Partners Group Next Generation Infrastructure

Evergreen Fund Targeting Global Infrastructure: Fees, Holdings, and How the Manager Earned Incentive Fee

18.6% total return for the fiscal year ended March 31, 2025. Did this whet your appetite?

Today, we are doing a case study in a new asset class: infrastructure.

This is yet another evergreen vehicle, with all the familiar pros and cons.

👉 If you missed the evergreen primer, I recommend reading it first:

In today’s case study we will:

1️⃣ Break down the fee structure (trust me, you’ll want a coffee for this one)

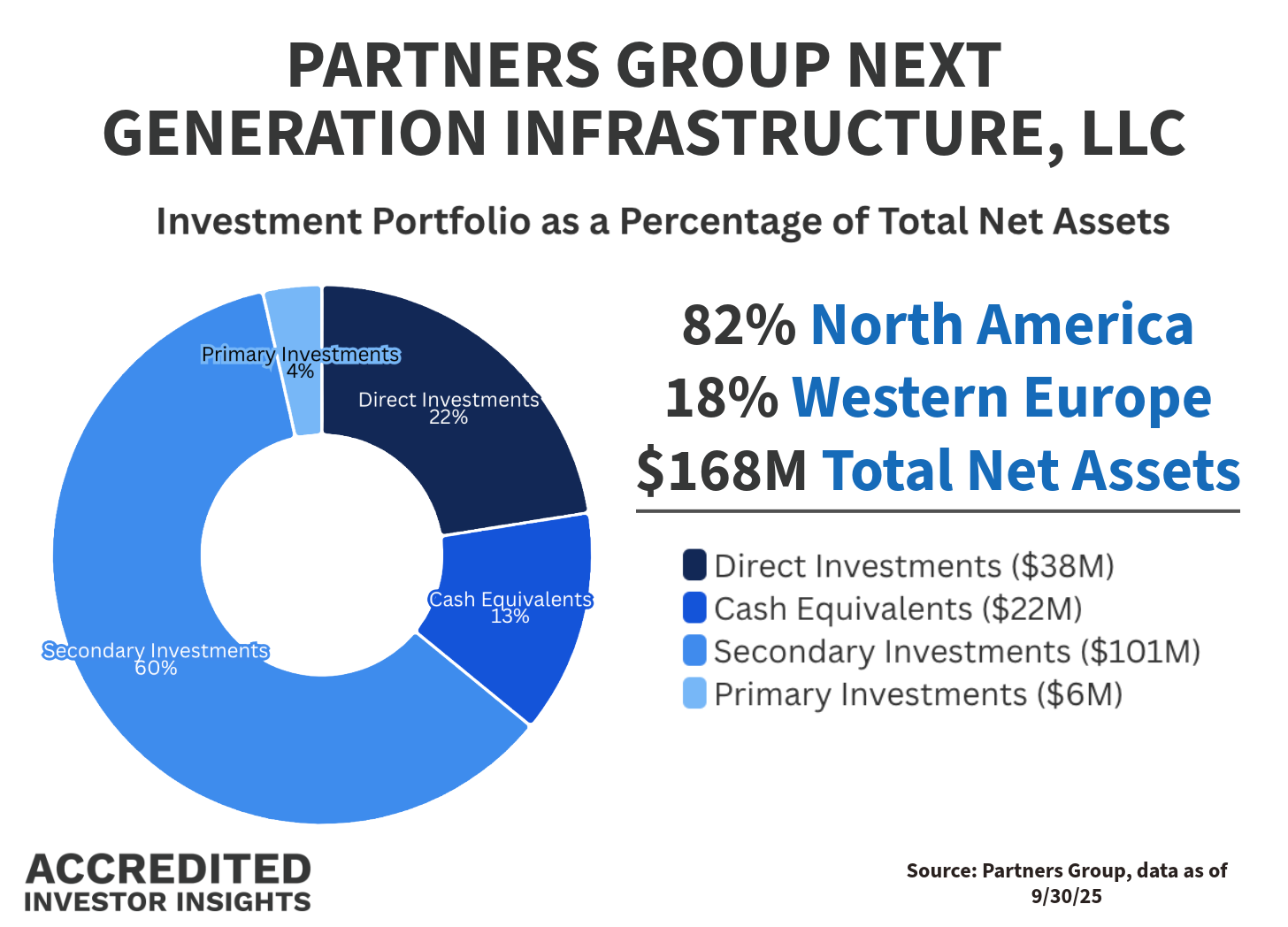

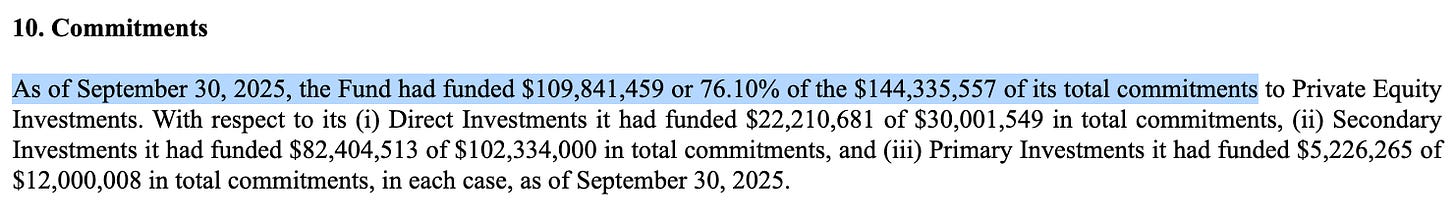

2️⃣ Dive into what’s actually in the fund

3️⃣ Explore how the fund generates returns

👉 60% of this fund is invested in secondary assets. “Leyla, what are secondaries?” — here you go:

👉 And here’s a great guest post on funds-of-funds:

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author. All examples are illustrative in nature and not guarantees of future outcomes. Readers should conduct their own independent research and consult with qualified professionals before making any investment or financial decisions.

The Pitch

Partners Group Next Generation Infrastructure, LLC is a Delaware-based, non-diversified, closed-end investment fund launched in 2023. It is overseen by a Board of Managers and advised by Partners Group (USA) Inc.

The fund targets risk-adjusted returns from global infrastructure investments, made either directly or through affiliated subsidiaries. Units are offered only to accredited investors who are also qualified clients, and are issued in three share classes (A, I, and S).

