Real Estate Debt Fund: a Case Study of What's Missing

Ask Better Questions, Shed Fewer Tears

Just when you think the era of “simple, safe” private debt funds is back… along comes a pitch deck that makes you reach for your due diligence checklist (and maybe a stress ball).

Today’s case study is a masterclass in what’s not said and the questions every LP should be asking before wiring a single dollar. If you’ve ever been tempted by an 11% fixed return from a real estate debt fund, buckle up.

But before we dive in...

Accredited Insight gives you the LP’s perspective on private credit, private equity, and CRE—drawing on hundreds of deals reviewed. Paid subscribers get access to 30+ case studies and our deep-dive series on reading a CRE proforma. If you’re a GP, this is your window into the allocator’s world.

👉 $10/month or $100/year

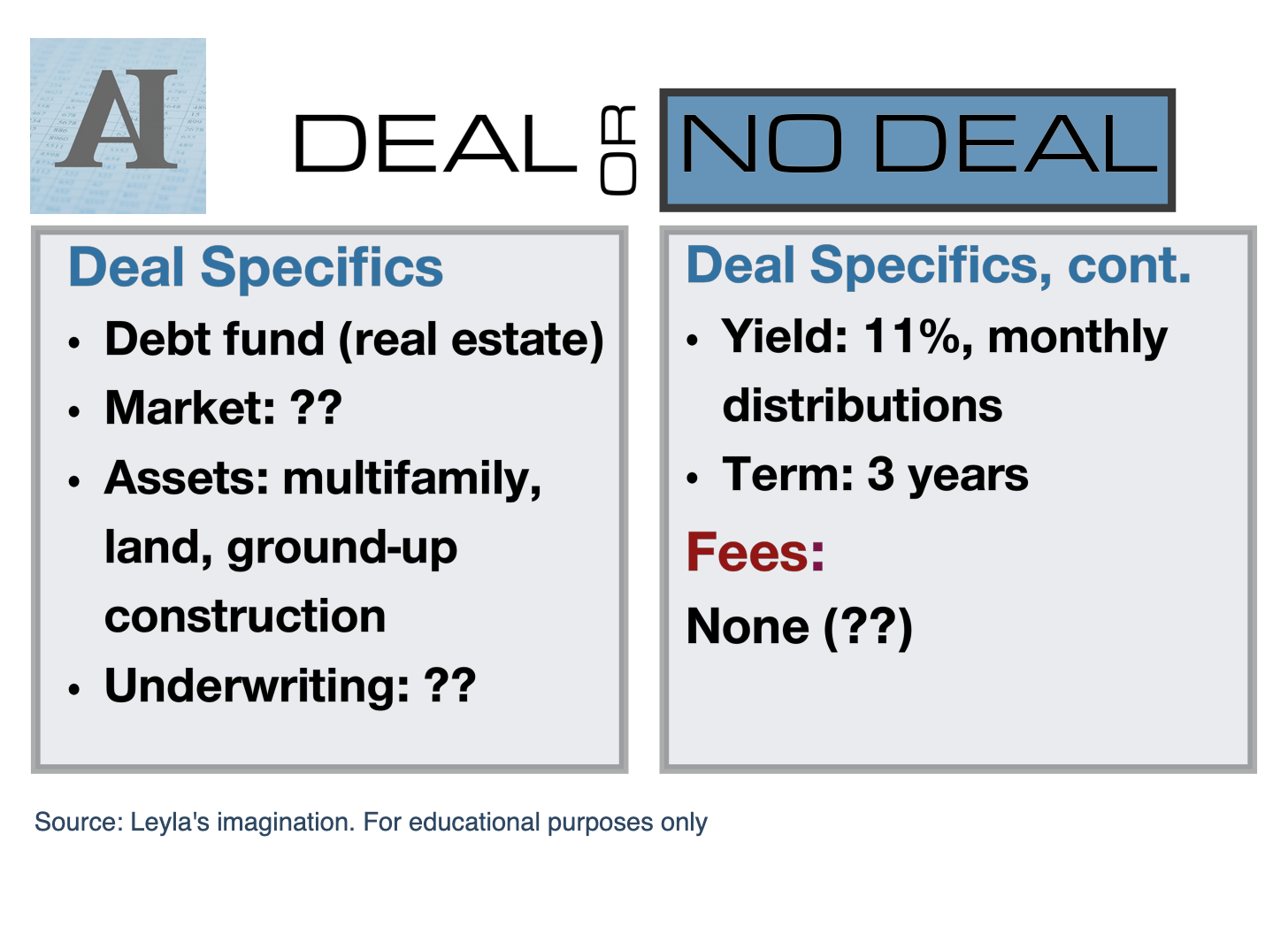

Deal or No Deal?

As always, this is for educational purposes only. Numbers, names, and details have been changed to protect the innocent (and the not-so-innocent)

The Pitch

This fund pitches itself as the Swiss Army knife for multifamily operators in need of quick cash. Rate cap expiring? Need to refinance? CAPEX running over budget? They’ve got a solution for every scenario.

Despite the “credit fund” branding, the offering isn’t just about second-position (mezz) loans; it also includes “preferred equity” investments (meaning you’re junior to the senior lender but still ahead of the common equity).

Curious where that leaves you? Here’s why your spot on the capital stack matters more than you think:

The sales pitch? A “more secure” spot and an 11% preferred return, with monthly distributions and a three-year maturity.

Sounds great, right? But let’s break down what’s missing:

What’s in the portfolio

Conflicts of interest

Leverage and downside protection

Fees

Track record (equity ≠ debt)

‼️ Quick confession: every question in these five sections (and the red flags I left out for brevity) was generated by someone else. I’ve been training my AI sidekick (mini-Leyla) to think like an LP, and she nails it. Want your own? The prompt is at the end of this post.

1️⃣ What’s Actually in the Portfolio?

The deck lists a buffet of use cases: rate cap financing, refi rescue, even land banking. But nowhere does it say how much capital will go to each bucket.

Why does this matter? Because lending for a rate cap on a stabilized asset is a world apart from funding raw land. Without a target allocation, you have no way to gauge the portfolio’s real risk profile.

📌 Questions to ask (compliments of mini-Leyla):

What’s the target allocation for each loan type? Are there exposure limits for higher-risk buckets like land, and ground-up development?

2️⃣ Conflicts of Interest

This is the THIRD (yes, you read that right!) fund I’ve seen in the past six months from a GP with thousands of multifamily units under management.

Each sponsor loves to tout their “vertically integrated” setup (property management, acquisitions, etc). But here’s what they don’t mention: whether the fund will be lending to its own affiliates or properties managed by related parties.

Why does that matter? Because lending to yourself (or your friends) without real oversight is a recipe for misaligned incentives and conflicts of interest.

📌 Questions to ask:

Will the fund lend to affiliates? If so, what independent safeguards are in place? Is there a third-party review process for related-party loans?

3️⃣ Leverage & Downside Protection

The fund’s position in the stack is fairly clear.

What’s not clear: whether the fund itself will use leverage (i.e., borrow money to juice returns). If it does, you’re stacking risk on top of risk (on top of risk, on top of risk … - like a stacking doll)

Also missing: any detail on underwriting standards: LTV, DSCR, recourse, collateral, or what happens if a borrower defaults.

Why does this matter? Because “preferred” doesn’t mean “protected” if the underlying deals are worth less than the senior loan balance (oh, don’t look so shocked)

📌 Questions to ask:

Will the fund use leverage? If so, how much and on what terms?

What are the typical LTV/LTC ratios and DSCR requirements for loans?

What’s the actual legal process if a borrower defaults?