🗞️ Sunday Digest: Private Markets Insights 6/15

Retail Money Meets Private Markets — And How Family Offices Are Shifting Allocations

Happy Sunday!

This week, we’re looking at how capital is moving across private markets: retail money is rushing in (and bringing fresh risks), while family offices are quietly repositioning to navigate higher rates and growing uncertainty.

Before we dive in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective through the LP lens. We cover private credit, private equity, and CRE investing, drawing on countless deals we’ve seen.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click below to choose your plan:

👉 $10/month or $100/year.

🧭 Retail Money Meets Private Markets

“Retail investors may not fully appreciate the risks inherent in private credit, particularly during times of market stress, when liquidity is most constrained.” — Moody’s Ratings

1️⃣ This week, Moody’s flagged growing risks tied to the surge of retail capital flowing into private credit. With non-institutional investors gaining exposure through 401(k)-linked vehicles, interval funds, and new ETFs, the report warns of potential liquidity mismatches and weakened underwriting standards. (Does it feel eerily familiar to late-cycle behavior in other asset classes? Or is it just me?)

If you're investing in private credit, it's worth keeping a close eye on PIK (and knowing how to tell the different types apart). I wrote a piece that breaks it down and shows how you can use AI to track PIK usage across quarters.

2️⃣ On the flip side, efforts are underway to bring more transparency to private markets. FTSE Russell just announced plans to launch private asset indices, data, and analytics products for private assets later this year, in partnership with StepStone.

The timing is no accident. As access broadens, the need for institutional-quality benchmarks and stress-tested structures is becoming urgent, not just for LPs, but for regulators and risk managers too.

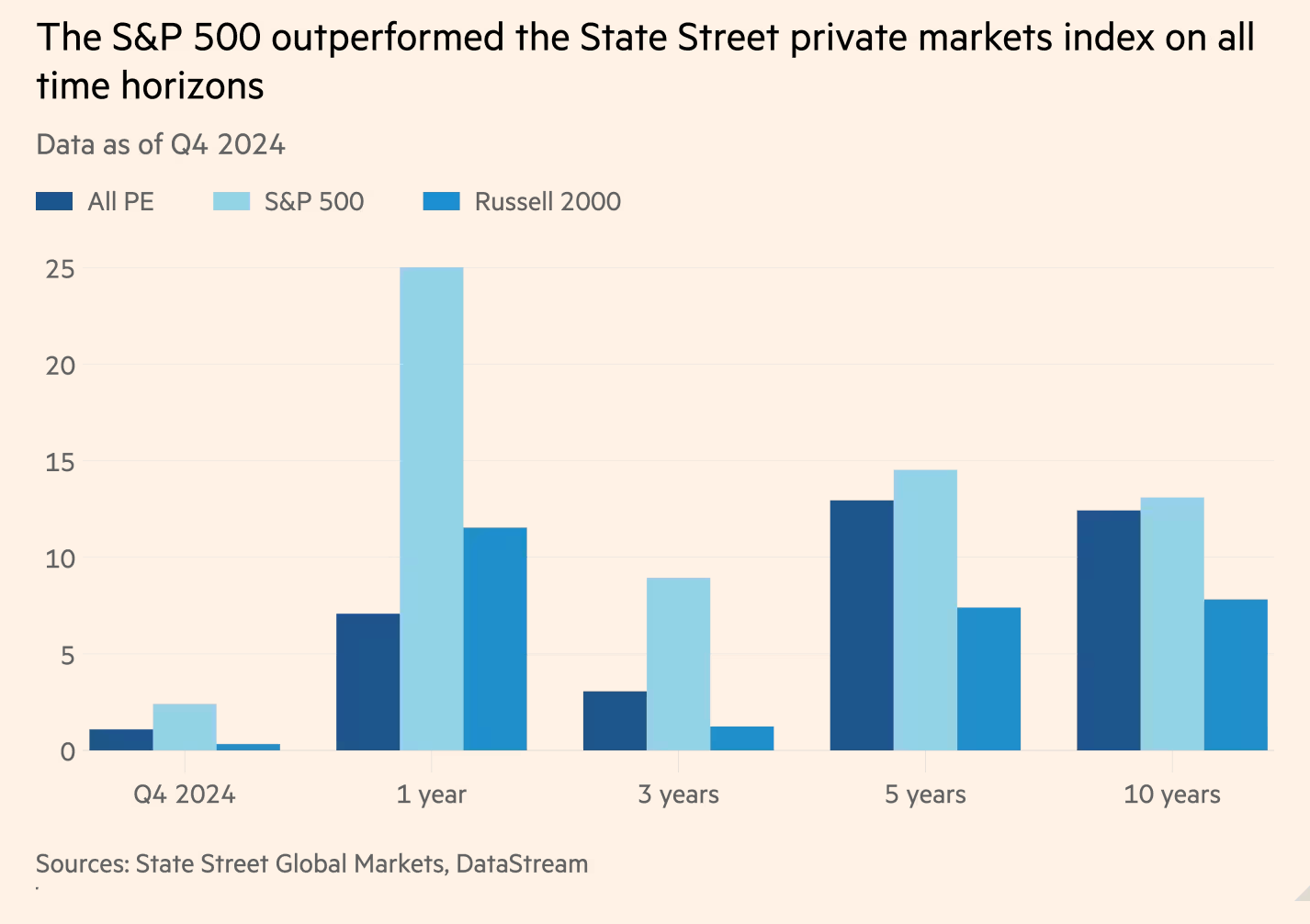

3️⃣ While all that is unfolding, State Street’s private equity benchmark, which tracks PE, private credit, and VC funds, just posted a milestone no one’s celebrating. For the first time since 2000, private market strategies underperformed public equities across every tracked time horizon in a calendar year:

💼 What $650B in Family Office Capital Is Doing Now

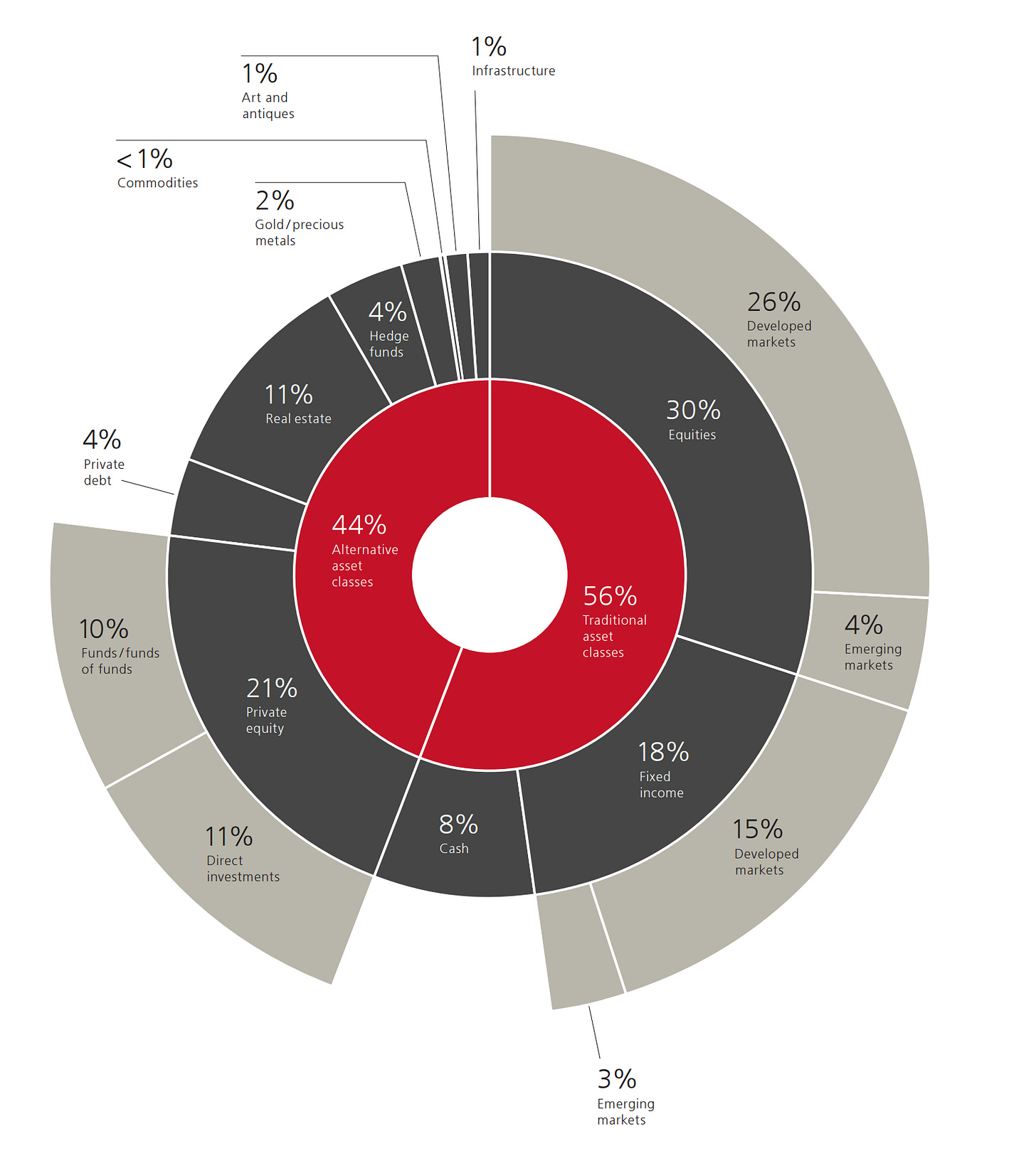

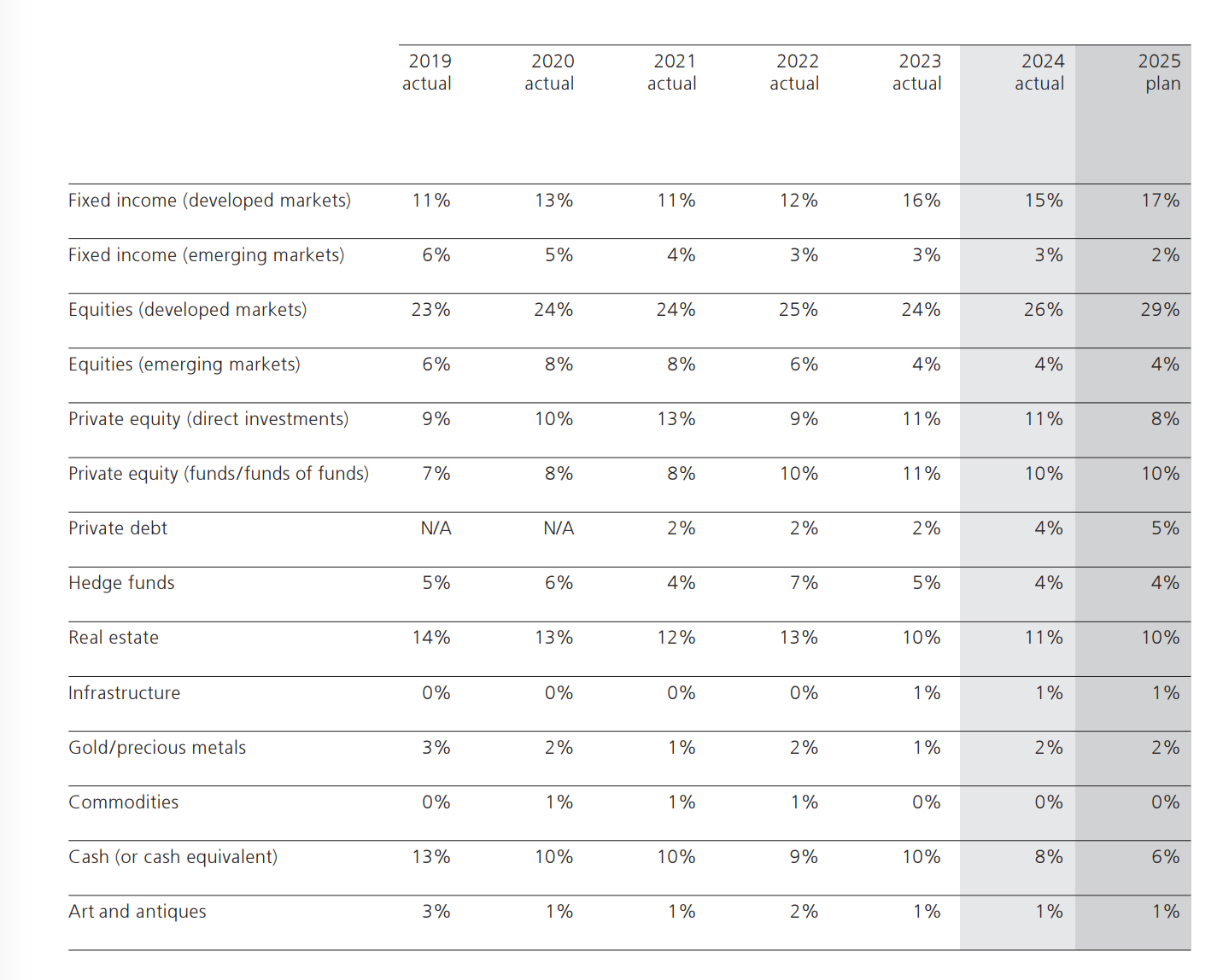

UBS surveyed 317 family offices managing over $650B. Despite market volatility and geopolitical risk, most are staying the course. Beneath the surface, however, allocations are shifting.

📈 FOs are upping exposure to developed market equities and private debt (up from 2% to 4% year-over-year), chasing yield and long-term themes like AI, healthcare, and electrification.

📉 Private equity allocations are being trimmed, especially among those without in-house PE teams. And U.S. family offices have never been more home-biased, now holding 86% of their portfolios in North America.

Family offices are also leaning into AI (especially for financial reporting), reassessing real estate, and eyeing a global trade war as the #1 risk in 2025.

New here?

Check out some of our popular topics to get started:

If you have any questions or suggestions, just hit reply — I’d love to hear from you!

-Leyla

Love that meme, Leyla. And it is not just you.