The IRR-elevant Metric?

Understanding the flaws in IRR - and the metrics that give investors the full picture

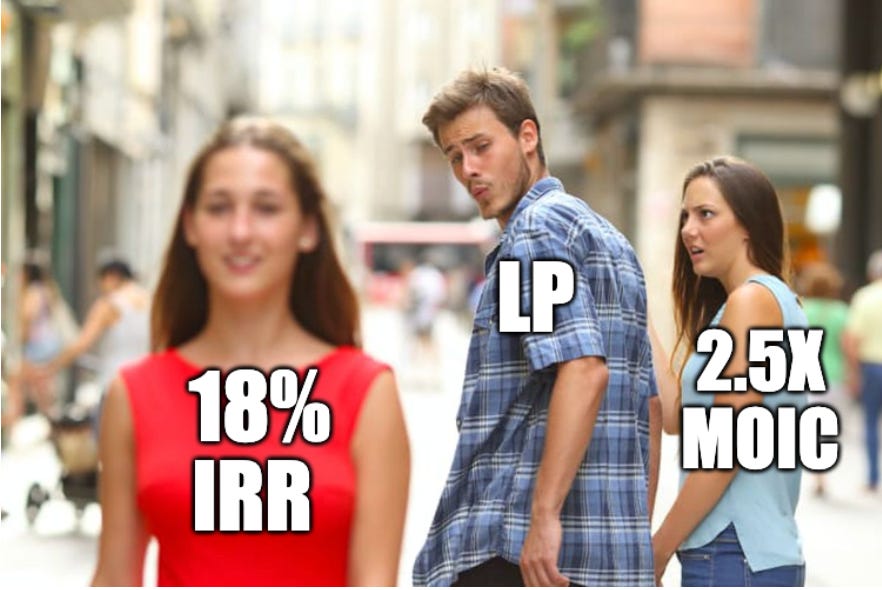

IRR IS A USELESS METRIC on its own (in most cases). Yes, I’m yelling at you. Sorry, not sorry.

The metric is so popular because it distills complex, multi-year cash flows into a single percentage. Investors like it because it gives us a neat number to compare across opportunities. But the very feature that makes IRR appealing, - its sensitivity to the timing of cash flows, - also makes it highly vulnerable to manipulation.

“Leyla, what other metrics should I be looking at?” I got you:

Today, we’ll look at five marketing sleights of hand that inflate IRR. To be clear, I don’t think most GPs sit around plotting how to game this number. But when two funds are otherwise equal, the one with the higher IRR is going to look better in a track record (just sayin’).

👉 Want to keep going down the IRR rabbit hole? Don’t miss this guest post by Hanoch Frankovits:

The art of “IRR-flation”

Sponsors and fund managers can use a variety of tactics to make projected and historical IRRs look more attractive. These tricks take advantage of both the quirks of the IRR formula and the information gap between GPs and LPs.

Let’s take a look at the five most common tactics.

Tactic #1: Gross vs. Net IRR

One of the simplest ways to dress up a track record is by showing gross IRR instead of net IRR

Gross IRR: return before any fees, expenses, or carried interest (essentially the asset or fund-level performance).

Net IRR: return after subtracting management fees, fund expenses, and carried interest. This is the actual returns to investors.

Because gross IRR will always be higher, managers sometimes highlight it in marketing decks to create a stronger first impression.

📌 Notes for LPs: always ask for net IRR. That’s your real return after costs. A big gap between gross and net is a red flag that fees are eating into performance.

Tactic #2: Front-loading Cash Flows

The IRR formula is highly sensitive to early cash flows because of the time value of money: a dollar received today is worth more than a dollar received later.

This means a sponsor can dramatically boost IRR with an “early win” or quick distribution, even if the overall return is modest. Here’s how it can be done: