How Private Real Estate Funds Value Assets

How to turn $.9 into a dollar, using a variety of methods

Imagine you own a commercial building outright. You keep a balance sheet (for your own sick entertainment, and maybe your CPA’s) and every so often you mark the building up in value as it appreciates. To do that, you’d probably rely on comparable sales, broker opinions, or the income the property generates (using a cap rate). Straightforward, right?

🔧 Now, let’s ratchet this up a bit. Instead of directly owning one property, you invest in a large, non-traded real estate fund. Let’s say it’s an evergreen interval fund (meaning you can buy shares at any time, and the fund may occasionally buy them back from you).

Everyone loves interval funds:

So how does the fund determine the fair value of its assets, and by extension, the value of your shares? At first glance, the answer seems obvious: comparable sales, broker opinions, or dividing net operating income (NOI) by a cap rate.

But in most private funds, that’s the wrong answer ❌

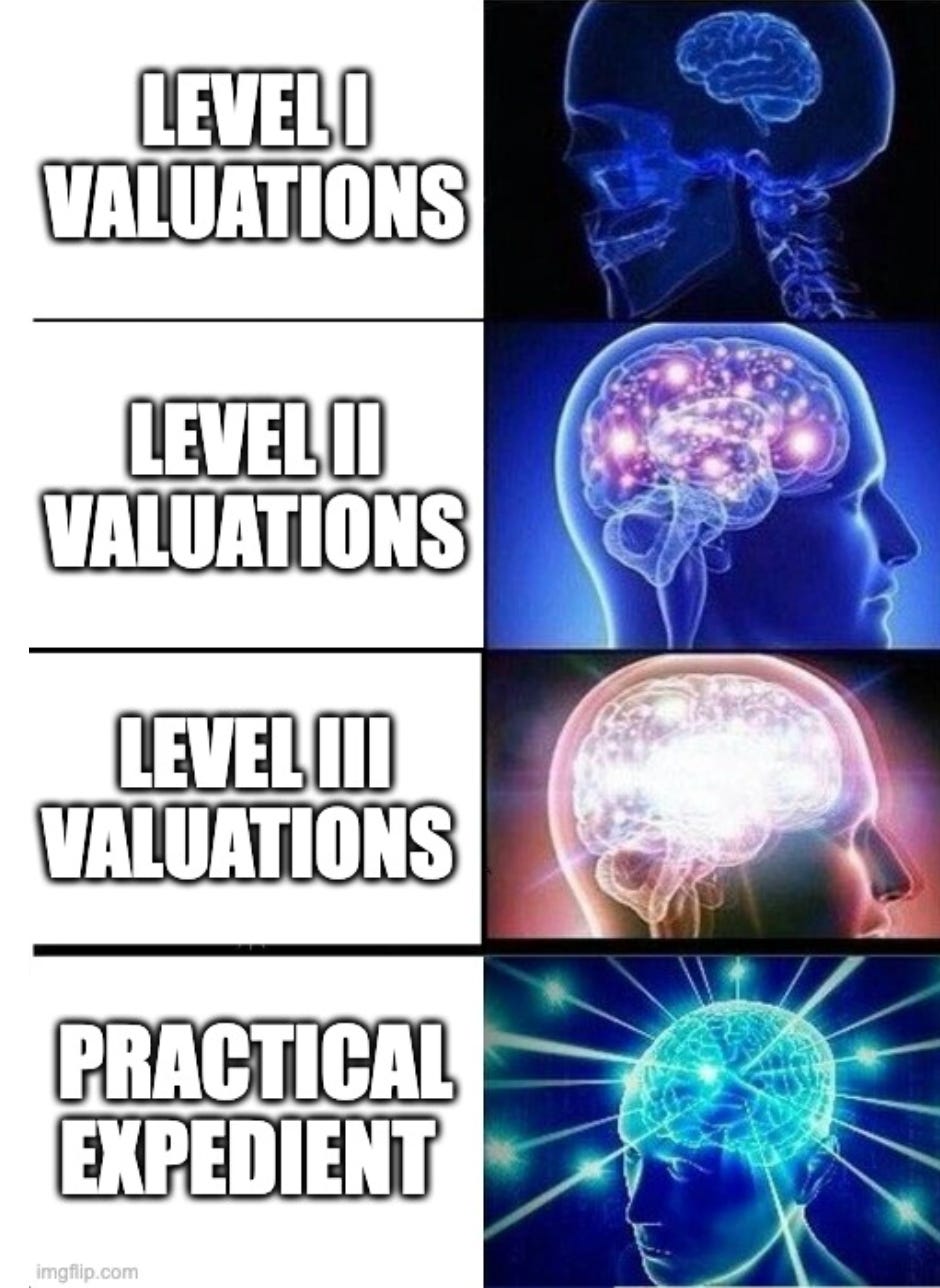

Today, we’ll cover how funds actually approach valuations:

Discounted cash flows on directly owned properties

The three levels of fair value reporting (and why most of the action happens in Level III)

The “practical expedient” shortcut managers use for secondary fund stakes

Many private real estate funds mix these methods in a single portfolio, holding public REIT shares, direct assets, and secondary fund interests (each valued differently). Examples include SREIT and the Goldman Sachs Real Estate Diversified Income Fund, which we’ll break down below.

👉 Here’s a deep dive on a pure-play secondaries CRE fund - link

👉 Want to see how a fund that owns properties directly does it? - link

If you invest in secondary funds, you must read this:

Valuation Levels

This is where I need to tell you about valuations in general. I’ll keep it high level, just enough so you can dazzle your dining companions at the next CPA conference you attend (I’m kidding, nobody goes to those).

In accounting and financial reporting, assets are classified into three “levels” based on how observable their fair value is. Level I and II are relatively straightforward (but they show up only sparingly in private real estate funds):

Level I: assets with quoted prices in active markets. Think shares of publicly traded REITs or ETFs. Transparent, easy to value, little judgment required.

Level II: Assets without directly observable prices, but whose value can be inferred from similar market inputs (distant cousin of Level I, but less frequently traded, more judgement required).

Level III assets are a different beast altogether: