Manufactured Home Community Case Study

Does entry cap rate matter?

Did you know there are just 44,000 manufactured home communities (MHCs) across the United States? According to CoStar, only five new MHCs have been built or expanded since 2023 - these deals don’t often come across my desk.

Before we get into the case study, I wanted to share some background on this asset class. Following the Global Financial Crisis, MHCs experienced significant cap rate compression. Simply put, this meant owners could sell their properties for much higher prices even if net operating income (NOI) remained flat. Investors became willing to pay more for each dollar of income, assuming all other factors stayed the same.

Investors, you should know the difference between achieving high IRR via NOI growth vs. cap rate compression:

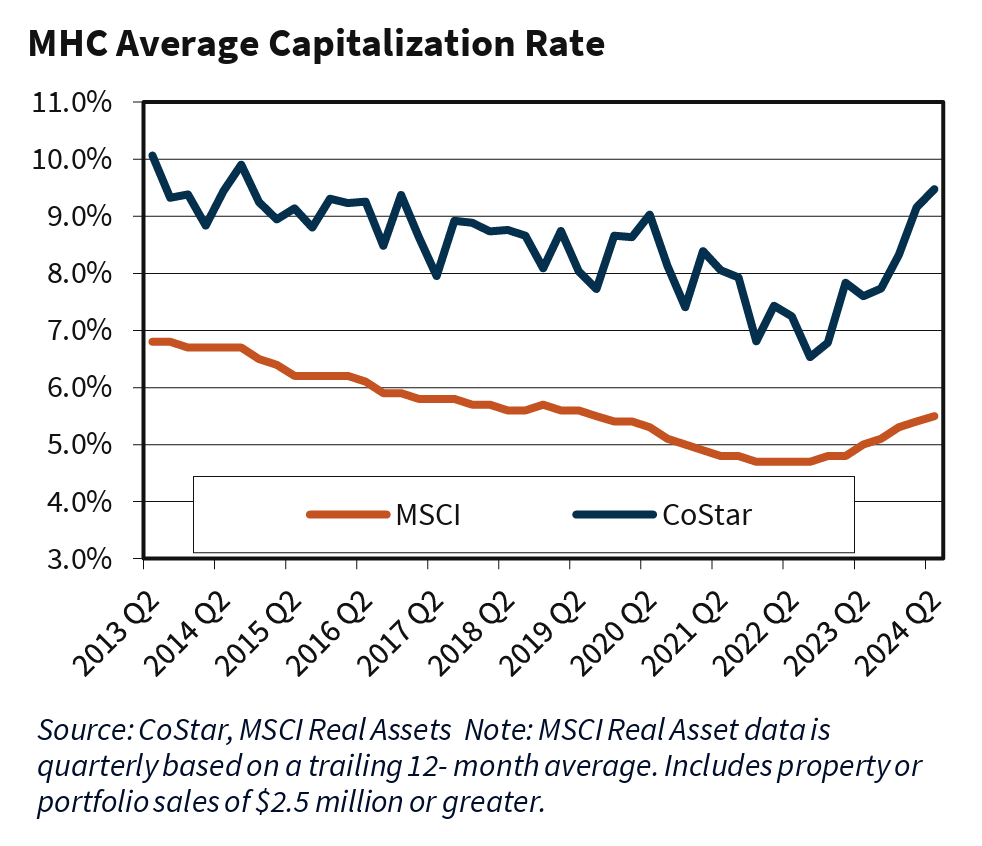

In 2022 things began to change. Take a look at the Fannie Mae chart below: CoStar data, which includes smaller transactions for which cap rates can vary more widely, shows a sizable jump in cap rates. It estimates that cap rates rose to 9.5% as of second quarter 2024 from 7.2% as of second quarter 2022.

But before we dive in...

Accredited Insight gives you the LP’s perspective on private credit, private equity, and CRE—drawing on hundreds of deals reviewed. Paid subscribers get access to 30+ case studies and our deep-dive series on reading a CRE proforma. If you’re a GP, this is your window into the allocator’s world.

👉 $10/month or $100/year

Deal or No Deal?

As always, this is for educational purposes only. Numbers, names, and details have been changed to protect the innocent (and the not-so-innocent)

The Story

The deal is an acquisition of a large mobile home park community in the South. Occupancy at the park is currently at 60%, most of the homes in the park (both occupied and vacant) are park-owned.

For those new to this asset class: tenants in MHCs pay lot rent and have two options:

they can either rent a home directly from the park owner,

or place their own homes on the leased lots.

From the park owner’s perspective, managing park-owned homes is far more hands-on and operationally demanding, since they’re responsible for repairs, maintenance, and renovations between tenants. Because of this, many park owners prefer to sell the homes and focus solely on leasing the land lots.

The Business Plan

The GP plans to acquire the park and immediately begin selling the vacant park-owned homes. Here’s the breakdown:

205 total spaces, with 170 homes owned by the park.

Current occupancy sits at 60%, meaning the park owns 82 vacant homes.

The value-add is this: the park is effectively buying the land lots at nearly the same price as the homes themselves. I.e., if they successfully sell the homes at or near their estimated values, they’re acquiring the land and infrastructure for very little cost. If the plan succeeds, the land is almost “free,” and the rents on those lots will go directly to the NOI.

But there’s the catch:

➡️ The purchase cap rate? A startlingly low 3.2%.

For more on cap rates, read this:

After you catch your breath (yes, that cap rate is eye-poppingly low), take a moment to vote in the poll 👇

Of course, I wouldn’t write a case study if the takeaway was as simple as “pass on any deal bought below a certain cap rate.” Before you dismiss this deal solely because of its low entry cap rate, remember this: with value-add properties, the entry cap rate isn’t the most important metric. It’s the stabilized yield on cost that you should be paying attention to.

📌 Here are some key questions to consider:

What’s the historical absorption rate for similar assets in this market?

How strong is the actual demand for park-owned homes compared to tenant-owned homes?

How much capital is allocated for make-ready work, marketing, and incentives to reach 90%+ occupancy?

You need to understand the feasibility of the lease-up plan and the real upside potential. (And yes, this takes far more skill than operating stabilized Core + assets.)

When is Low Too Low?

This deal’s 3.2% purchase cap rate is well below the market norm. In this case, such a low entry cap rate likely reflects two things:

The property is significantly distressed with substantial operational challenges.

The purchase price includes embedded value beyond current income (like the potential to sell park-owned homes and lease-up vacant lots).

So, when is a cap rate too low? It’s when the entry yield doesn’t adequately compensate for the risks and capital required to stabilize the asset.

📌 Before signing on, ask yourself:

Does the projected stabilized yield on cost justify the low initial cap rate?

Are the operational and lease-up risks fully accounted for in underwriting?

Is there sufficient capital and expertise to execute the turnaround?

If the answer to these questions is yes, a low entry cap rate can be acceptable, because the real value lies in the upside, not the starting point.

❗️However, don’t ignore this number altogether: a 3.2% entry cap rate leaves very little margin for error. If any underlying assumptions fall short, the deal’s economics could quickly unravel.

And When is High Too High?

Finally, I’ll leave you with this: do you think this waterfall is acceptable? (6% preferred return - or first hurdle - followed by a 50/50 split). Please drop a comment!

Thank you for reading! If you are new here, you’ll enjoy these articles:

For more on Commercial Real Estate, click here.

Thanks for reading. If you have any questions or suggestions, just hit reply — I’d love to hear from you!

This park is a real mess. I would want to understand why the occupancy is so low. Location? Home quality? Nuisance tenants? Or what?

And no matter what, I'm probably not up for that preferred return on something this risky.

Also, is any land included that can be developed in the future? That can be a significant source of earnings growth.

For this deal to work, the operator has to be incredibly skilled. I foolishly invested in a deal like this in 2018 and even with severe caprate compression, it has not done well.

So much depend depends on what else is out there in this submarket. Likely the property has a very bad reputation so you have to overcome that as well. You need skilled on-site people to make this work and they are hard to come by.

I don’t think the return justifies such a huge risk. Hard pass.