KKR Private Equity Conglomerate LLC (K-PEC)

The HNW retail PE fund raising billions while delivering mostly unrealized returns

$2 billion in six months.

— That’s how much fresh capital this fund pulled in during the first half of 2025 alone. And here’s the kicker: it all came from high net worth retail investors.

If you invest in private equity, you need to read this:

In today’s case study we will:

1️⃣ Unpack how the fund really makes money.

2️⃣ Look into the portfolio (spoiler: it’s a fool’s errand, I’ll show you why).

3️⃣ Discuss why investors can’t get enough.

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author. All examples are illustrative in nature and not guarantees of future outcomes. Readers should conduct their own independent research and consult with qualified professionals before making any investment or financial decisions.

The Pitch

KKR Private Equity Conglomerate LLC launched in 2022, backed by - you guessed it -KKR. The strategy: acquire majority stakes across financial services, healthcare, consumer, industrials, and tech. Geographically, it spans North America, Europe, and Asia Pacific.

About 80% of assets go into portfolio companies. The rest (up to 20%) sits in a “liquidity sleeve” (cash, Treasuries, credit, other marketable securities). The reason is simple: the fund offers share repurchases, but portfolio companies don’t generate high cash yield. So, they need liquid assets on hand to cover redemptions.

As of 6/30/25, the fund carried no leverage (though it does have a revolver in place) and, unsurprisingly, paid no dividends.

Now for the numbers from the first half of 2025:

Dividend income: $36M

Operating expenses: $133M (of which $121M went to performance + management fees)

Realized gains: $33M

FX gain: $3M

Unrealized gains: $448M

K-PEC spent $1.3B on acquisitions.

🧮 Are you doing the math? You don’t need a calculator to figure out we are now $1B+ short on cash.

Background

So how does a fund that just spent $1.3B (and showed a net investment loss) still keep investors piling in?

To answer that, I need to give you some background first.

Traditional private equity is fairly simple: buy companies → improve them → sell for more. This is a slow process. That’s why closed-end PE funds historically locked up investor capital for 7–10 years.

But that model is becoming antiquated. With the “democratization” of private assets, private equity is no longer just the playground of institutions. And when it comes to individual investors, they want two things:

Access to exclusive asset classes (PE checks that box).

Liquidity (even though PE, by nature, is illiquid).

This paradox was neatly solved by emergence of tender offer and interval funds:

1️⃣ How the money is made

Back to our fund at hand.

K-PEC was built for the retail investor sweet spot: brand name PE asset manager, and the promise of liquidity. The fund doesn’t actually run portfolio companies - it invests alongside other KKR vehicles (K-PEC is effectively an equity provider).

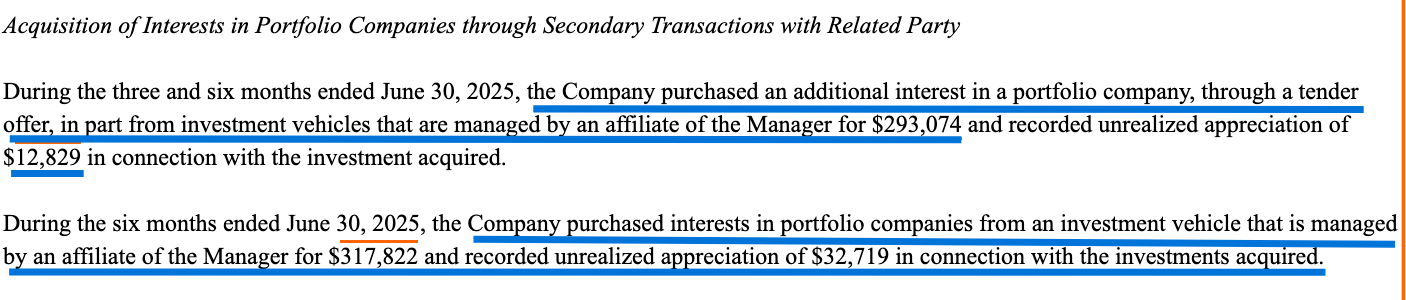

And when you dig into the SEC filings, the way investments get booked is… eye-opening. You’d expect value to show up over time. Instead, we see this (the screenshot is from the most recent quarterly report):

K-PEC bought additional stakes in a company it already owned (for $293M), from another KKR fund, and marked it up by $12.8M.

It bought another $318M of assets from affiliates and marked those up by 10% immediately.

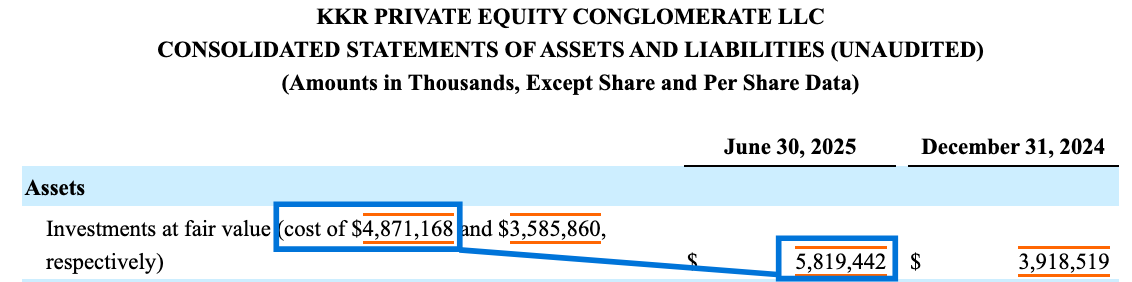

This isn’t a one-off. From its very first acquisition in 3Q23, this has been the fund’s standard playbook. As of 6/30/25, investments sit at $5.8B against a $4.9B cost basis - a 19% markup:

This has two major implications (number two will make you want to get reincarnated as a PE fund manager):