Cliffwater Enhanced Lending Fund (CELFX)

What's inside, what to watch, and where the distributions come from

97% CAGR since 2022*.

27% growth in just six months*.

$1.8B raised from investors in the six months ending 9/30/25.

(*Measured by growth in fair value of assets)

Folks, this thing is going to get very large.

May I present to you a $7.2B interval fund-of-funds investing in private credit.

In today’s case study we will:

1️⃣ Look at what’s inside the Fund

2️⃣ Discuss the balance sheet (including the $1.8B number you must watch)

3️⃣ Review the sources of distributions and the flow of capital

Interval funds are a subset of evergreen funds. Here’s a primer, if you missed it:

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author. All examples are illustrative in nature and not guarantees of future outcomes. Readers should conduct their own independent research and consult with qualified professionals before making any investment or financial decisions.

The Pitch

The Cliffwater Enhanced Lending Fund (CELFX) is a non-diversified, closed-end management investment company structured as an interval fund.

Under the hood, it’s essentially a fund-of-funds: roughly 72% of assets sit in various SPVs. The strategy is straightforward: allocate at least 80% of assets (net assets plus any borrowings for investment purposes) to lending to businesses.

💰 Now look at the returns. Is it any surprise the Fund pulled in $1.8 billion in just the six months ending 9/30/25?

👉Here’s more on the advantages and pitfalls of fund-of-funds structures:

What’s in the Fund?

“What’s in the fund?” is a solid question. The honest answer: we mostly don’t know. Sure, we can show what’s in the marketing materials and filings, but as of 9/30/25 the Fund holds 114 separate special purpose vehicles, and we have little visibility into most of them.

(Opacity, anyone?)

The three largest holdings by fair market value are:

Dawson Evergreen 1 LP – $335M

Hercules Private Global Venture Growth Fund I, L.P. – $189M

BSOF Parallel Onshore Fund L.P. – $147M

Not one of these funds files with the SEC.

The Fund broadly allocates across three pillars: corporate, real asset, and alternative credit opportunities:

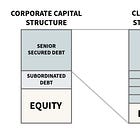

Corporate Credit includes US and non-US direct lending (typically senior secured loans to middle-market companies), mezzanine debt, structured debt (CLO debt and equity), and venture debt.

⁉️“Leyla, what are CLOs???” - I got you:

Real Asset Credit covers leasing (aircraft, equipment), real estate debt, and infrastructure debt.

Alternative Credit encompasses asset-based lending, royalties, insurance-linked products, legal finance, and marketplace lending.

As of September 30, 2025, net assets totaled approximately $6.9 billion. The portfolio is concentrated in Private Investment Vehicles (72.0%) and Senior Secured Loans (17.4%).

Within Senior Secured Loans, the top industry exposures were

Financials (4.1%),

Consumer Discretionary (3.7%),

Health Care (2.2%), Industrials (2.2%), and Technology (2.2%).

👉 Here’s a case study on a real estate fund of funds:

Before we get to the meat and potatoes (how the fund makes money and funds distributions), we need to quickly touch on these balance sheet items: