Inside BCRED: A Deep Dive into $30B of Debt

Reading between the lines: what the balance sheet shows (and how I used AI to figure out what it doesn't)

The last case study on Golub’s non-traded private credit fund was a hit. Today, we’re going bigger: let’s take a look under the hood of a $73B behemoth, Blackstone’s BCRED.

We’re going deep into the notes (pages 166–202 of the quarterly report). But don’t worry: I’ll keep it high level and show you how I used AI to break down the borrowings and maturity picture.

If you invest in private credit, you need to read this:

Here’s what we’ll cover:

1️⃣ Loan Valuation - why roughly 90% of BCRED’s loan book is “unknowable” and what that means for investors.

2️⃣ $30B of Borrowings - a deep dive into SPVs, CLOs, fund-level credit lines, and bonds, with risk implications.

3️⃣ AI-Powered Analysis - how I used AI to chomp through 38 pages of notes in under an hour, plus a fun comparison of 7 different LLMs with a clear winner 🥇.

📌 JSON prompt and LLM performance breakdown are included at the end of the article for reference.

Before we dive in...

Accredited Insight gives you the LP’s perspective on private credit, private equity, and CRE—drawing on hundreds of deals reviewed. Paid subscribers get access to 30+ case studies and our deep-dive series on reading a CRE proforma. If you’re a GP, this is your window into the allocator’s world.

👉 $10/month or $100/year

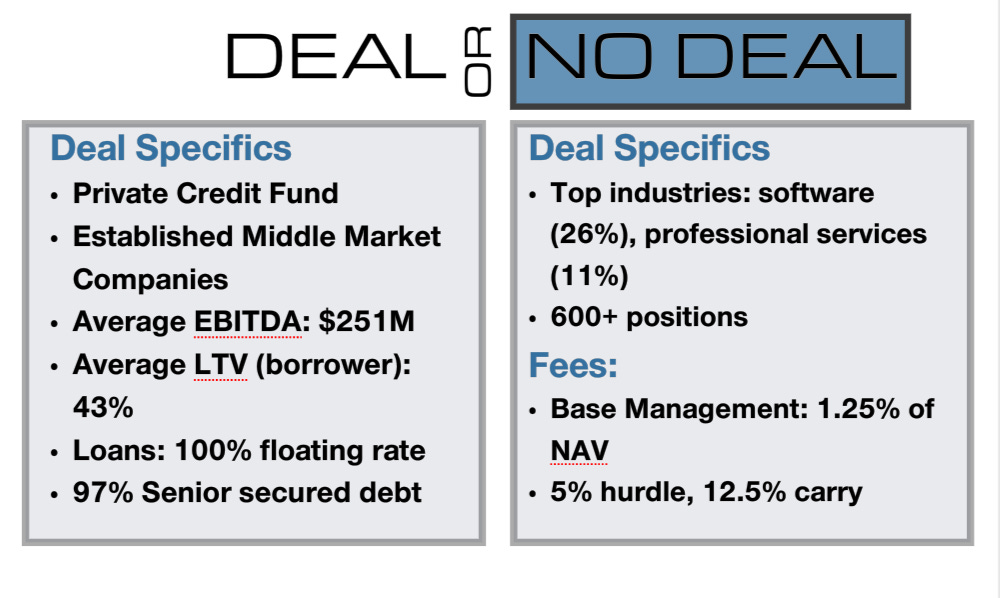

Deal or No Deal?

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of any affiliated organizations. All examples are illustrative in nature and not guarantees of future outcomes. Readers should conduct their own independent research and consult with qualified professionals before making any investment or financial decisions.

The Pitch

Blackstone’s BCRED is a $73B credit fund launched in January 2021.

97% of the portfolio is in first-lien senior secured loans across 656 positions spanning 55 industries.

It’s well diversified, with the biggest bets in software (26%), professional services (11%), and healthcare (9%).

Metrics sound fairly conservative: 0.7x leverage, 43% average LTV, and issuers with $238M average EBITDA.

The fund targets established middle-market companies, leaning on Blackstone’s “scale, origination platform, operational expertise, and a strong track record”.

$135B in direct lending with only 0.05% realized losses (keep in mind, the fund is only 4 years old - it would be a disaster if a newer fund was booking immediate losses)

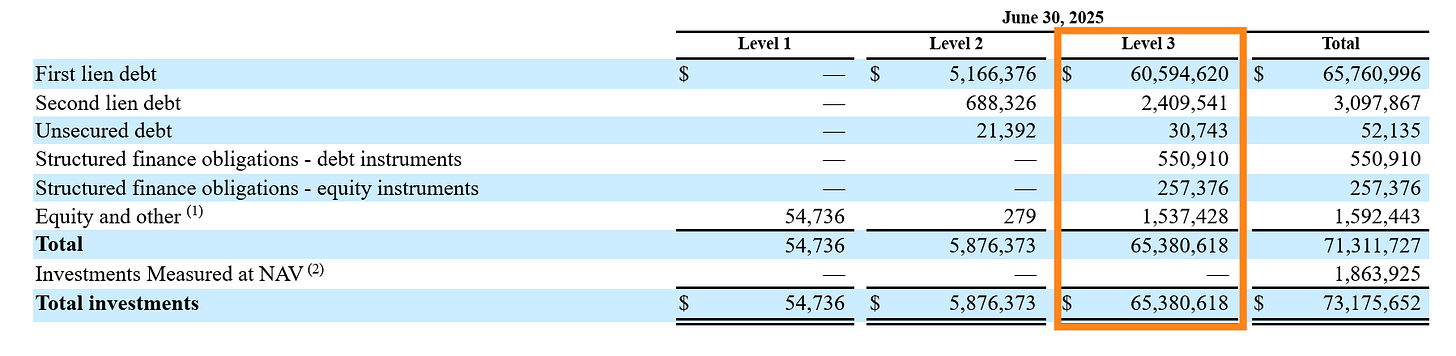

1️⃣ Loan Valuation: The Level 3 Problem

Here’s a fun fact: ~90% of BCRED’s loans are classified as Level 3.

From the SEC filings:

“Level 3: Inputs to the valuation methodology are unobservable and significant to overall fair value measurement. The inputs into the determination of fair value require significant management judgment or estimation.”

Translation for LPs: we really don’t know what most of these loans are worth.

This is par for the course in private credit: borrowers are private, loans aren’t traded frequently, and GPs hold all the data. Marks can - hypothetically - drift far from fair value.

It’s usually not a problem for assets held to maturity under reasonable default assumptions. But it becomes critical if the fund needs liquidity (for example, to meet redemption requests or loan maturities). Buyer beware.

👉 I’ve written more about Level 3 valuations here:

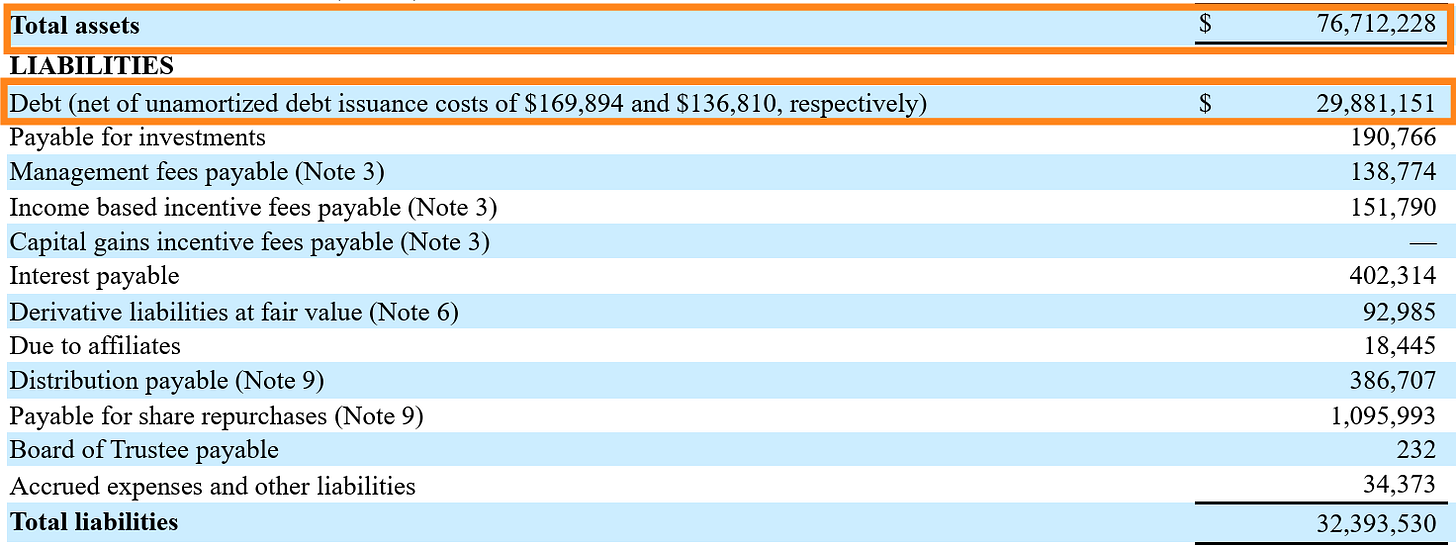

2️⃣ Fund Borrowings: $30B of Leverage

Below is a snapshot of BCRED’s balance sheet (from the most recent quarterly report). The assets side is straightforward: over $73B in Investments, mostly loans. Today, we’re zooming in on the $30B in debt.

👉 To learn more about layers of leverage in private credit funds, read this:

LPs, I know you are eager to find out:

Are loans secured by fund assets?

Are the rates fixed or floating?

When do the debts mature? Plus a million other questions…

.. But when you’re staring down a 568-page quarterly report (Note 7: Borrowings alone is 37 pages), making sense of it quickly is a challenge, let’s put it that way.

So I went out in search of a solution, and tested 7 different LLMs to summarize the structure and answer these questions. There is a clear winner: