Watch Liquidity. Closely.

How I track share transactions (and why you should too)

The private markets universe is leaning toward semi-liquid vehicles, there is no doubt about it. And there are good reasons for their popularity (read this post, if you missed it):

But here’s the deal: there are two fundamental things you need to watch in evergreens. One of them is liquidity. (“What’s the other one, Leyla?!?” - Patience. I need you to subscribe first).

Since you’re a subscriber now, let’s dive into how I track liquidity in evergreen vehicles.❗️And FYI: this applies to private Regulation D debt funds that allow redemptions: the mechanics are the same, and you ABSOLUTELY need to review the cash flow statement for such funds.

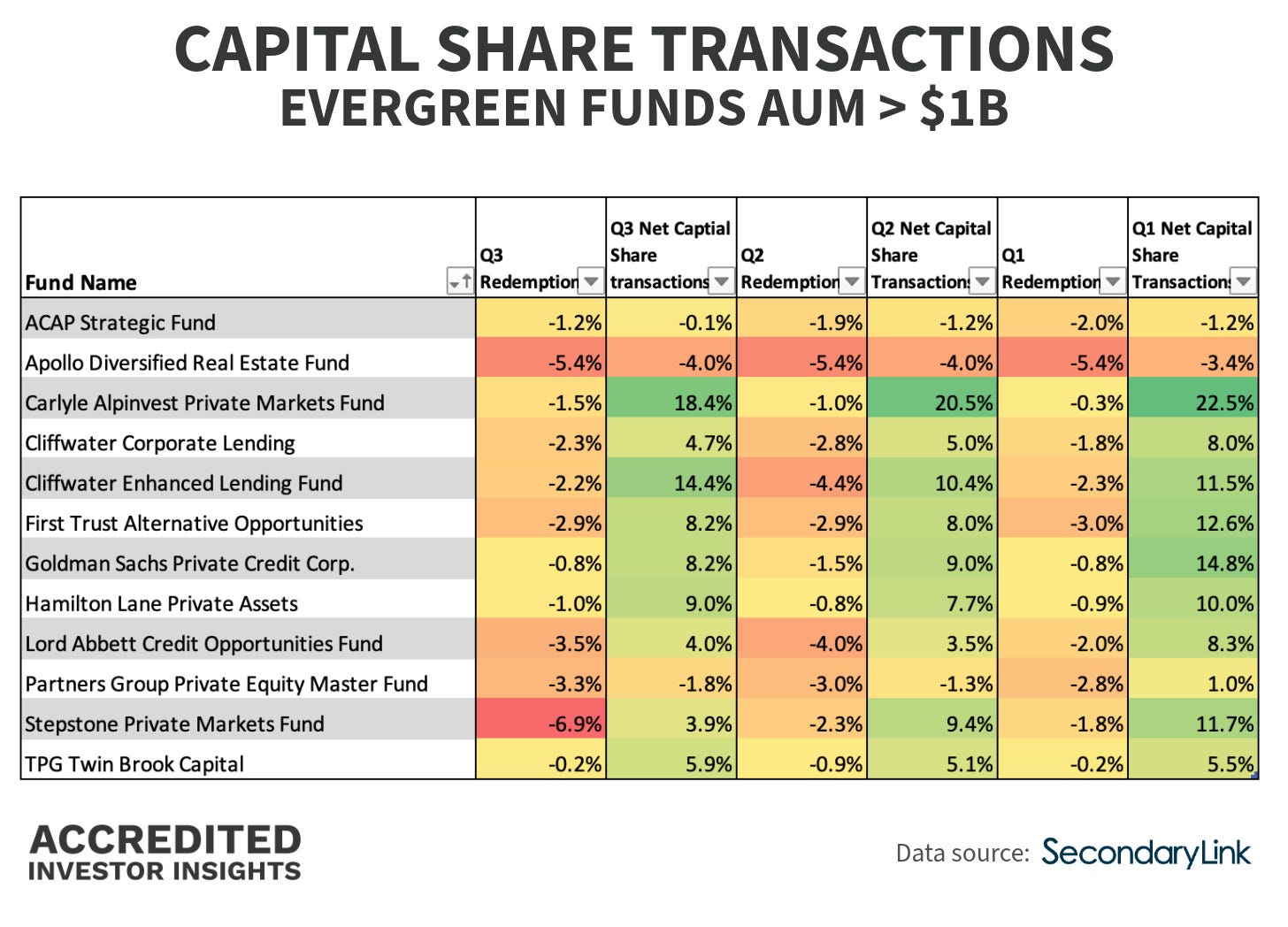

Here’s a snapshot of how some large evergreen funds performed recently:

I’ve done case studies on a few of the above funds:

Also, Goldman’s Private Credit Corp, Partners Group Next Generation Infrastructure, Carlyle Credit Solutions, among others.

(📧 I’m always open to suggestions: drop a comment or shoot me an email if there’s a fund you want me to dig into)

Why Is This a Big Deal?

The biggest selling point of these funds is the “liquidity” part, - the ability to access your capital (*after a lock-up, subject to fund limitations).

Most evergreen funds limit redemptions to 5% of total NAV and often include gating provisions. These are in place to protect your capital: gating prevents the fund manager from being forced into fire sales.

The trouble starts when a fund consistently breaches that limit:

Investors queue up to exit

Word spreads about liquidity issues

New investors stay away

It’s an unholy spiral that no fund manager wants to experience. Most retail investors get frustrated when they can’t access funds they thought were “liquid.”

👉 Take a look at this fund: following multiple quarters of not being able to meet redemption requests, it listed on a public exchange

But you? You are going to learn how to check your fund’s share transactions, so you can monitor inflows and outflows yourself. Liquidity issues shouldn’t come as a surprise to investors. (Yes, there are exceptions, but in most cases, deterioration shows up in the numbers for several quarters before things get dire).

Important caveat: rising redemptions are not, by themselves, a fire alarm. In healthy evergreen funds, periodic increases often reflect normal portfolio rebalancing, tax planning, or shifts in investor cash needs.

Before we get to what numbers you will be checking, let me show you where to find this information. We’ll use TPG Twin Brook Capital Income Fund as an example: