Private Equity Returns: What Really Drives Gains (and Risks LPs Should Watch)

What Every LP Must Ask Before Investing

In Part 1 of this series, we covered how private equity works. Now we get to the part everyone actually cares about: what really makes the money.

Spoiler: it’s not magic - and it’s definitely not always repeatable. Most PE returns come from a handful of well-worn levers. Some are as old as the oldest profession (oldest profession being middle management, of course). Others have only grown in importance as the market shifted.

In this piece, we’ll cover:

The three core drivers of private equity returns (and which one of the three is the most important)

The risks LPs should watch, from leverage traps to operational issues, plus my dream list of due diligence questions. (If you find a PE sponsor who will answer all of them, please DM me. A girl can dream.)

Here’s Part 1 if you missed it:

What Actually Drives Returns in Private Equity?

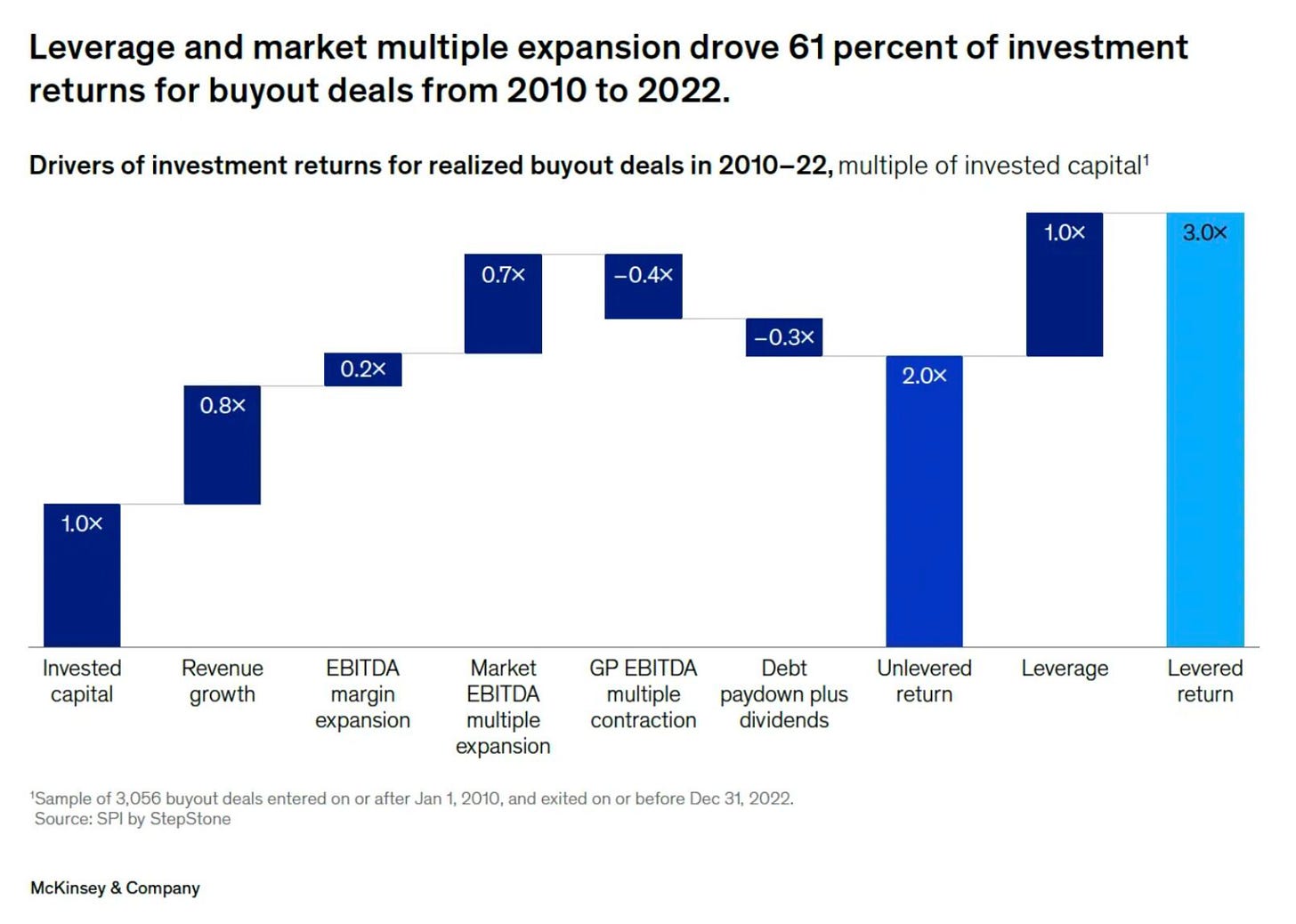

Private equity’s reputation is built on delivering stronger returns than traditional public markets. That may be changing (I wrote about this here and here), but today we’re focused on the mechanics: how these returns are actually generated.

1. Leverage (AKA the Double-Edged Sword)

Leverage amplifies returns. This shouldn’t be a big surprise. By acquiring companies with significant debt, PE managers put less equity to work and maximize purchasing power. The popularity of leverage rests on one simple math trick: as long as the return on equity exceeds the cost of debt, LPs win. You know where this is going, right?