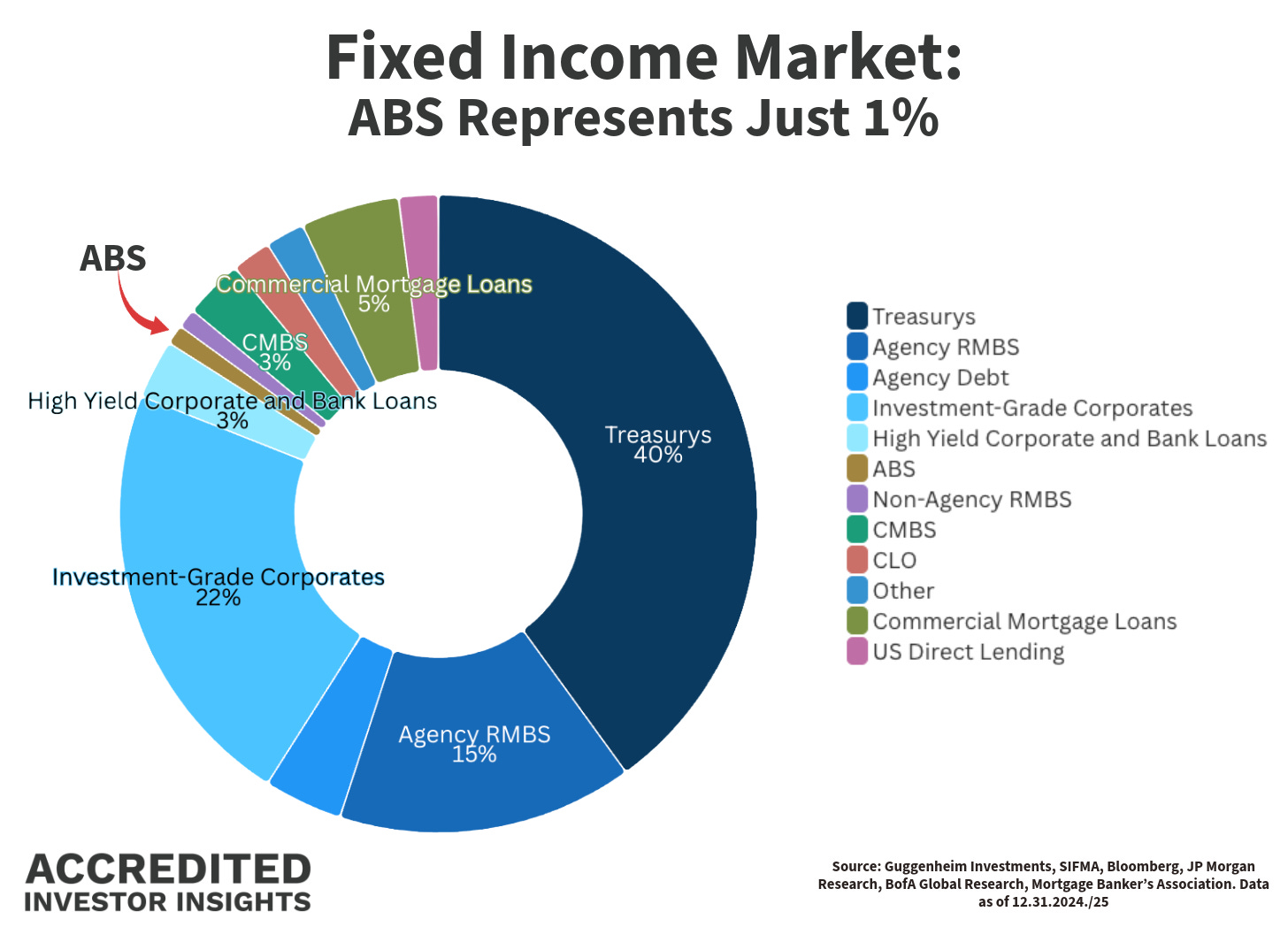

Asset-Based Securities (ABS) are a subset of Asset-Based Finance (ABF).

ABF refers broadly to financing structures backed by pools of income-producing assets. ABS represents the tradeable, bond-form expression of that market.

While most ABF transactions involve securitizing assets through Special Purpose Vehicles (SPVs), ABS is typically issued as publicly registered securities or under Rule 144A, making it accessible to a broader investor base.

To support liquidity and transparency, ABS structures usually include:

Credit ratings from major agencies

Standardized valuation and modeling frameworks

Regular, detailed collateral reporting

As a result, ABS (effectively tradeable ABF) is liquid and scalable enough for traditional fixed-income portfolios.

I’ll show you where this relatively small ABS segment (approximately $1.6 trillion) fits within the broader ABF universe below.

🔎 What IS Asset Based Finance?

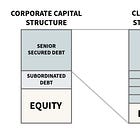

At its core, Asset-Based Finance (ABF) is credit secured by pools of income-producing assets, rather than the standalone EBITDA of a single operating company.

Those assets can include consumer receivables, lease payments, rental streams, or royalty income. In other words, any contractual obligation that generates predictable cash flows over time.

❗️Another important side note: