Multifamily Real Estate: a Curious Case of Financial Engineering (and a Complex Capital Stack)

How a Complex Capital Stack Nearly Broke My AI (plus 20-Minute Market Research Tool You'll Love)

Just when I start thinking the days of financial engineering in CRE deals are behind us… today’s deal lands in my inbox.

It’s a doozy. In fact, it almost broke my AI assistant.

In this post, I’ll walk you through two things:

A creative capital stack (and the questions you MUST ask if you see one like this).

And a practical tool for doing your own market research (in 20 minutes, or less).

But before we dive in...

Accredited Insight is the only publication offering a clear, unfiltered view from the LP side of the table. We cover private credit, private equity, and CRE investing, drawing on hundreds of deals we’ve seen.

Paid subscribers get full access to our growing library of 30 case studies and our in-depth series on how to read a CRE proforma. If you are a GP, this is your window into the world of capital allocators. Click below to choose your plan:

👉 $10/month or $100/year.

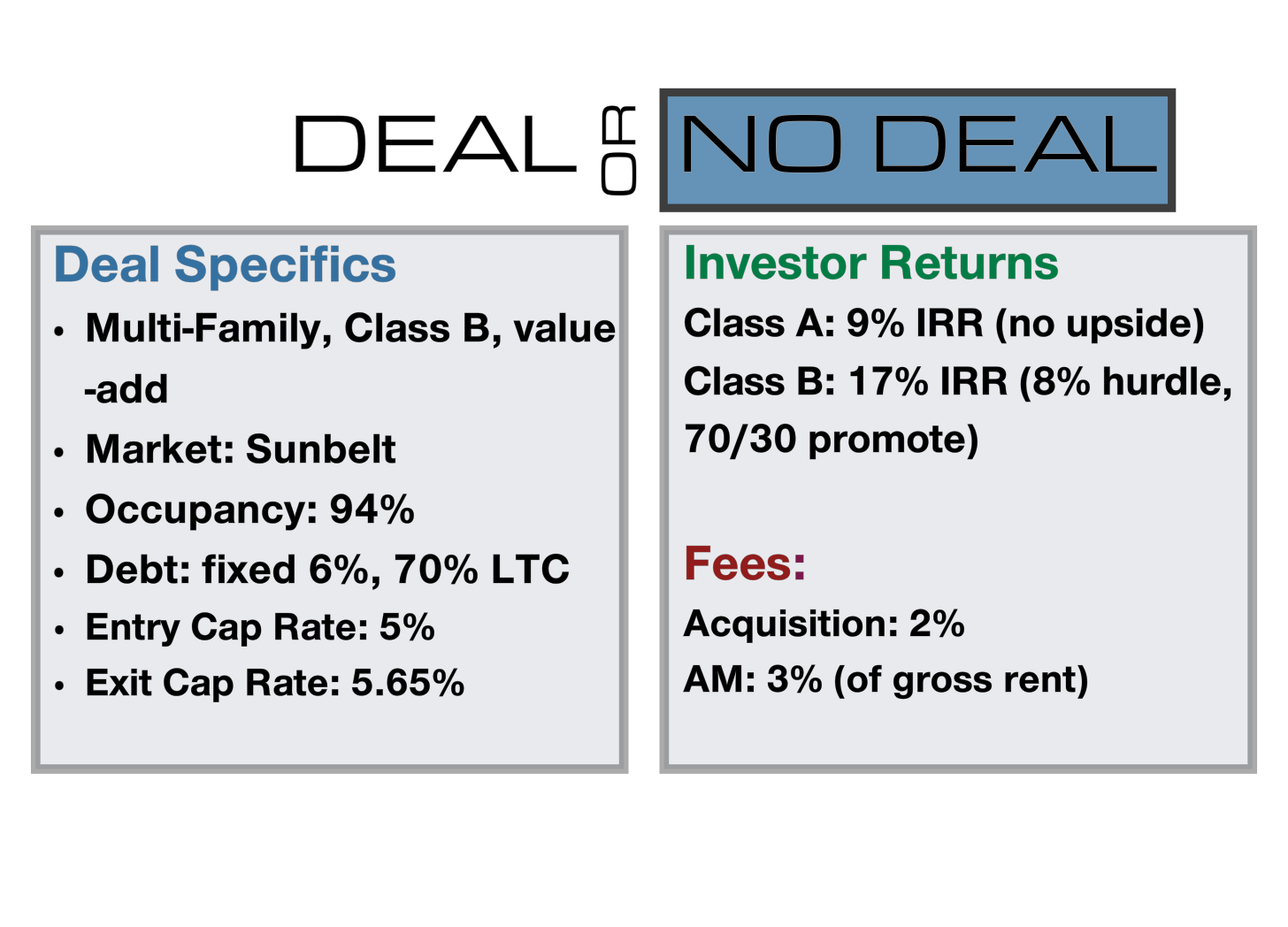

Deal or No Deal?

Just a friendly reminder: this is for educational purposes only, not financial advice. Numbers, location, and details have been changed to keep the sponsor’s identity confidential.

If you remember the heady days of 2021-early 2022, you will recall how many deals had multiple equity sleeves (Class A, B, Premium, Platinum, über-Special.. you name it).

It was a workaround for overpaying: once you max out what lenders will give you (hi, 88% LTV bridge loans from private credit funds 👋), the next move is to treat part of the equity like debt (i.e. offering capped returns in exchange for seniority). That’s exactly what’s happening in today’s case study.

Need a refresher on why investing in common equity behind a preferred tranche can backfire? Read this:

Deal Summary

This multifamily deal is being acquired at a 5% entry cap, as a value-add play. Occupancy is high (94% at acquisition), and rent premium for renovated units is fairly low (ROI on capex is around 15%) - I could write another 1,000 word article with a compelling argument as to why it might not be a very good value add deal, but let’s move on.

Stabilizes to about 6.7% yield on cost (thoughts? Is this high enough?)

”Leyla, what is yield on cost???” - here you go:

The capital stack includes:

Debt at 70% LTC (5-year loan, fixed rate)

Preferred Equity (Class A) earning a flat 9%, no upside

Common Equity (Class B), or what’s left after everyone else eats

⚠️ The OM doesn’t disclose how much is allocated to Class A vs. Class B equity.

— random question:

1. The Big Unknown

The biggest unknown here is the break-down of equity: the deck lists Class A and Class B equity tranches, but doesn’t specify % allocated to each.

Remember, equity already sits behind debt, which is at 70% loan-to-cost. The more Class A (preferred) equity in the stack, the greater the potential upside for Class B… if the deal performs. But it also means Class B is absorbing more risk. It’s effectively another layer of leverage (just not labeled that way):

So can AI solve the puzzle 🧩?

I put my mini-Leyla to the test, trying to reverse-engineer the capital stack by working backwards, using the overall deal IRR (known) and the projected returns for each equity class (also known) to estimate the missing pieces.

Unfortunately, no luck without access to the full Excel model. What it did do (reliably) is ask the right questions. The first (and most important) one was:

“Equity Allocation Breakdown: The sources state the Total Equity Required is $…. but do not explicitly show the breakdown of this amount into Class A and Class B capital contributions. Could you please provide the specific dollar amount or percentage of the $… total LP equity that is allocated to Class A investors versus Class B investors?”

The second question my mini-me generated would make any mother proud:

“GP Co-Investment and Full Waterfall Mechanics: While the sources mention GP participation in profit splits for Class B and show "GP" as part of the equity stack, the specific dollar amount of the General Partner (GP) co-investment is not clearly stated in the financial tables.... Could you please clarify the precise amount of the GP's capital contribution?”

Want to train your own mini-you to help you evaluate OMs and generate follow-up questions? Here’s how:

2. How to Generate a Comprehensive Market Report

Separately (and to greater success), I found an AI tool that didn’t melt down. This tool helps you create detailed, LP-ready market reports in under 20 minutes.

I’ve written before about why GPs and LPs alike should do their own market due diligence here, even in well-known metros.

But what if you're short on time and long on submarkets? This prompt will save you hours of research: