Inside Apollo Diversified Real Estate Fund

What's inside, where the 5% distribution comes from, and what investors find attractive.

Today’s case study is an interval real estate fund. I’ll cut to the chase.

The good: the fund has a 28% allocation to public securities (I’ll explain later).

The less good - and likely the reason a redemption queue has formed:

Invest in non-traded REITs? You’ll like this:

In today’s case study we will:

1️⃣ Look into what’s in the fund.

2️⃣ Figure out where the headline distribution comes from.

3️⃣ Discuss why some investors keep allocating despite the performance.

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author. All examples are illustrative in nature and not guarantees of future outcomes. Readers should conduct their own independent research and consult with qualified professionals before making any investment or financial decisions.

The Pitch

The Apollo Diversified Real Estate Fund ($3.7B AUM) bills itself as a one-stop solution for retail investors who want broad real estate exposure without selecting individual deals.

The positioning is straightforward: institutional-grade real estate access through a single, diversified fund. Target? Retail investors (the minimum investment is just $1,000 for qualified accounts).

👉Here’s another semi-liquid real estate fund (this one directly owns assets, and doesn’t have a liquid sleeve):

💰 As of 10/1/25, the fund reports a 5.22% annualized distribution rate. We’ll unpack the sources of that distribution shortly (spoiler alert: it ain’t cash flow from the underlying assets).

This is a closed-end interval fund, meaning investors can’t exit whenever they want. Liquidity only comes through quarterly repurchase offers, where the fund must buy back at least 5% of outstanding shares at NAV. If requests exceed that amount, the fund may repurchase an additional 2%, but it’s not required to.

👉 For more on interval and tender-offer funds:

That’s where the liquid sleeve becomes relevant:

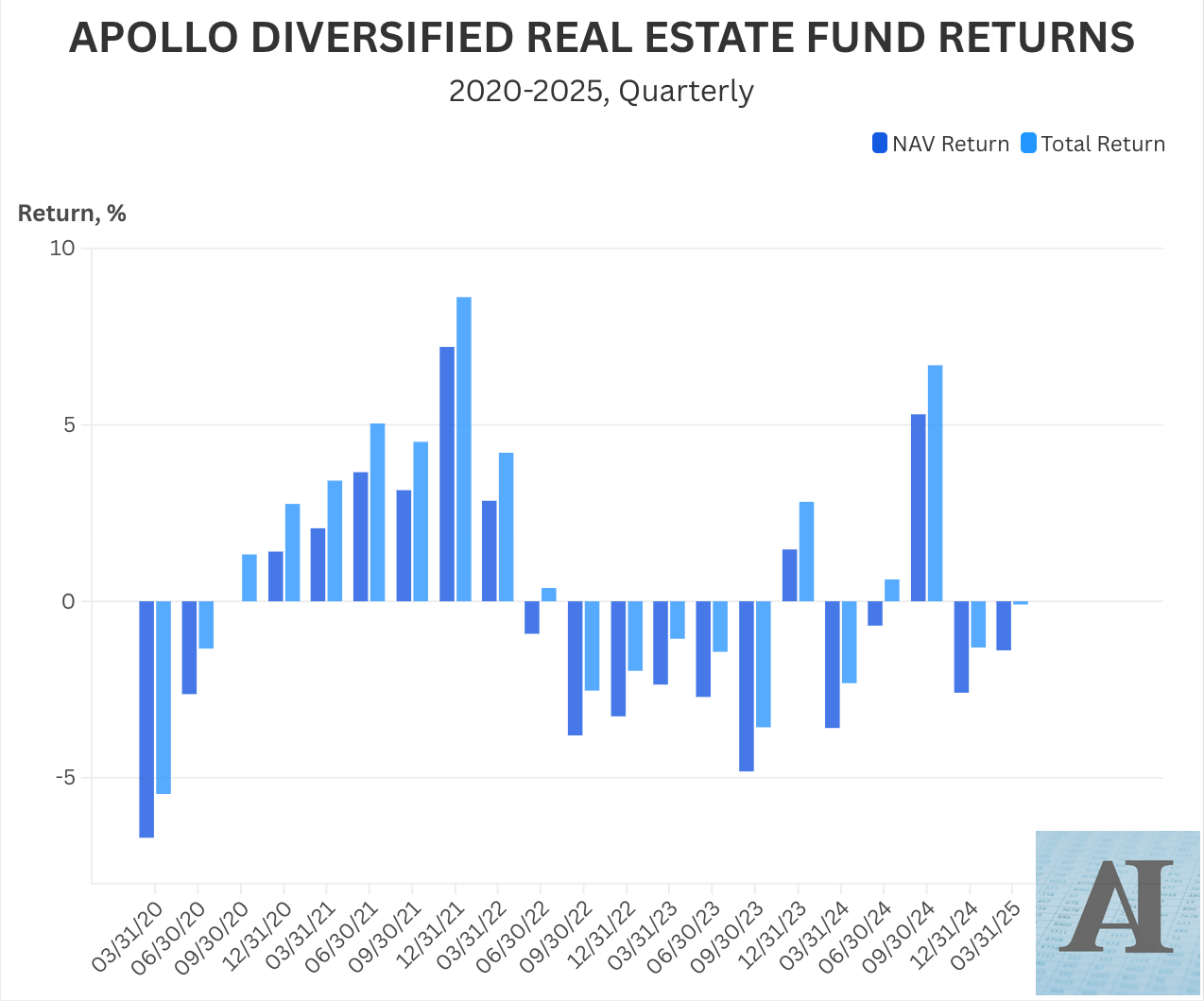

Roughly one-third of the fund’s assets sit in publicly traded securities and cash, giving the manager flexibility to meet redemption requests without being forced to sell illiquid private holdings at a discount. Even so, recent quarters saw a lot of redemption requests: the fund only purchased 43% of requested redemptions in November’24 and 36% in February’25.