Private Equity 101: What Every LP Should Know

The basics of fund mechanics, performance dispersion, and why transparency still lags.

Private equity has long carried an aura of exclusivity and legendary returns. For decades, it was the domain of elite institutions and the ultra-wealthy. Just getting in the door often required a seven-figure check and a warm introduction. (This has to explain why so many people are so enamored with the asset class, but I digress.)

That’s changing.

Access has broadened through feeder funds, digital platforms, and the expanding “wealth channel.” The industry has fought hard to “democratize” private equity, and the day may soon come when you’ll see it as an option in your 401(k).

That’s the good news.

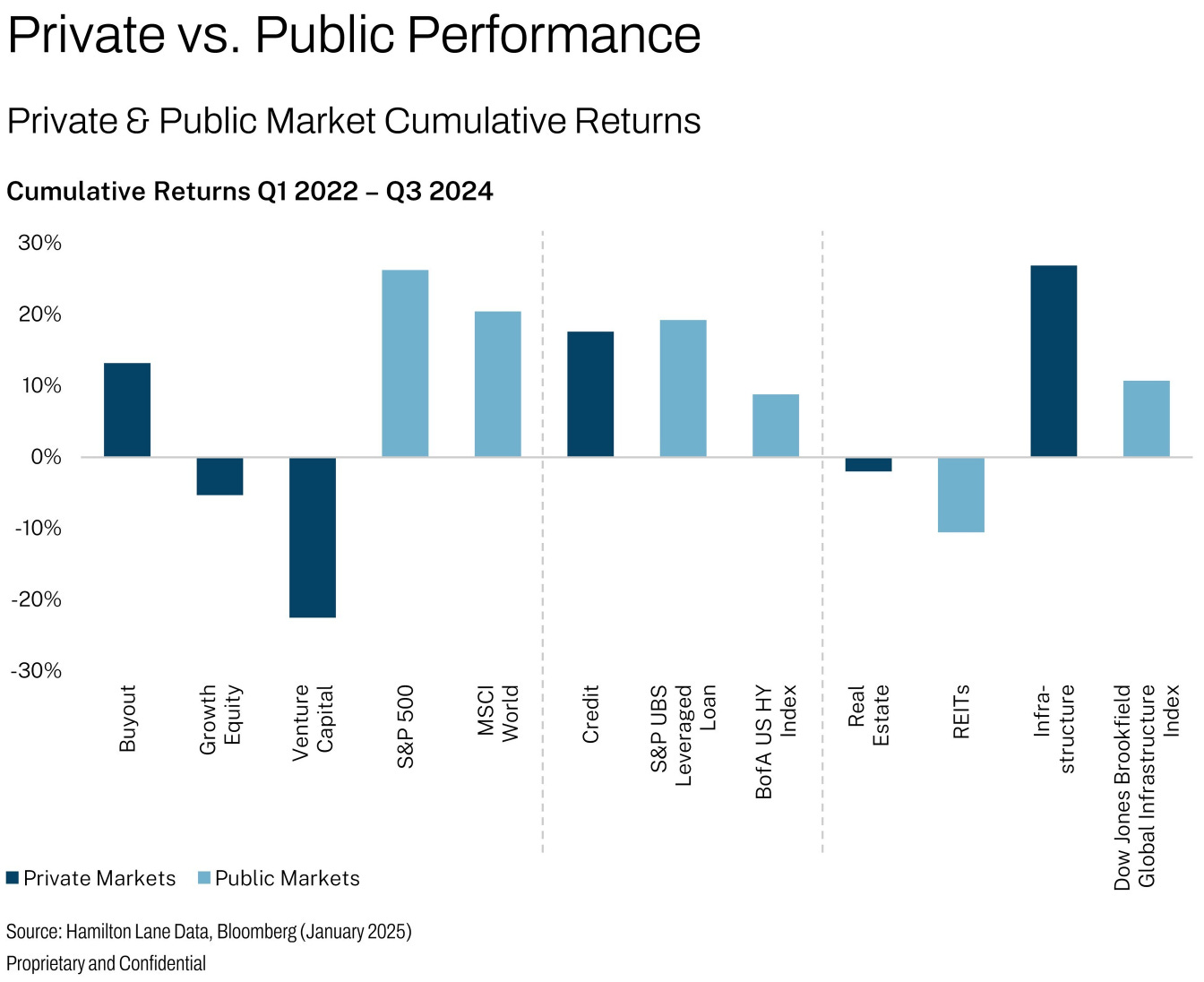

The bad news? Access has been democratized, but transparency hasn’t. And increasingly, the returns don’t live up to the legends passed around in business school hallways - on average. (But the top quartile still outperforms by a wide margin.)

I wrote about the slow death of illiquidity premium here:

Today, we’ll walk through the fundamentals of investing in private equity funds and talk about what LPs should watch for in fund structure, strategy, and incentives.

We’ll cover:

How private equity funds are structured

What investors should know about fees, fund terms, and performance mechanics

Red (and yellow) flags LPs often overlook

You’ll also find a set of starter questions to use in due diligence.

This post explores the data behind performance persistence: how often top-performing managers actually stay on top.