Markups, Fees, and Fine Print

A Look Inside the $3.9B Hamilton Lane Private Assets Fund

The story I’m going to tell you today centers on the $3.9 billion Hamilton Lane Private Assets Fund (HL PAF). If the name rings a bell, it might be because the fund has appeared in the news a few times over the past year - most recently here.

We’re going to cover three things:

A curious shift in how the fund reports its data

How the fund manager earns incentive fees

And why reading the fine print matters, especially when investors think they’re approving one thing, but end up greenlighting something else entirely.

Why should you care?

Because the secondary fund wave is coming.

Many RIAs already have these products on tap. And we’re not far from a world where they start showing up in 401(k) plans. Meanwhile, most investors (including professionals) have only a vague idea how to evaluate them.

What complicates things, of course, is the opaque nature of private markets.

To be clear, I’m not picking on Hamilton Lane. I’m focusing on HL PAF because it’s one of the few secondary-focused funds that files with the SEC. That means we can actually see what’s happening under the hood.

Quick reminder: this is not financial advice, nor a solicitation to sell securities. All information is shared strictly for educational purposes.

Background

Hamilton Lane’s Private Assets Fund invests primarily in direct co-investments (~47% of NAV) and secondaries (the focus of this piece).

Secondary investments = LP stakes the fund acquires from other investors in private equity funds. Think of it as buying into a PE fund midway through its life, often at a discount.

Most of HL PAF’s portfolio is equity, not credit, so it’s not expected to generate steady cash yield like a private credit fund or BDC might - this makes things a little easier to manage from the cash flow stand point, you’ll see why.

📚 Need a refresher on secondaries?

If you are allergic to reading financial reports, I wrote a very simple illustration of how an imaginary fund can buy assets, mark them up, pay a promote to the fund manager, and keep showing great returns to investors in quarterly statements. All purely hypothetical, of course. If you haven’t yet, you should read it:

Asset Valuation

Back to our fund at hand. In fiscal 2024, HL PAF bought $1.9 billion of assets and sold ~$380 million. One of the main attractions of secondaries is the ability to buy at a discount to NAV, then realize gains as the portfolio matures.

But here’s the billion-dollar question:

How big were the discounts?

We don’t know.

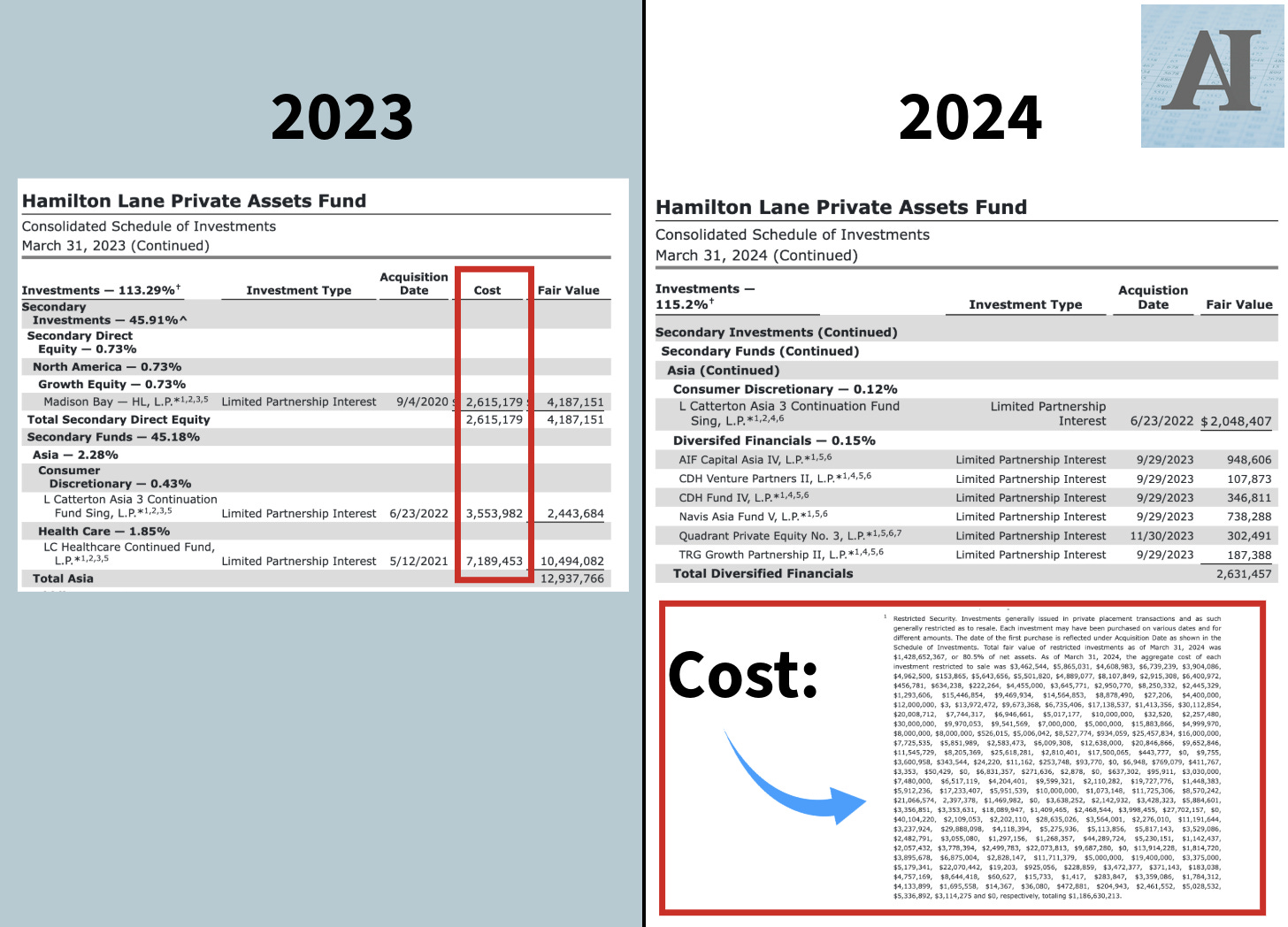

Historically, HL PAF made this easy. The cost basis (i.e., what they paid for each investment) was listed directly in the Schedule of Investments. You could see, line by line, how the portfolio was marked (left side of the chart below).

But in 2024, things became more interesting with this fund’s reporting.

The cost basis disappeared from the main table and was relocated to the footnotes, buried in what can only be described as a number salad. There’s no clear way to match the figures to the investments (that is, until I got AI to help):

As an investor in this fund, you might think: “Who cares what they paid, as long as the the marks are higher?”