Purchase and Tender of Shares

Here’s what investors pay to get in:

Ongoing distribution and servicing fees: up to 0.85% (Class A) and 0.25% (Class S) annually; none for Class I

One-time placement fees at purchase: up to 3.5% (Class A 🤕) and 1.5% (Class S); none for Class I

(Excludes incentive fees, taxes, interest, trading costs, and underlying fund fees.)

Liquidity: periodic tender offers, typically quarterly, for up to 5% of net assets (subject to market conditions). Early repurchases (<1 year) may incur a 2% fee.

Expense caps: 3.15% (Class A), 2.55% (Class S), 2.30% (Class I). The Adviser may temporarily waive or cover costs to stay under the cap; waived amounts are recoupable for up to three years. In the six months ended 9/30/25, $267,624 (Class I) and $4,027 (Class S) were recouped.

Fees

1️⃣ Management Fee

1.25% annually, calculated on the greater of NAV or NAV plus unfunded commitments (net of cash) 👈 that last part is important:

Not a huge deal in absolute dollars, given the size of the fund, but as of 9/30/25, investors were effectively paying this fee on ~24% of the fund not yet deployed.

For the six months ended September 30, 2025, management fees totaled just under $1 million.

A temporary fee waiver reduced the effective rate by 0.25% annually from July 2025 through June 2026, resulting in approximately $107,000 of waived fees during the period

2️⃣ Incentive Fee

15% of net profits

❗️This is the key point I need you to pay attention to ⤵️