Continuation Vehicles: The New Lifeline

How GP-led funds are reshaping exits, extending ownership, and challenging LPs to rethink risk and opportunity

How many times can you sell the same company (to yourself), and what does it mean for your investors?

In August 2025, Accel-KKR closed a $1.9 billion single-asset continuation fund for isolved, a human capital management software provider it has backed since 2011.

What makes the deal stand out is that it’s not just a continuation vehicle (CV), but a continuation vehicle squared: back in 2019, Accel-KKR had already rolled isolved into a $1.4 billion multi-asset continuation fund, fueling a tripling of revenue and profitability (Accel-KKR originally invested in isolved way back, in 2011).

And while CV² deals are still rare, first-generation continuation vehicles are rapidly becoming a dime a dozen in today’s private markets. Private equity is not the only domain, either: private credit is starting to see an uptick in similar structures.

In the commercial real estate world, the closest analog is a recapitalization, which serves a similar purpose of extending ownership and unlocking liquidity. Read more about them here:

Today, we’ll cover:

✅ What continuation vehicles (CVs) are

✅ Why they’re booming

✅ Their advantages, and - more importantly - what investors need to watch out for.

Investor Community Spotlight: Boulder Investment Group (BIG)

The number one question I hear from fellow LPs is, “How do I see more quality deals?” A close second: “Where do I meet other LPs?”

BIG answers both. It’s a volunteer-run investment club of 950+ sophisticated investors (87% are qualified purchasers). Since 2009, members have invested more than $1.4B in offerings presented through the group.

Community: meet and network with other investors.

Curated access: only opportunities with a proven track record and verified member referrals make the cut.

Deal flow + education: pitch meetings every six weeks feature both investments and expert perspectives.

Learn more and apply for membership here:

(Full disclosure: this post is NOT sponsored. I’ve been a member since 2022 and currently serve on the board of directors.)

🔎 What Are Continuation Vehicles?

Let’s zoom out for a second. Before a continuation vehicle even enters the picture, you’ve got the classic private equity playbook: a GP raises a fund, buys a handful of companies, and works to grow their value.

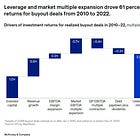

Here’s a deeper dive on what drives returns in PE:

Fund lives are typically around ten years, at which point the GP is supposed to sell and return capital to investors.

Exits usually fall into one of three buckets:

IPO (taking the company public)

Sale (to a competitor, strategic buyer, or another PE sponsor)

Continuation vehicle

That last one, continuation vehicles, or CVs, is where things get interesting. A CV is a fund the GP sets up specifically to keep owning a company (or a few of them) past the original fund’s expiration date.

(Continuation vehicles fall into a broader category of secondary funds. Learn more here:

The mechanics are straightforward, but the implications are not: