Reverse-Engineering Valuation and the Capital Stack

An LP’s guide to reading between the lines on a preferred equity deal

“You can’t lose money in real estate” is a lie.

Take this deal, for example.

Despite solid execution and meaningful NOI growth, common equity in this transaction has already taken a hit.

Today, I’m going to walk through a real-world case study and show you how to do very simple math on an individual preferred equity deal in commercial real estate. This is the kind of math every LP should be comfortable doing.

Before you say, “Leyla, stab me with a butter knife, but don’t make me do math!” Fine. I’ll give you an AI prompt that’ll do it for you 🤖. You’re welcome.

If you don’t understand capital stacks, I implore you to read this:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything from evergreen funds to due diligence.

Background

Just a friendly reminder: this is for educational purposes only, not financial advice. Numbers, location, and details have been changed to keep the sponsor’s identity confidential.

You’ve probably heard about the maturity wall in commercial real estate (a large volume of loans coming due over the past few years). The narrative has been circulating for a while, yet visible distress has been slower to emerge.

Why?

A significant portion of this debt was originated by private lenders, many of whom have been willing to grant extensions, this is your classic “extend and pretend.”

In the short term, this has been good news for both debt and equity investors. Deals that might have otherwise handed back the keys are still being operated by the original sponsors (and many LPs are oblivious, just sayin’).

What we’re starting to see now, however, is the next phase: some of these assets are being refinanced into fixed-rate agency debt, often at lower leverage and with reshuffled capital stacks.

👉 Read this to learn the many ways recapitalizations can be done:

The Deal Backstory

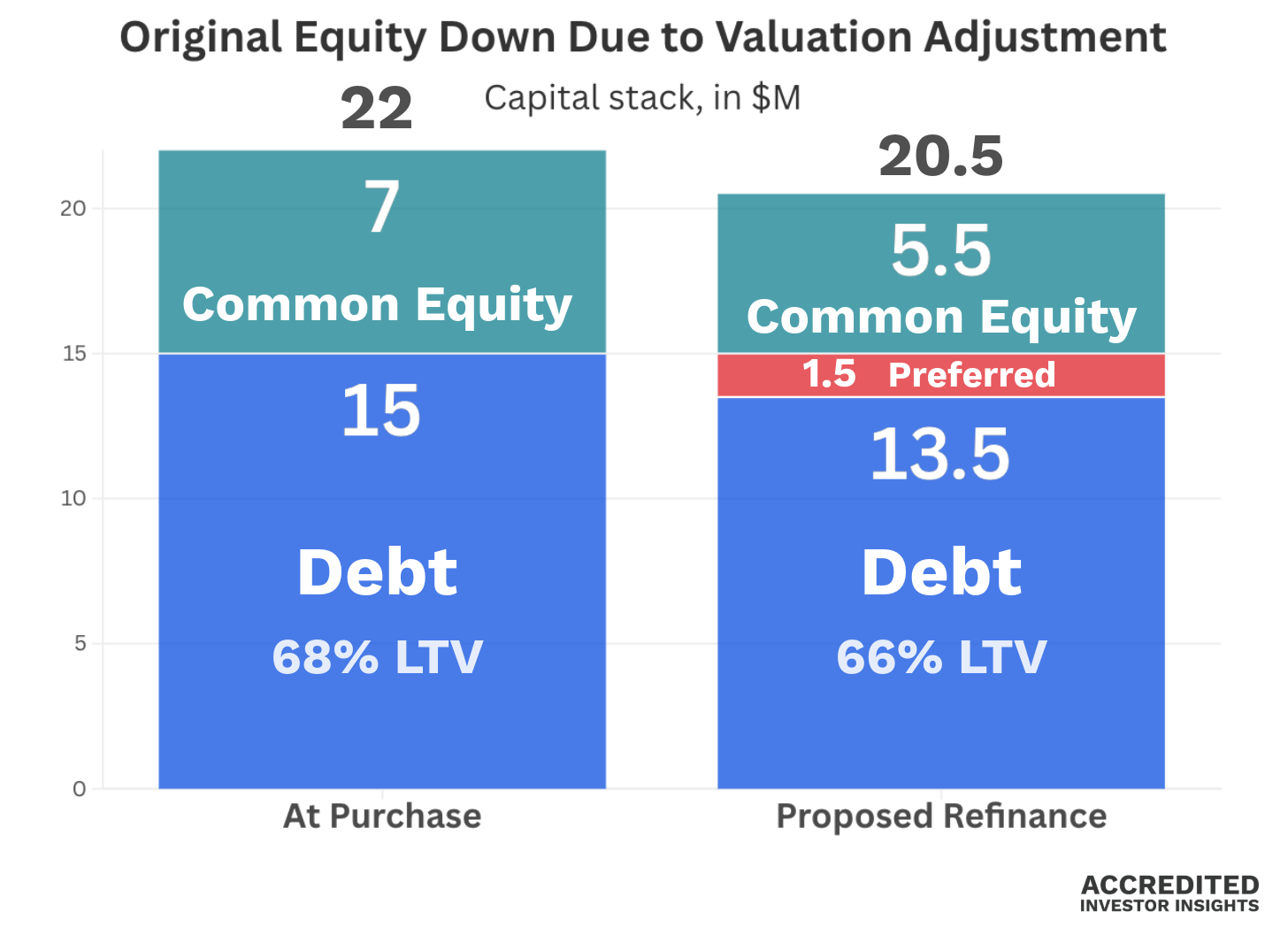

The property is an early-1990s vintage multifamily asset in Houston. It was acquired in mid-2022 for approximately $22 million.

Initial Capital Stack

$15.0 million senior debt (≈68% LTV)

$7.0 million common equity

Don’t faint: the entry cap rate was approximately 4% on trailing twelve-month NOI. We know this because the acquisition NOI was disclosed in the deck.

👉 Here’s the relationship between cap rates and values:

Since acquisition, roughly $1.56 million has been invested in property and unit upgrades.

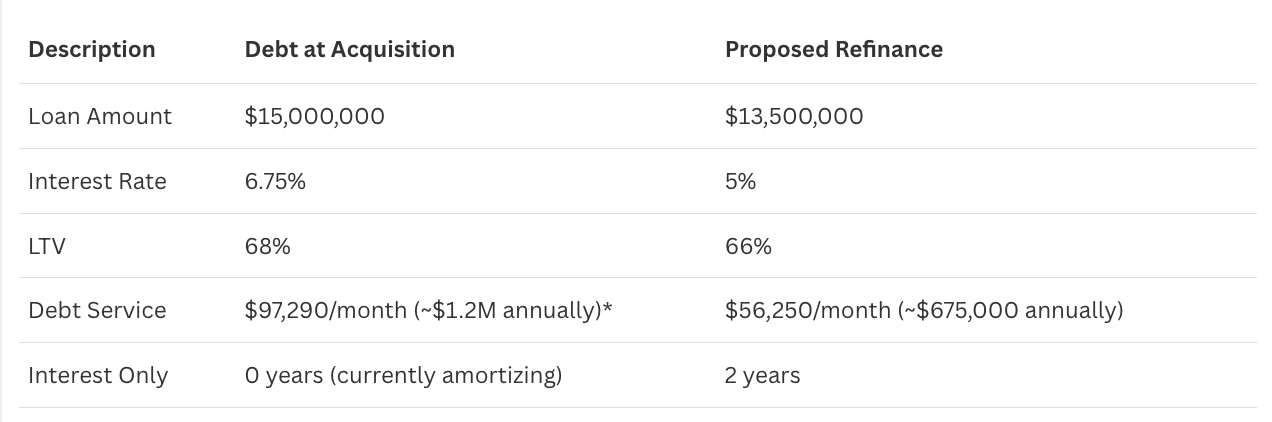

Debt Then vs. Now

The deck does not disclose the current property valuation or the cap rate used to derive it. However, it does provide sufficient detail on the proposed refinance, which allows us to back into an implied valuation.

Here’s how:

Do you see the LTV? A $13.5M loan at 66% LTV gives us implied value of ~$20.5M.

We also know from the deck that net operating income has increased by approximately 31% over the first three years of ownership, reaching ~$1.12 million by year three.

Now we simply reverse the cap rate math:

$1.12M NOI ÷ $20.5M value = ~5.5% cap rate

Where Did the Money Go?

Operationally, the deal has performed well (30% NOI increase is nothing to sneeze at).

LPs, I beg you, learn to evaluate a GP’s operational skill. (And no, realized IRR alone doesn’t give you the full picture) Check this out: