Past ≠ Future

The Limits of Performance Persistence in Private Equity, Venture Capital, Private Credit, and Real Estate

Few ideas in private markets are as seductive as the belief that past performance predicts future results. If a GP just handed you a 2.3x net return, why wouldn’t you re-up?

And I get the appeal, I want a shortcut to my due diligence too.

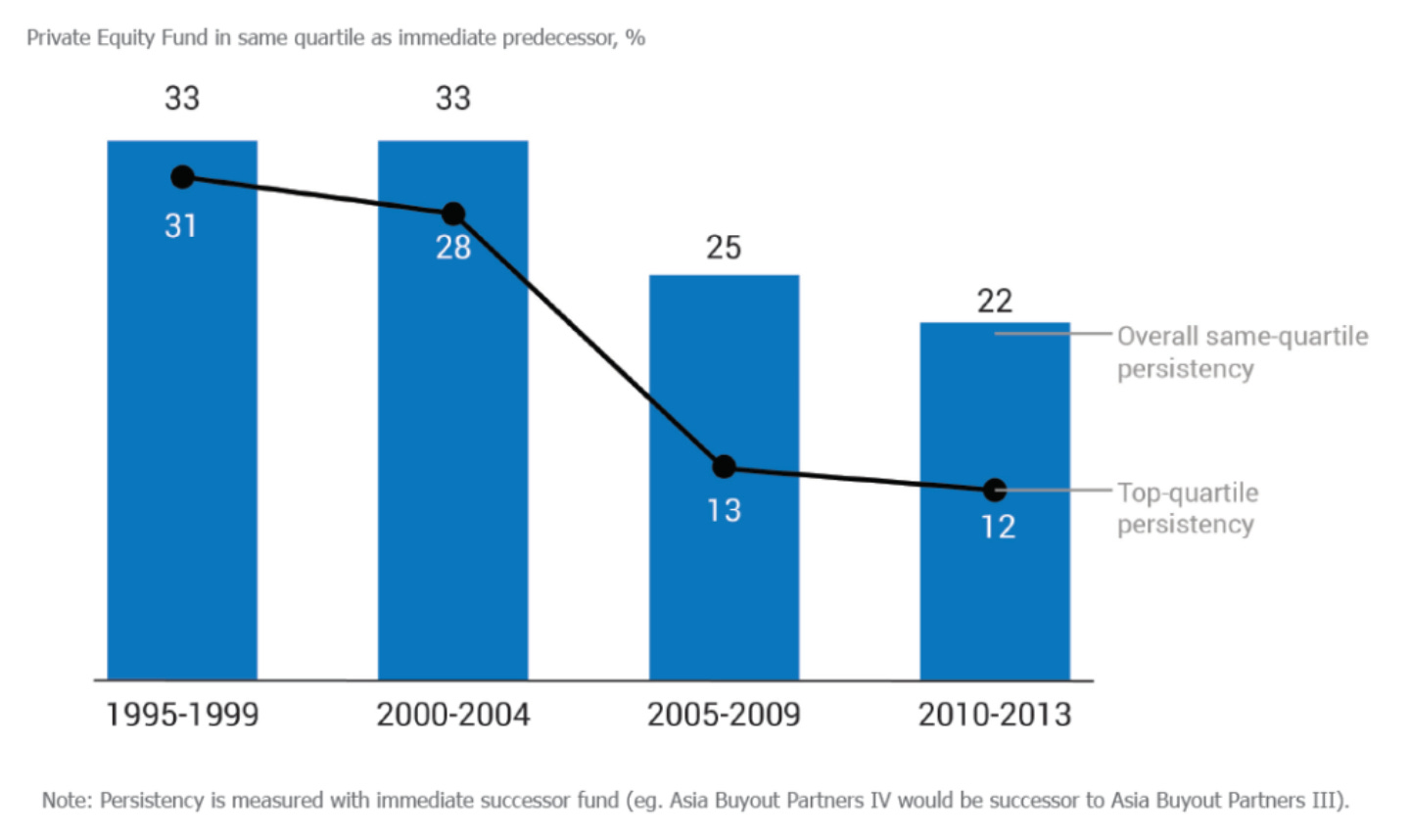

Unfortunately, I have bad news: while some persistence exists, it’s limited, unevenly distributed, and has been diminishing in recent vintages.

Today we’ll break down what the data actually says about performance persistence in private equity, venture capital, private credit, and CRE. We’ll pull from academic research (I see your eyes gazing over, I promise to spare you the footnotes), industry reports, and what we’re seeing in today’s market.

For LPs, there is a clear takeaway: quartile rankings could be useful, but they are far from the full story.

What Is Persistence, and Why You Should Care

In public markets, we’ve long known that alpha rarely persists. Active managers who outperform one year often regress to the mean. But private markets are a different animal: less liquid, less transparent, and more dependent on sourcing advantages and operational execution (or so we are told in the marketing materials).

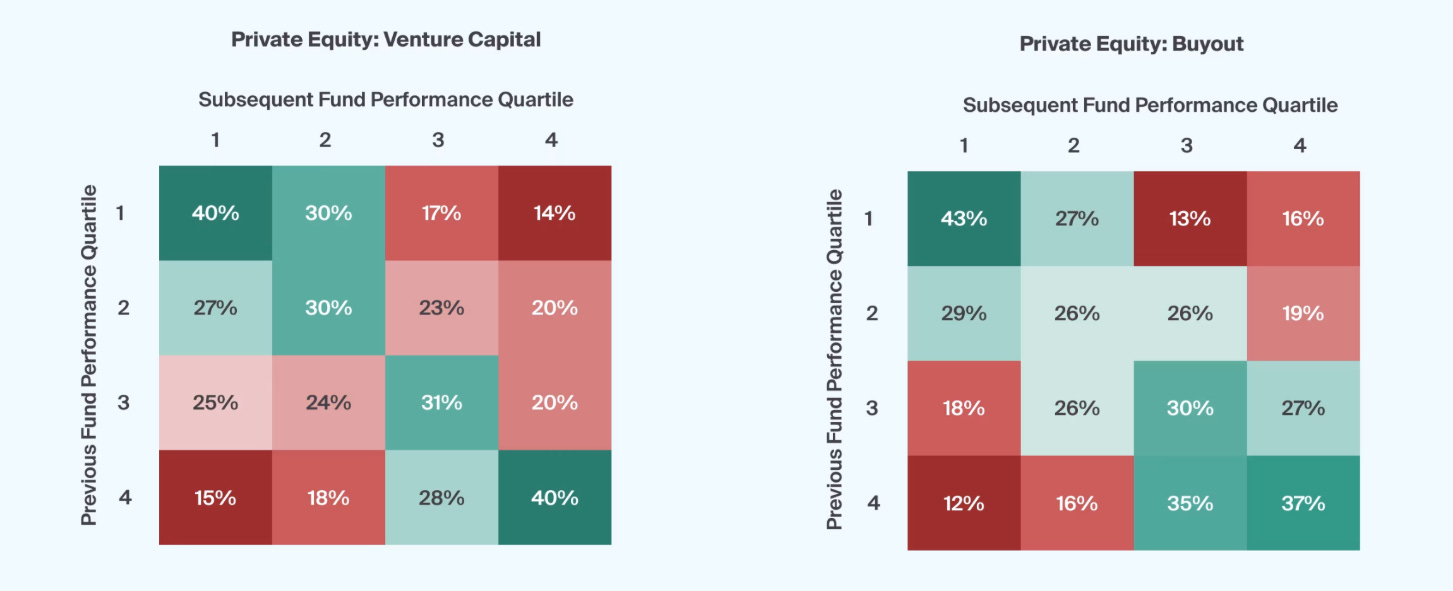

Persistence, in this world, means the degree to which a GP’s past fund performance predicts their future results. So, can it? And if not, what can past performance tell us?

This article goes into why realized IRRs (especially in commercial real estate) aren’t always the skill signal we’d like them to be.

PRIVATE EQUITY

What the Research Says

1️⃣ Persistence (when observed) is short term.

Classic studies (like this one) have long pointed to short-term persistence in buyout and growth equity. If a GP outperformed with Fund III, odds were above random that Fund IV would also deliver. However, this relationship is strongest in adjacent vintages and weakens as you move further out or as the GP scales.