The Golden Doodle of Private Markets: Evergreen Secondaries

What to watch when evaluating evergreen secondary funds

They’re the Golden Doodle of private markets: they’re everywhere, everyone loves them, and (I’m told) they cost a lot.

Today, we are talking about the most popular mixed breed: evergreen secondary funds.

We’ll discuss what you, the investor, need to focus on to pick a “good puppy”:

1️⃣ How these funds make money

2️⃣ How they manage liquidity (plus a checklist of what to watch)

3️⃣ The difference between closed-end and evergreen secondaries.

🤖 Bonus: I’ve included an AI prompt to help you analyze fund financials (just in case GAAP accounting isn’t your idea of a good time).

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always conduct your own due diligence or consult a professional before making investment decisions.

🦴 Quick Refresher

If you need a recap on secondary funds, read this:

What exactly is an evergreen fund?

It’s an open-ended investment vehicle with no fixed end date, allowing investors to buy in or redeem periodically at NAV (net asset value).

Unlike closed-end funds that have a defined life, evergreen funds continuously reinvest capital, offering semi-liquid access to private markets.

For a deeper dive into how secondary funds mark assets, read this:

How do secondary funds buy assets?

Secondary funds purchase stakes in existing private funds, usually from institutional LPs.

When you hear that Yale is selling private equity it usually means they’re selling their LP stakes on the secondary market.

Here’s a case study on one such fund:

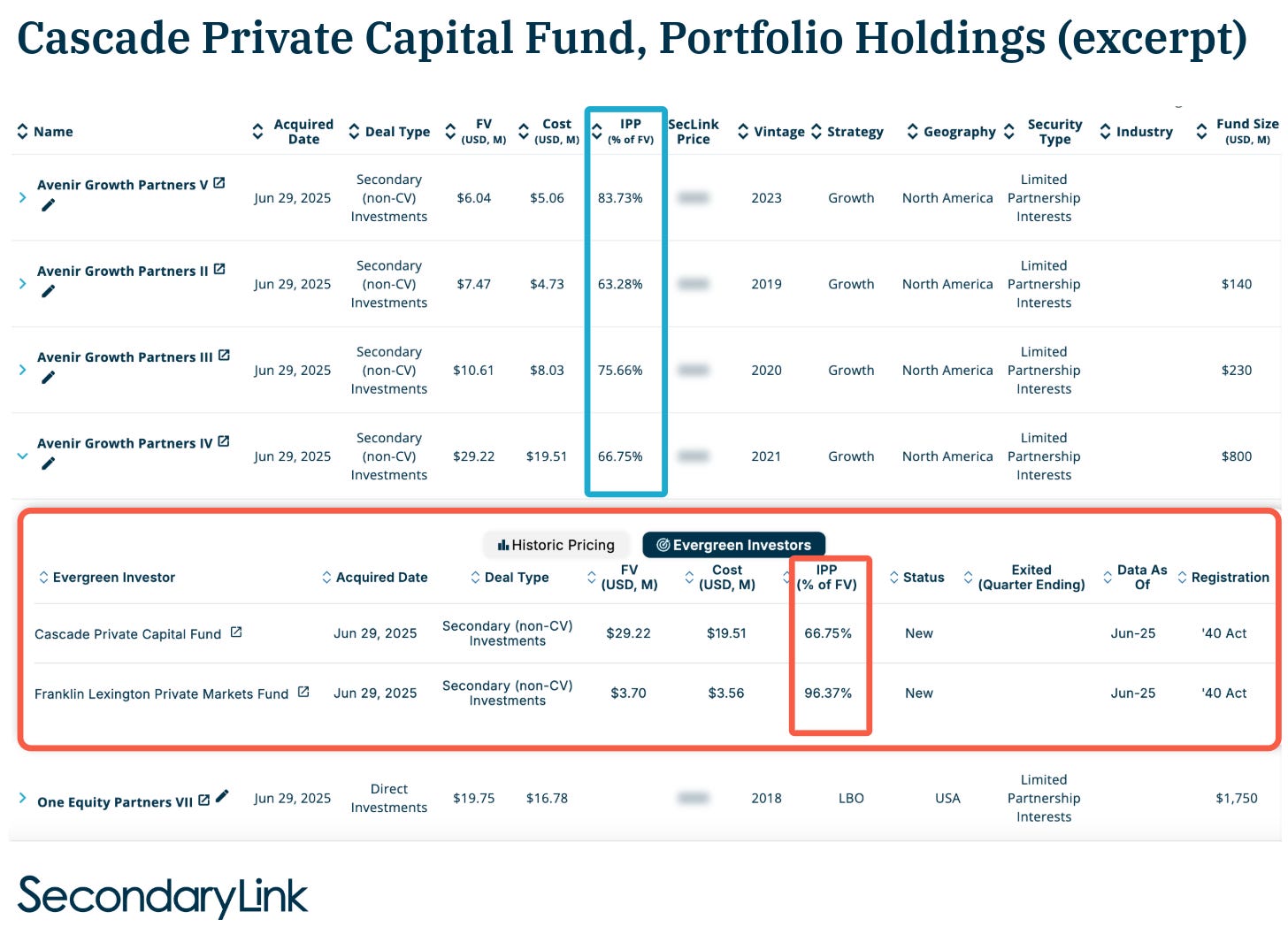

Let’s take a look at this example.

This excerpt from Cliffwater’s Cascade Private Capital Fund portfolio on SecondaryLink highlights several fund interests acquired in the secondary market on June 29, 2025.

What does this tell us?