Multi Family Deal 5

Case Study + Weekly Article Roundup - PE, PC, CRE

In today’s digest we will highlight three most compelling articles we’ve run across in private equity, commercial real estate, and private credit.

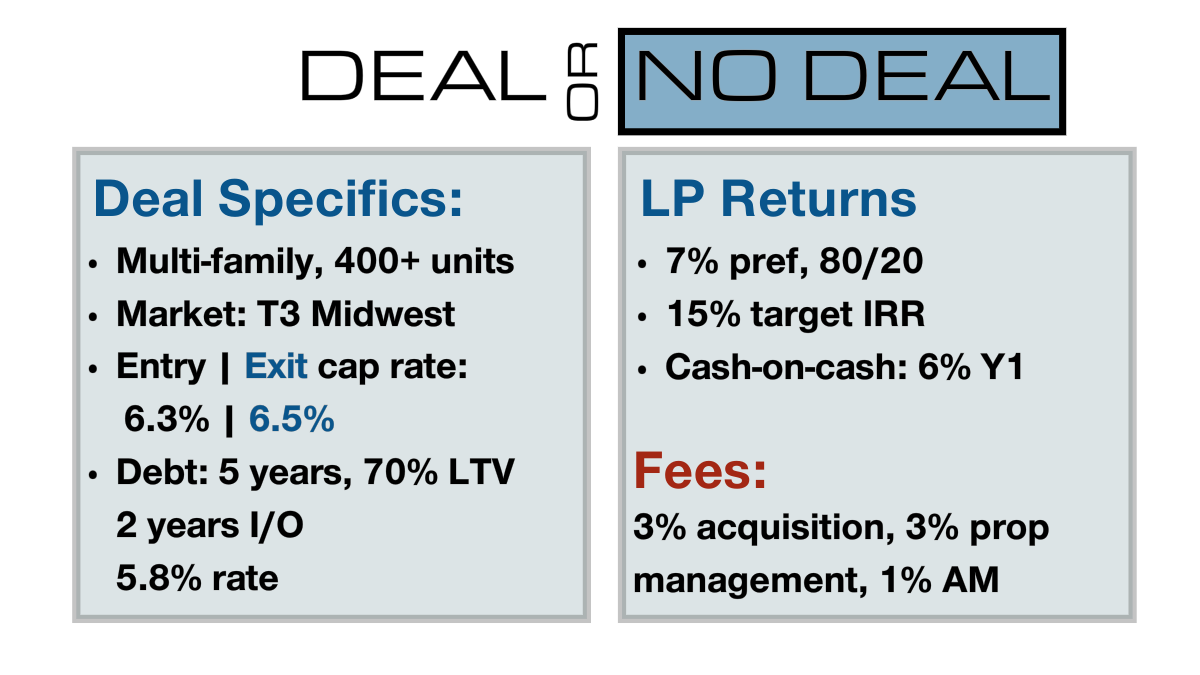

Deal of the week is a one-off multi-family offering. The deal looks solid on the surface, but don’t let that fool you - there are two major concerns with it, don’t miss the commentary that follows the poll.

Deal or No Deal?

Please remember, the deal is presented as an education exercise, and all relevant information has been changed to protect the identity of the sponsor.

Additional information:

This is a partial value-add deal, class B property (about 20% of all units will be renovated).

Small market with stagnant population growth (read this to learn how to quickly assess demographic trends).

Stabilized trended yield on cost 8.9% in Year 5.

Underwritten stabilized 3% rent growth.

Underwritten for refinance in year 5 at 65% LTV, returning ~80% of equity.

Comments

The following is my (Leyla’s) take on the deal. This is not investment advice, and your opinion may be quite different - please consider this an educational exercise.

I’m generally wary of small tertiary markets with low (or non-existent, like in this case) population growth. The smaller the market, the better you need to understand demographics and economic drivers.

The value-add here is slim with only 20% of units to be renovated (underwritten ROI on capex is around 20%, which is just about the minimum I want to see). In-place rents are already close to market. Value-add and loss-to-lease provide a margin of safety for investors - this deal doesn’t have much of a margin.

Now on to the bigger issues: did you notice the 3% organic rent growth? The number is tiny, but with any deal over 100 units pay very close attention to it. Why? Because even a $12/month difference in rents translates into a $900K value annually on a 400 unit property, when valued at 6.5% cap rate: