Talking First Brands (on live TV!), Secondaries 🌊, and Alts in Your 401(k)

🗞️ Sunday digest: private markets insights 10/12

Happy Sunday!

Here’s what caught my eye in private markets this week:

💳 Private Credit: the First Brands bankruptcy story is making its rounds

📈 Private Equity: DPI is down, secondaries are surging

🏦 Alts in 401(k)s: a podcast on how private assets will make their way to DC plans

And here’s yours truly discussing the First Brands fiasco on Fox Business’ Making Money with Charles Payne.

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything you need to become a better investor. GPs, get a front-row look at how capital allocators think.

💳 Private Credit – First Brands

Public BDCs are selling off, spooked by the First Brands and TriColor stories unfolding as we speak. The former is a case of complex financing gone wrong; the latter, outright fraud.

📌 The million dollar question: how widespread is this?

The market is clearly worried about contagion - the S&P BDC index is down 15% since the beginning of September. First Brands might be a one-off, but we won’t know until the next one blows up.

(Personally, I don’t think the entire space is a house of cards, but I also don’t think it’s isolated to First Brands. There are likely other over-levered borrowers).

Here’s a recap:

First Brands’ bankruptcy shows what happens when opacity meets high leverage. The auto parts giant filed for Chapter 11 on Sept 28, 2025, after a failed $6.2B refinancing and a liquidity collapse.

$10B+ in liabilities: $5.5B in term loans, $226.9M in asset-based borrowings, and $2.3B+ in off-balance-sheet facilities.

$900M+ in annual interest costs.

Trade finance & factoring blow-up: it appears the same receivables were pledged to multiple lenders.

Major creditors: Jefferies, Norinchukin, ING, and Katsumi Global (owed $1.75B).

Raistone, a fintech that helped structure much of the off-balance sheet financing, claims $2.3B “vanished.” Only $12M in cash remains, with $1.9B in collateral unaccounted for. They’re calling for an independent examiner amid misconduct allegations.

Some of the senior secured loans were packaged into CLOs - those loans are trading for $.33 on the dollar, and equity tranches will take biggest hit. (But the beauty of CLOs is that investors in upper tranches are well-insulated against defaults of any given borrower: exposure is minimal and highly diversified).

If you missed the post on CLO exposure to First Brands debt, read this:

(Side note: Apollo reportedly shorted First Brands’ debt via a bespoke credit default swap (CDS). A full year ago. Comforting, in a way, that someone saw the cracks, while others kept the party going).

Invest in private credit? You’ll want to read this:

👉 I’m thinking of doing a side-by-side case study of two comparable BDCs: one non-traded and one publicly listed. Any suggestions on strong candidates? Drop them in the comments!

📈 Private Equity

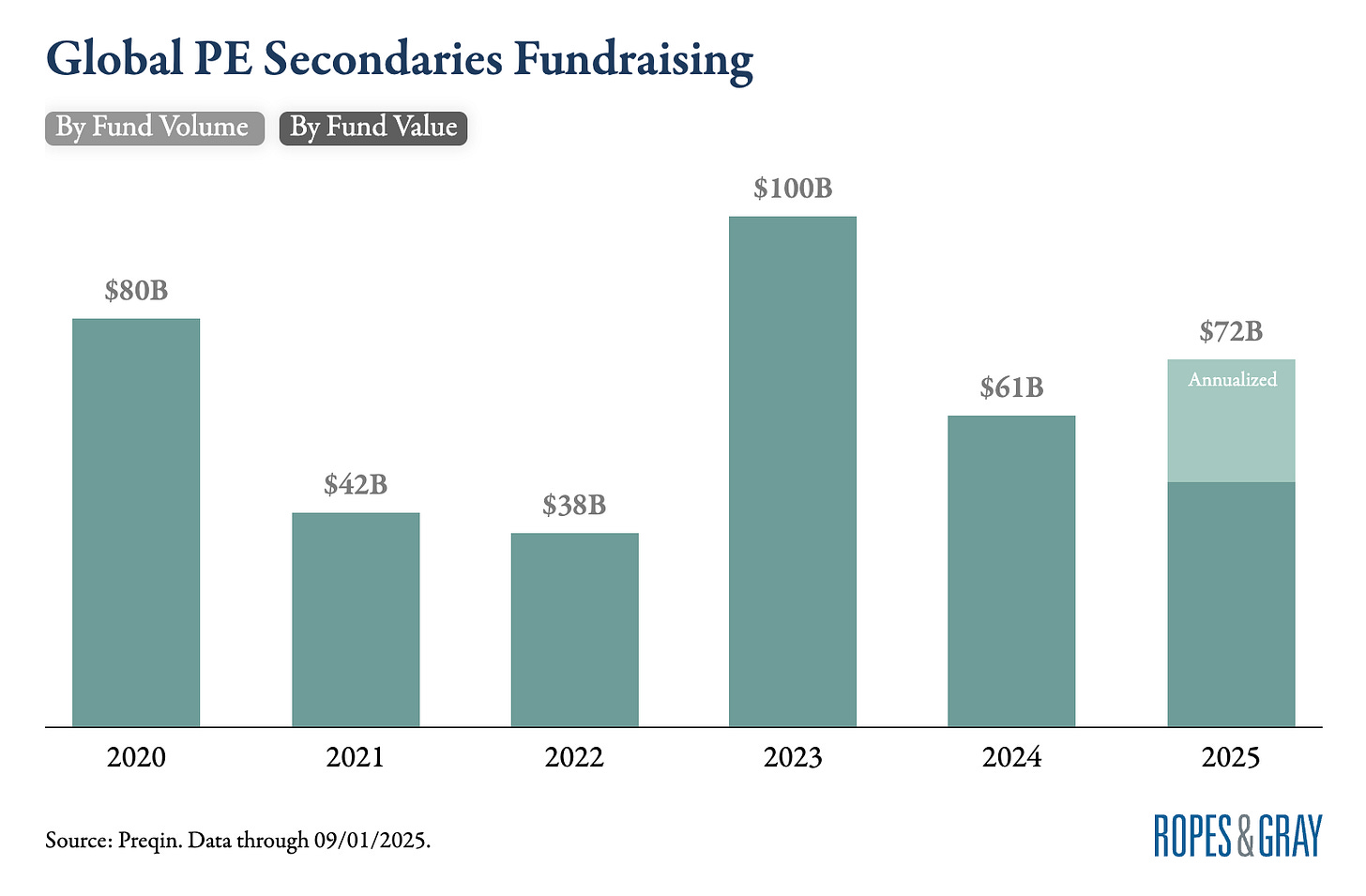

Ropes & Gray just released an excellent report on private equity. Key takeaways:

2025 deal and exit activity is roughly flat vs. 2024.

Five-year DPI (cash distributions to LPs) is the lowest in a decade.

Holding periods for buyouts are up to 6.4 years on average.

Secondaries are booming: total deal value in H1 2025 is up 42% YoY, and continuation fund capital has already surpassed all of 2024.

Take a look at fundraising for secondaries:

🌊 Bottom line: expect a wave of new secondaries funds. It’s quickly becoming the preferred exit path for many managers.

In 2024, GP-led secondaries represented 44% of the secondaries transactions. Read more here:

🏦 Private Assets in 401(k)s

Like it or not, private markets are coming to a retirement plan near you. In August, President Trump signed an executive order: “Democratizing Access to Alternative Assets for 401(k) Investors.”

This is the clearest explanation I’ve yet seen on how this will happen. On Capital Allocators, Ted Seides interviews Eric Mogelof (KKR) on how alternatives will be integrated into the $40T U.S. retirement market, particularly through custom target-date funds and managed accounts.

I was going to spare you the obvious: how tasty a 10% slice of a $40T pie must be for asset managers, but I can’t resist. This is real money, folks.

Highlights:

DC plans represent $12.5T of the market and are growing fastest.

Allocations to alts could reach 10–15% within a decade.

Remaining challenge: daily pricing and liquidity management for illiquid assets.

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading, and have a great week. If you have any questions or suggestions, just hit reply. I’d love to hear from you!

-Leyla

Here's hoping you do that BDC comparison, Leyla. It would be really interesting to see it.

MAIN, is one I'm invested in