What Do You Call a Group of Cockroaches?

Also: PC valuation gaps, CMBS delinquency trends, and the multifamily OpEx data you didn’t know you needed

Happy Sunday! Every other week, we send a quick digest on what’s catching our eye in private markets.

Today’s lineup:

💳 Private credit: more cockroaches (and yes, I’m going to make you scroll all the way to the bottom to find out what a group of them is called).

🏢 CRE: CMBS delinquency rates inch higher, and multifamily investors would love the data on operating expense growth.

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything you need to become a better investor. GPs, get a front-row look at how capital allocators think.

💳 Private Credit

Two quick stories about private credit valuations: one loan went from 100% of par to zero in weeks; the other shows how different lenders can mark the same loan very differently.

1. Renovo

Earlier this month, Renovo filed for Chapter 7 bankruptcy (that’s full liquidation, not Chapter 11, where the company tries to restructure). What grabbed headlines wasn’t the filing itself, it was the fact that several lenders were still holding Renovo’s loans at 100% of par as of September 30, 2025.

A quick scan of BlackRock’s Q3 filings shows:

BlackRock Direct Lending Corp — 100% of par

BlackRock TCP Capital Corp — 100% of par

Here’s the kicker: per BlackRock’s Direct Lending Corp 10-Q, Renovo’s loans had previously been in non-accrual, then the company was recapitalized in Q2, and the remaining debt was marked at par in Q3 (I could not find any footnotes in Q2 filings about the details of the restructuring).

Then, one month later (Nov 3), Renovo filed for bankruptcy. BlackRock now expects to fully write the investment down. (Good news: this loan only represents 1.3% of BlackRocks’s Direct Lending fund, and 0.7% of TCP).

And this isn’t an isolated case. Zips followed a similar pattern:

👉 Something for you to mull over: If lenders didn’t see this one coming, what else is being marked at 100% that’s actually one month away from zero?

From BlackRock’s 10-Q:

“The Company views this outcome to be a result of issues specific to this issuer, rather than a reflection of broader sector weakness.”

2. Medallia

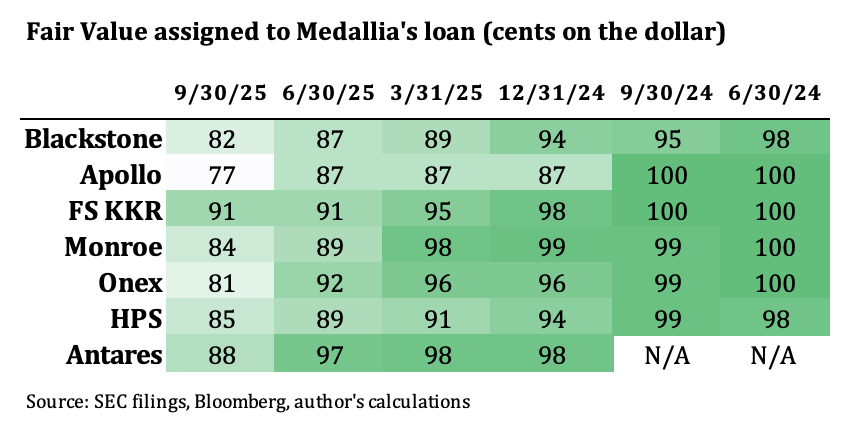

Bloomberg recently flagged a valuation discrepancy for Medallia debt across different lenders’ books.

For instance, marks on the same Medallia loan as of September 30, 2025:

Apollo: 77¢ on the dollar (typically considered distressed)

FS KKR: 91¢

Ron Kahn of Lincoln International comments on the gaps in valuations:

“It’s close in almost every case, until there’s a problem loan. That’s where you see the difference become wider.”

Why the divergence? Lenders make different assumptions about recovery, potential restructuring, and sales, and they don’t always have the same info from the borrower. Even with third-party valuation firms, managers make the final call:

“We try very hard to have the marks be on top of each other whenever possible. But we have to use the information we receive from each client; you can’t cross-populate even if one lender knows something another doesn’t.” - Kahn. (emphasis mine)

Translation: some of these fund managers may have better information than others. Most of them use their own internal valuation methodologies to make the final decision on valuation.

And while you’re wondering what KKR knows that Apollo doesn’t (or vice versa), here’s some additional food for thought:

You know what’s impossible to find out? Any actual information on how Medallia (the borrower) is performing. Thoma Bravo took it private for $6.4B in 2021, and the only concrete recent datapoint I can find is a reference to “30% growth in demand” (whatever that means).

We don’t even know if the business is growing revenue, expanding margins, losing customers, or treading water, because once Medallia went private, it effectively became a black box.

👉 We do know the loans had a PIK component. Read this on why it’s important:

🏢 Commercial Real Estate

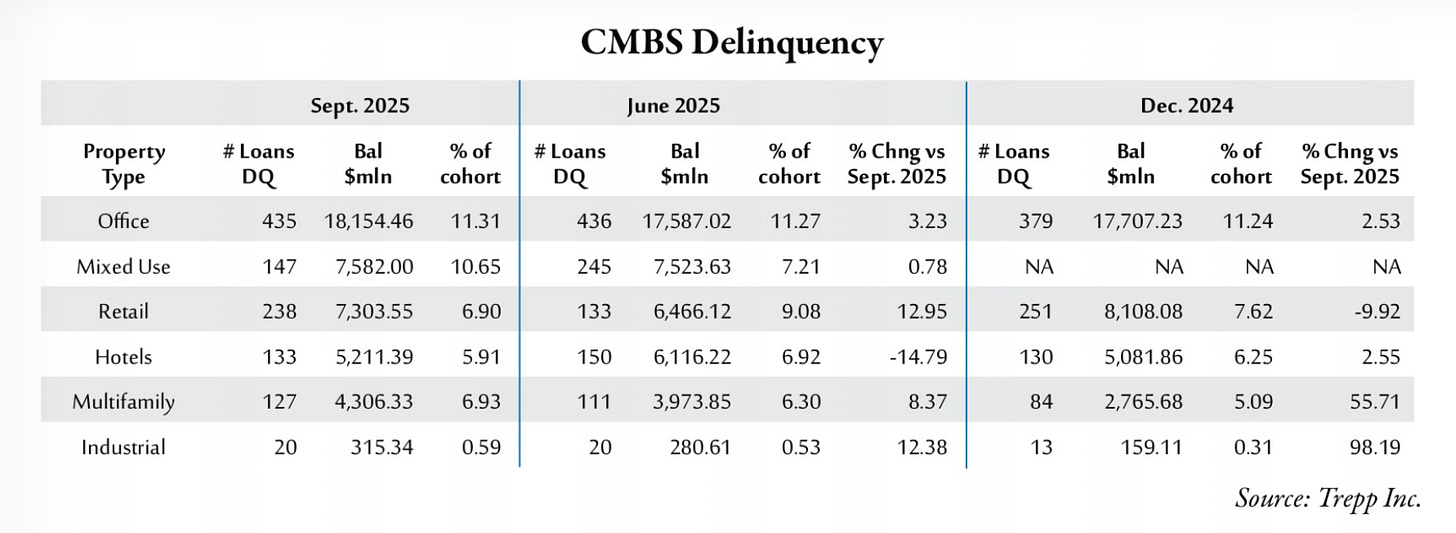

Trepp’s latest quarterly data review shows CMBS delinquencies (30+ days past due) rising to $43.52B, up from $38.13B at year-end 2024. The overall delinquency rate now sits at 7.24%, up from 6.57% at the end of 2024, though slightly down from August.

September marked the third consecutive month of declining delinquency volume, but don’t get too excited: the improvement is driven by special servicers modifying and working out loans, not a reduction in underlying distress.

Here’s a deep dive on debt in commercial real estate:

For all you MF investors

(and by MF I mean multifamily)

If you invest in CRE, you’ll find this series helpful:

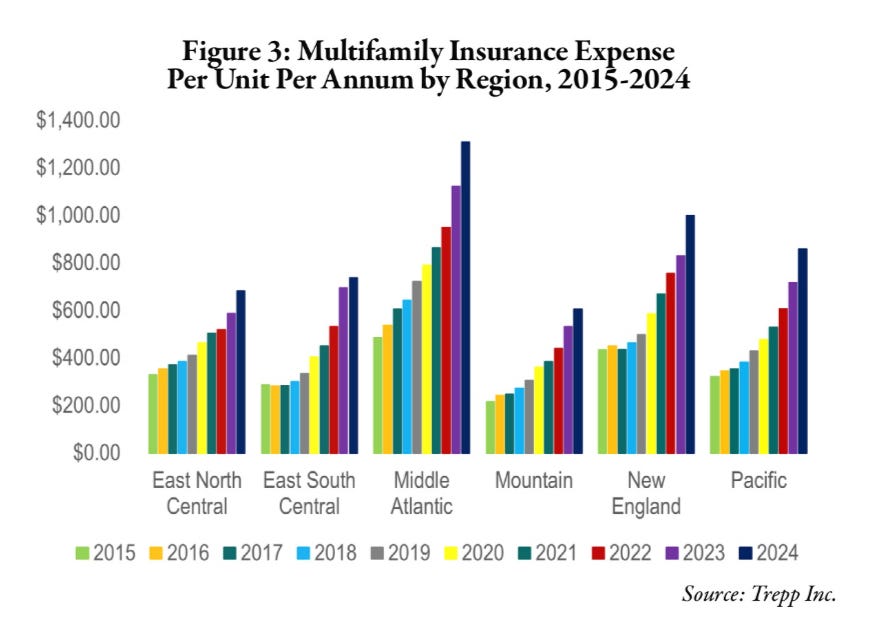

Trepp’s report included some excellent data on operating expenses:

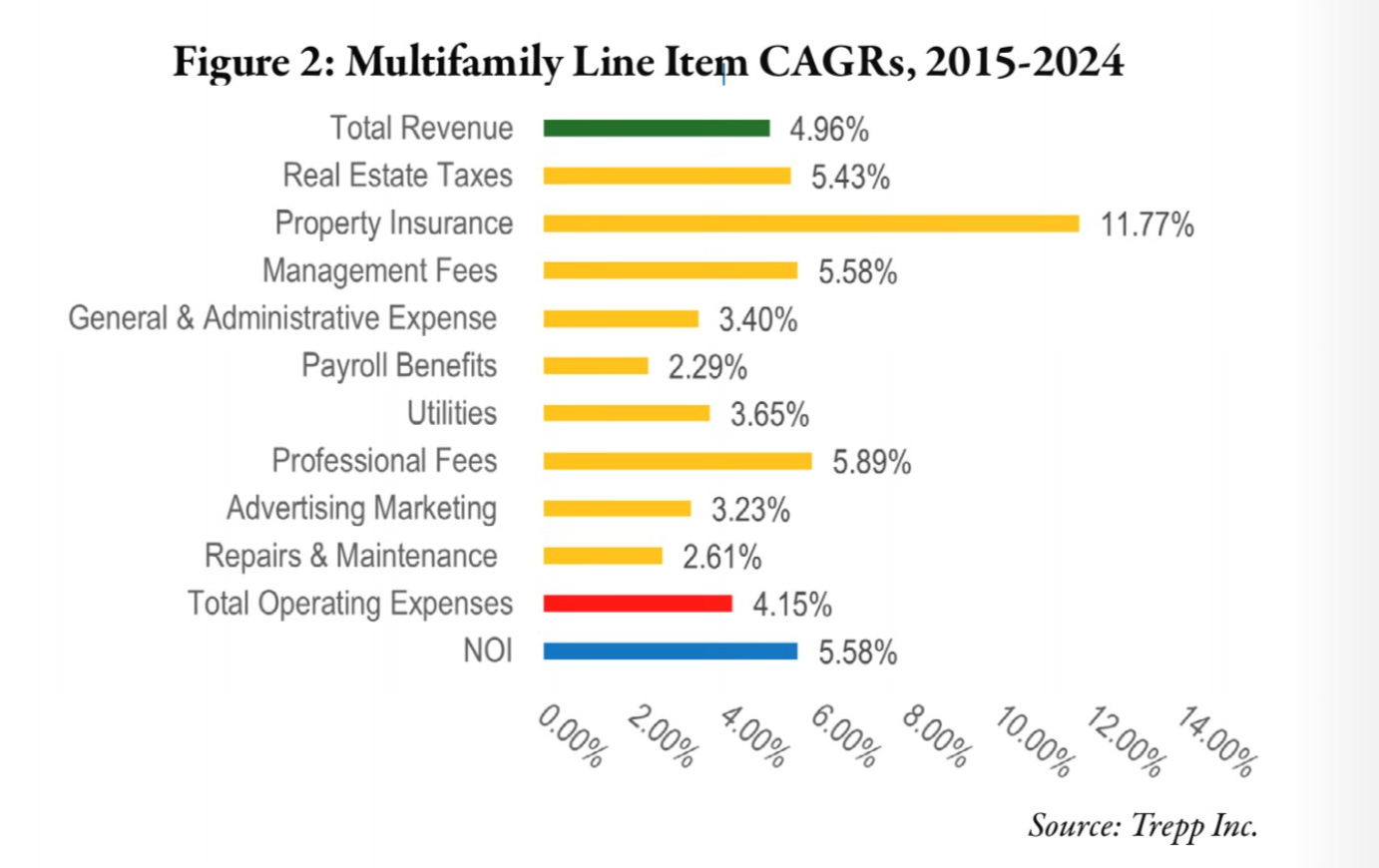

Operating expenses are rising faster than expected: from 2015–2024, OpEx grew 4.15% annually, above the historical 3.5% norm.

Insurance is the biggest culprit: insurance costs jumped 11.77% annually, outpacing every other category and rising faster than total expenses in nearly half of major metros.

Multiple costs are running well above the rate of CPI:

📌 LP takeaways:

Rising operating costs squeeze returns and affect loan performance.

Even with healthy NOI growth, OpEx is compounding at 4.15%, well above the ~2% assumption baked into many proformas.

👉 This is your reminder to stress-test expenses. Ask a GP to rerun the model with expenses growing at 4% instead of 2.5%. Most deals will be fine (you’ll see some impact on cash flow).

But be wary of deals where expense reduction is the only value-add lever.👉 Here’s what stress-testing is all about:

👉And here’s how you can use AI to help:

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading! As always, if you have any suggestions, reply to this email, leave a comment, or find me on socials (X and LinkedIn)

-Leyla

🪳🪳🪳 P.S. A group of cockroaches is called an intrusion. Feel free to flex that fun fact on your loved ones. Have a great week!

If you do not know

The term "cockroach theory" is used to describe a situation where one company's problems suggest there are likely more hidden issues affecting other companies in the same sector or market, much like finding one cockroach indicates there are more nearby.

also

In private equity slang, "cockroaches" can refer to resilient, sustainable companies that can survive in tough markets, as opposed to the flashy but risky "unicorns".

Just wait until AI blows up- then We are talking Trillions.