Morgan Stanley Direct Lending Fund (MSDL)

Durable Yield and High Inside Ownership for this Relatively New BDC

This business development company (BDC) is a recent addition to the public market, offering potential advantages that may appeal to income investors. Today, we’ll take a closer look at MSDL and explore why it presents a promising opportunity within the BDC landscape.

We recently screened the entire universe of public BDCs using 42 criteria, and MSDL was one of the 3 public BDCs that passed the screen. Read this to learn more:

Overview

Morgan Stanley Direct Lending Fund (MSDL) is an externally managed Business Development Company (BDC) that began trading publicly on the NYSE on January 24, 2024. Morgan Stanley Capital Advisors (established by Morgan Stanley in 2007) serves as the external advisor to MSDL. Morgan Stanley launched its private credit platform in 2010 and operates strategies including direct lending, opportunistic credit and tactical value investing.

MSDL aims to achieve attractive risk-adjusted returns via current income by investing in directly originated senior secured term loans issued by middle market companies ranging in borrower EBITDA between $15-200 million. This BDC focuses on borrowers owned and controlled by private equity sponsors.

Some points of interest:

Low percentage of PIK (2.84% of Total Investment Income as of 9/30/2024)

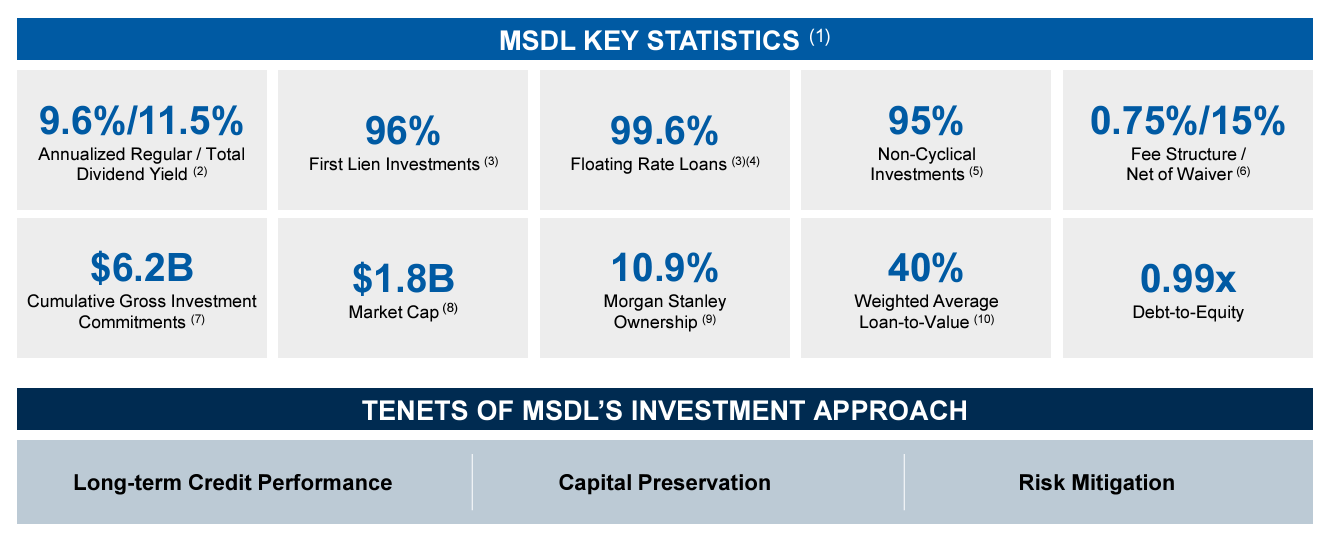

High amount of first lien investments at 96%

Beware of the temporary fee waivers. We exclude those waivers in our figures for more normalized NII.

As of the latest earnings release filed last week on November 7, 2024, approximately 99.7% of investments are backed by private equity sponsors; the weighted-average 12-month EBITDA is at $144.9 million.

Insider Ownership

Note the inside ownership figure above: MSDL is not a subsidiary of Morgan Stanley. Yet MS has approximately an 11% ownership of MSDL. This represents good skin in the game and confidence in their strategy.

Industry Diversification

While software does comprise the largest borrower industry for MSDL at 17.7%, MSDL is well diversified outside of this industry:

It is worth noting, however, that MSDL has increased its composition of loans in the software industry to 17.7% in Q3 from 15.7% in Q2 and 14.8% in Q1. As you can see below, this has not resulted in a higher percentage of PIK revenue. This is acceptable to me but I will continue to monitor the PIK and software percentages in the coming quarters.

Distributions and NII Yields

MSDL has been trading publicly for less than a year, but it does have a longer history as a non-traded BDC. It reports paid distributions at least back to Q2 2020.

The current quarterly recurring distribution is set at $0.50 per share yielding approximately 9.85% on market price and 9.60% on latest net asset value (NAV) as of this writing. MSDL has declared a few other special distributions of $0.10 per share each over the coming quarters, however we exclude this from the coverage ratios. The special distributions are temporary and often used post-IPO to encourage pre-IPO shareholders to retain their shares for longer.

More important is the actual net investment income (NII) and Cash NII yields that MSDL generates. These yields are higher than the recurring distributions and therefore provide a margin of safety against adverse loan performance and an opportunity to reinvest some excess NII into new loans or share repurchases. Here’s why it’s important:

LTM returns and distribution coverage ratios are shown below. MSDL sports healthy cash NII returns and distribution coverage.

Shareholder Alignment

The 11% insider ownership is great to see. In addition to that, MSDL offers more shareholder-friendly advantages given its ample cash distribution coverage.

MSDL is repurchasing its shares as it has been trading at approximately a 4% discount to NAV over the last several months. As of the latest earnings release last week, MSDL reported that it has repurchased 429,653 shares at an average price of $20.06 per share, which represents a discount to NAV of about 3.7% and is immediately accretive to earnings.

This discount corresponds directly to a 3.7% increase in its EPS offering investors higher returns. The share repurchases last quarter represent an annualized 2% reduction in share count.

Debt and Funding Strategy

There are a few strategies with which a BDC may fund its investments outside of equity capital. MSDL primarily employs unsecured fixed notes. This type of debt financing currently comprises 57% of its total debt funding at an average rate of 6.89%. The remainder consists of a couple of credit facilities.

The benefits and risks to unsecured fixed rate debt include:

Benefits

Not callable or collateralized by anything.

Interest rate cost is capped if rates move higher

Risks

Usually a higher interest rate relative to other types of debt due to lack of collateral

Not ideal as an asset-liability match. Declining loan rates due to competition can bring down portfolio yield while fixed rate debt remains high. This can compress net interest margin.

MSDL’s current net interest spread is 4.1%. It has contracted somewhat from 5.5% a year ago. This is partly a function of more than half its debt being fixed as SOFR rates have begun to come down - affecting rates on new loan commitments.

Each BDC typically reports a rate sensitivity analysis in its 10-Q that discusses the projected change in net income per change of 100bps in its investments and borrowing structure. MSDL is like most BDCs which use a diverse funding mix with about 50-70% of unsecured notes. MSDL does have a slightly higher than average rate sensitivity at about -1.34% of net assets per 1.00% drop of the rates in its portfolio structure. This compares to a range of -0.62% to -1.30% for other BDCs we have researched. Keep in mind this is not driven directly by SOFR but the specific investment structure of the BDC.

Morgan Stanley did execute an amendment to the BNP credit facility that reduced its rate pricing from 2.85% down to 2.25%. This will improve net interest margin and interest rate sensitivity.

Conclusion

MSDL’s low reliance on PIK interest, coupled with its strong cash generation and disciplined reinvestment approach, makes it a resilient option over the next several quarters. It trades below NAV with material insider ownership.

I will continue to keep an eye on the increase in exposure to software and monitor their funding structure. In another article we can discuss some other metrics including non-accruals, which are very low, and realized loss history.

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.