Bluerock Total Income Plus -> Bluerock Private Real Estate Fund (NYSE: BPRE)

When an interval fund goes public

I need you to pay close attention.

And not just if you’re an investor in this specific fund. If you have any allocation to an evergreen vehicle (or are thinking about going that route) you need to internalize what I’m about to tell you.

You’re about to see one version of how an evergreen fund solves an existential crisis by listing on a public exchange. This story first surfaced back in July (the WSJ covered it, with yours truly mentioned).

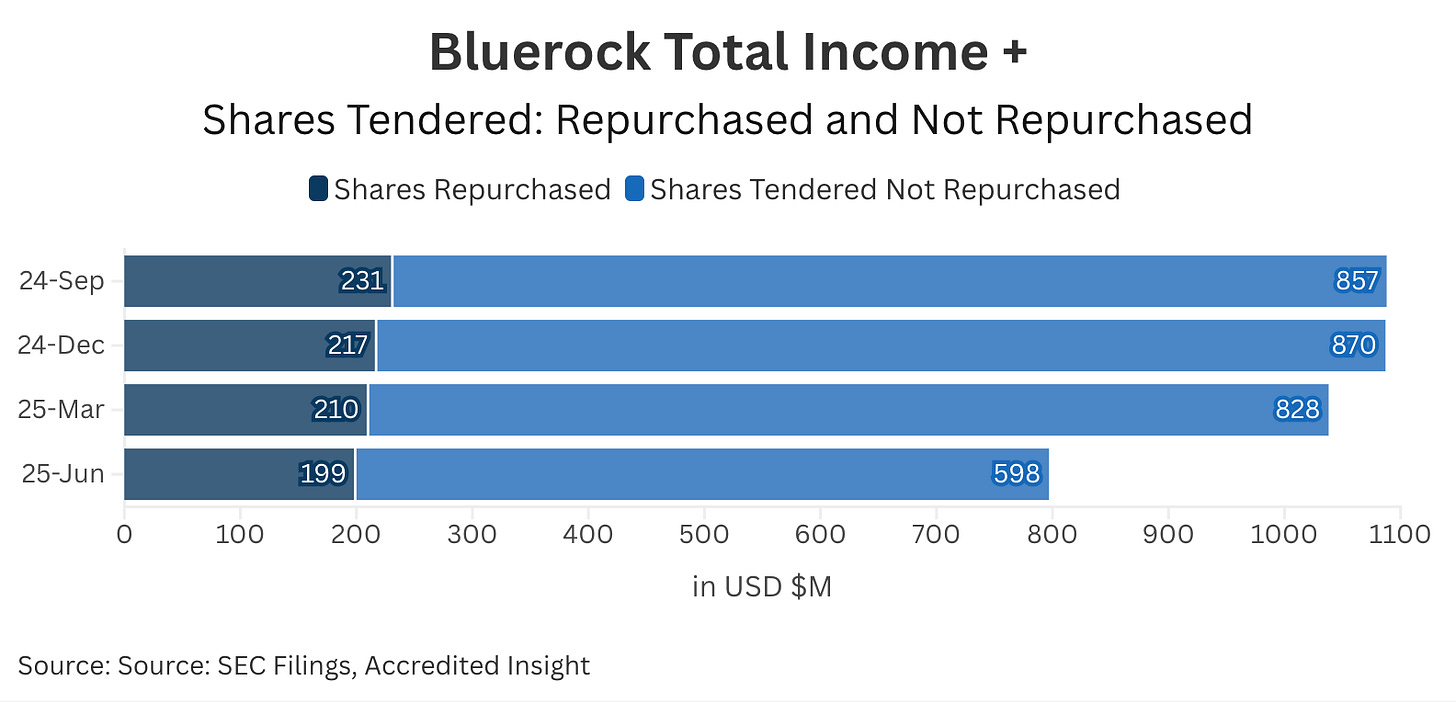

Here’s where things stand now: the fund is shrinking, and investors are still stacked in a redemption queue. After nine consecutive quarters of negative returns, 22% of the fund tendered their shares for repurchase in June, yet the fund only repurchased about a quarter of those requests:

Here’s your evergreen primer, if you missed it:

The Listing

On Tuesday, December 16th, Bluerock Total Income+ Fund (an interval fund that’s historically been sold through the wealth channel) will become publicly listed on the New York Stock Exchange under the ticker BPRE. It’s being rebranded as the Bluerock Private Real Estate Fund.

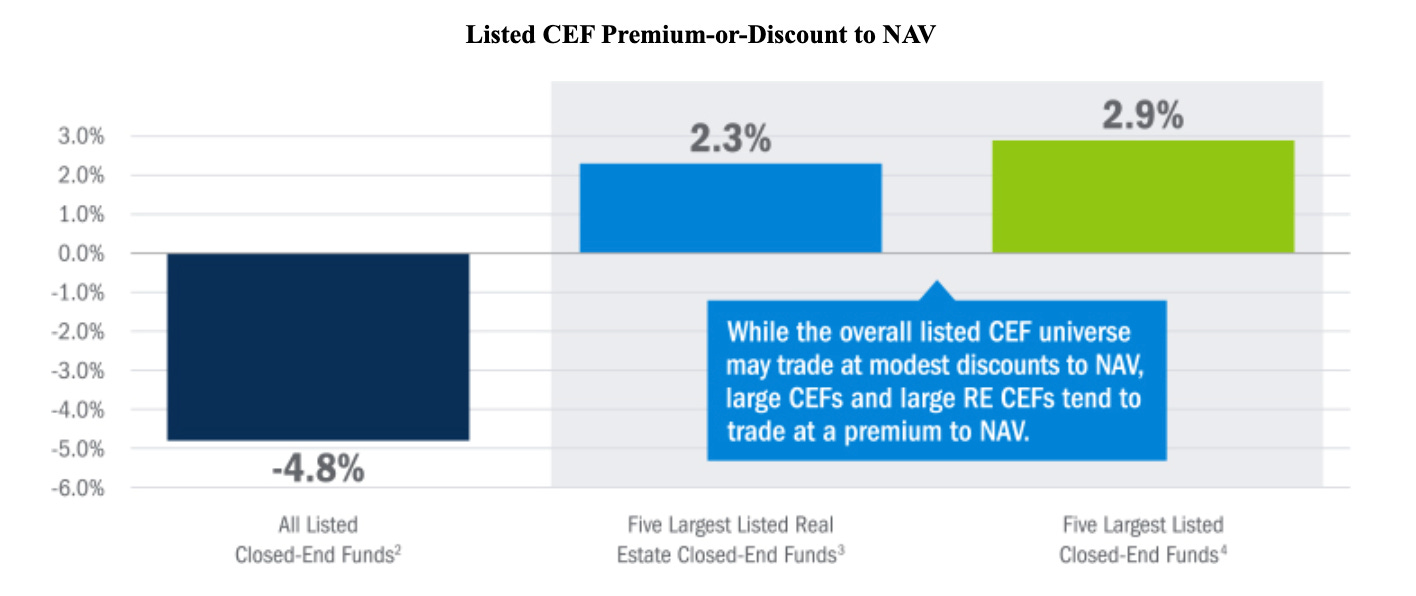

Once the fund starts trading, we’ll all find out what the public market thinks about the NAV marks on the private assets sitting inside this vehicle.

From the annual report (emphasis mine): “In consideration of pent-up liquidity demand from existing shareholders, we anticipate that the Fund will likely trade at an initial discount to its NAV upon listing.”

My personal opinion? Even a 4.8% discount to NAV is optimistic.

Yet 81% of more than 40,000 votes cast were in favor of listing. Why? Because liquidity is better than being stuck in a vehicle slowly selling assets just to meet quarterly redemptions.

Today, we’ll discuss:

What’s in the fund

How the fund makes money and generates distributions

The one chart that explains what happened (and, hopefully, makes you double-check quarterly reports of any fund you are invested in).

📚 Need a refresher on interval funds?

Quick reminder: this is not financial advice, nor a solicitation to sell securities. All information is shared strictly for educational purposes. Do your own due diligence.

Quick Background

Before we get into cash flows, performance, and the redemption spiral, let’s do a quick overview of the fund’s holdings and structure.

Bluerock Total Income+ (TI+) launched in 2012 as a closed-end fund that operates as an interval fund, meaning it offers limited, periodic liquidity through scheduled redemption windows. But that liquidity mechanism only works when inflows are strong. We’ll come back to that.

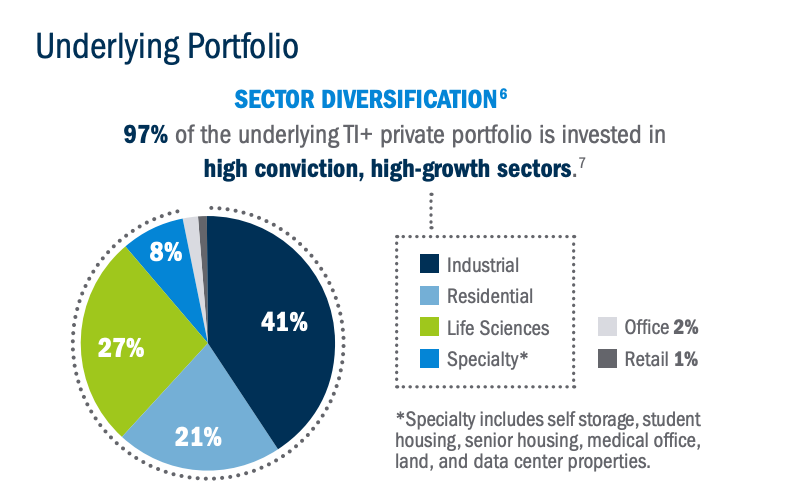

As of September 30, 2025, TI+ reported $4.2 billion in total assets, allocated primarily to:

Private Real Estate Securities: 87% of total assets

Real Estate Debt/Preferred: 13%

Short-Term Investments: 10%

The fund also reported $675 million in liabilities, bringing net assets to $3.6 billion.

What’s in the Fund?

Within the private equity real estate allocation, here’s what the fund is exposed to:

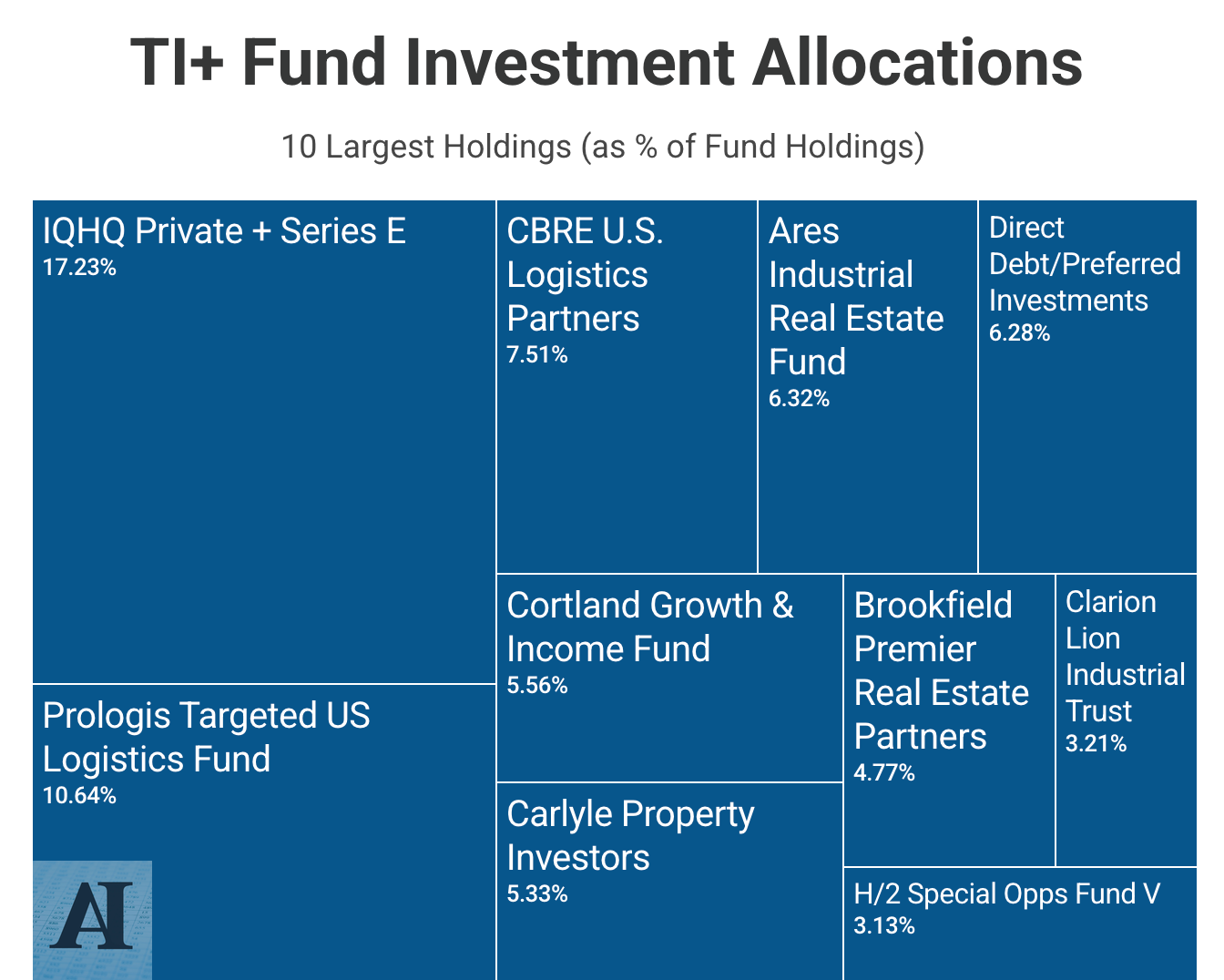

TI+ is not a direct owner of underlying properties: it allocates 100% through third-party private institutional real estate vehicles. This, friends, is a fund-of-funds.

On paper, you’re diversified across nearly 5,500 properties. In reality, ~70% of assets are concentrated in the top 10 holdings (as of 9/30/25), meaning your fate is closely tied to a handful of outside managers.

The Slow-Motion Crunch of Returns, Cash Flows and Redemptions

Let’s talk about performance.

Annualized Distribution Rate: 5% for Class I shares (but don’t get too excited).