🦉Hoot, There It Is: OBDC II Sells the Crown Jewels, Halts Redemptions

Are You Better Off with a Haircut?

Blue Owl dropped some news on investors on February 18th:

A sale of $1.4B of direct lending investments at 99.7% of par, with OBDC II accounting for $600M, or roughly 34% of its total investment commitments.

Going forward, OBDC II is replacing its quarterly tender offers with return of capital distributions, meaning the redemption program is effectively done.

You can find the press release here. The headlines (here and here) were not kind. The market reaction wasn’t either: Blue Owl Capital (NYSE: OWL) was down 6% on 2/19.

The deep dive on OBDC II was published back in November, you should read it first to get familiar with the fund. All numbers are as fresh as you can get, since we are still waiting on the Q4 financials.

Here’s what we’ll cover today:

What happened (I’m sorry to say it: the signs were sitting right there in the financial statements)

What’s left in the fund (and why it doesn’t look nearly as pretty as it did before)

Shocker of all shockers: portfolio overlap

👉 Interesting tidbit for y’all: the asset sale drew from all three funds. I compared the holdings of OBDC, OBDC II, and OTIC and identified 83 portfolio companies that overlap across all three, making them the most likely candidates for the assets that were sold. The full list is at the bottom of this post.

📚 Need a refresher on interval funds?

Quick reminder: this is not financial advice, nor a solicitation to sell securities. All information is shared strictly for educational purposes. Do your own due diligence.

Quick Recap

In November, Blue Owl proposed merging its non-traded BDC (OBDC II) into its publicly traded sibling, OBDC. OBDC II investors would have received OBDC shares based on NAV, but since OBDC traded at a ~21% discount to its own NAV, investors were looking at an immediate ~21% haircut if they wanted to sell.

The backlash was swift. Blue Owl reversed course within days.

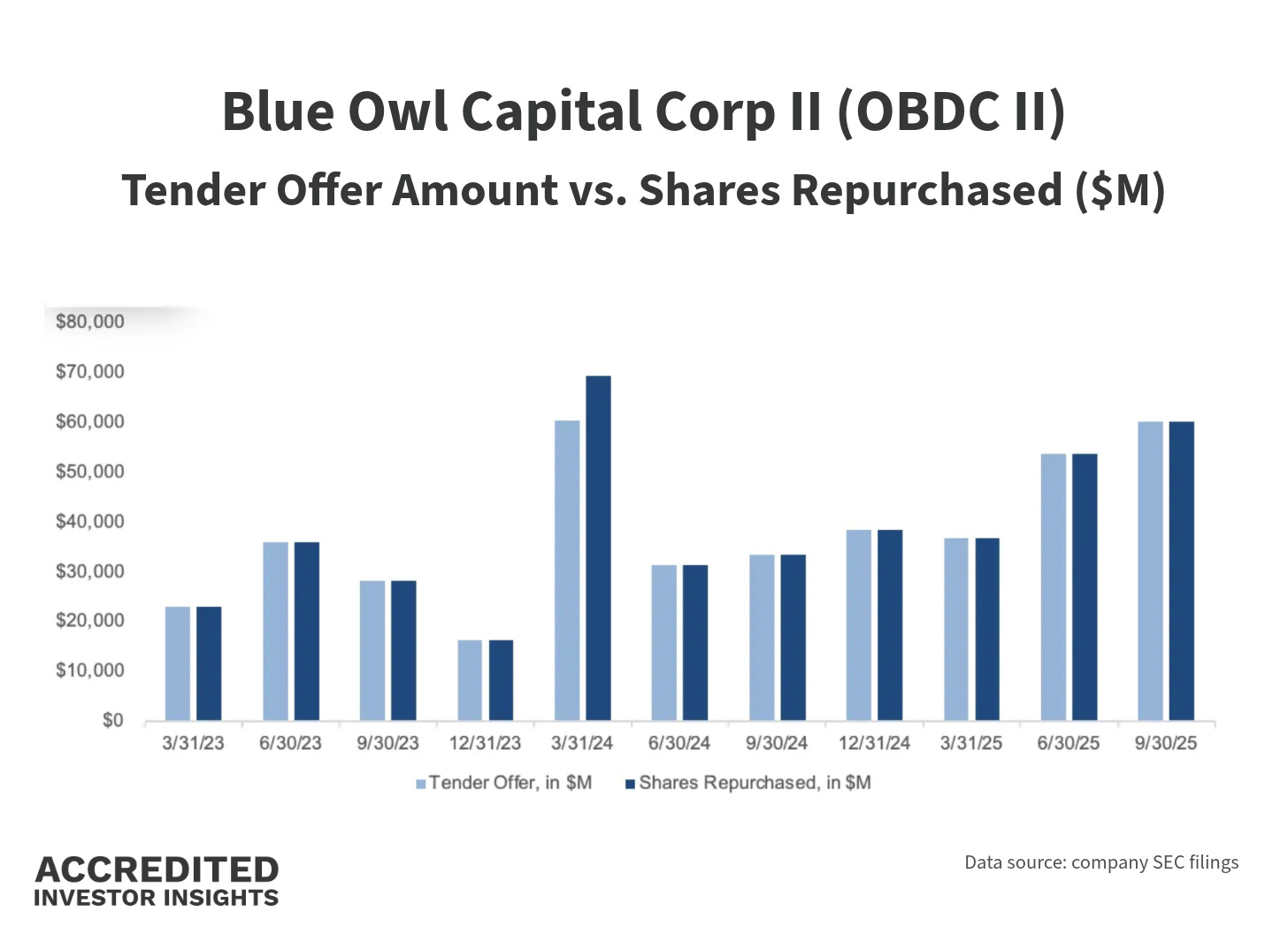

The problem, however, didn’t go away. OBDC II had been bumping up against its 5% quarterly tender offer cap for several quarters:

The fund was selling assets and slowly shrinking to fund redemptions.

I swear, you can avoid a lot of unpleasant surprises by reading financial statements (and occasionally find pleasant ones). It ain’t rocket science, I promise. Start here:

What Just Happened

On February 18, Blue Owl announced that three of its BDCs, - OBDC II, OBDC, and Blue Owl Technology Income Corp (OTIC), - entered into agreements to sell a combined $1.4 billion in direct lending investments to four institutional buyers (North American pension funds and insurers).

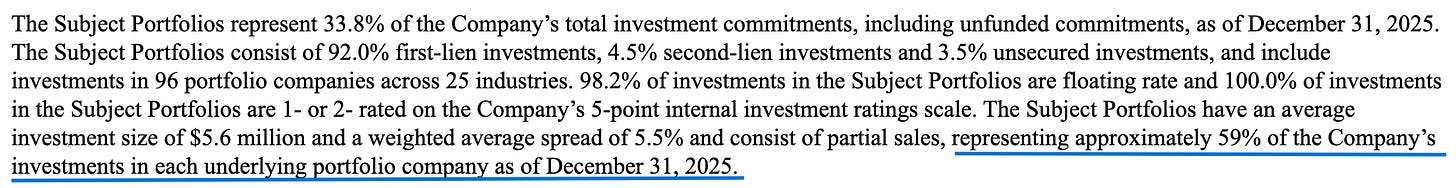

➡️ OBDC II’s share: $600 million in total investment commitments, representing roughly 34% of the fund’s total portfolio.

What was sold:

92% first lien (senior secured, this is the safest stuff)

100% rated 1 or 2 on Blue Owl’s internal 5-point scale (the best quality ratings)

98.2% floating rate

Spread across 96 portfolio companies and 25 industries (more on overlap later, you’ll be shocked lol)

Weighted average spread of 5.5%

The sale price? Fair value, which came in at 99.8% of par. Kroll provided a fairness opinion.

Importantly, these aren't full position exits: each sale represents approximately 59% of OBDC II's exposure to the underlying portfolio company. The fund is keeping the other ~41% of each loan on its books.

In other words, Blue Owl sold the good stuff. At par.

Where the Money Is Going

OBDC II plans to use the proceeds to:

Pay down the revolving credit facility (~$11.8M outstanding)

Pay down the Goldman Sachs credit facility (~$275M outstanding)

Distribute cash to shareholders. This will be a return of capital of up to $2.35 per share, or approximately 30% of NAV as of year-end 2025

👉 If you invest in evergreen funds, keep an eagle eye on liquidity (I’m too tired to think of a good 🦅/🦉 joke at the moment, please drop yours in comments)

❗️The board also terminated the dividend reinvestment plan. Going forward, all distributions (including regular monthly dividends and future return of capital distributions) will be paid in cash only.

What’s Left Behind?

❗️This is the part that investors should pay attention to: