🗞️ Sunday Digest: Private Markets Insights 9/28

Good news for CRE, less than good news for private credit, and more on continuation vehicles

Here’s what caught my eye in private markets this week:

💳 Private Credit: signs of rising stress (but none too obvious).

🚙 Private Equity: continuation vehicles keep on rolling (pun intended).

🏢 Real Estate: Good news on pricing, but remember DOGE? It’s still shaking up the CRE market.

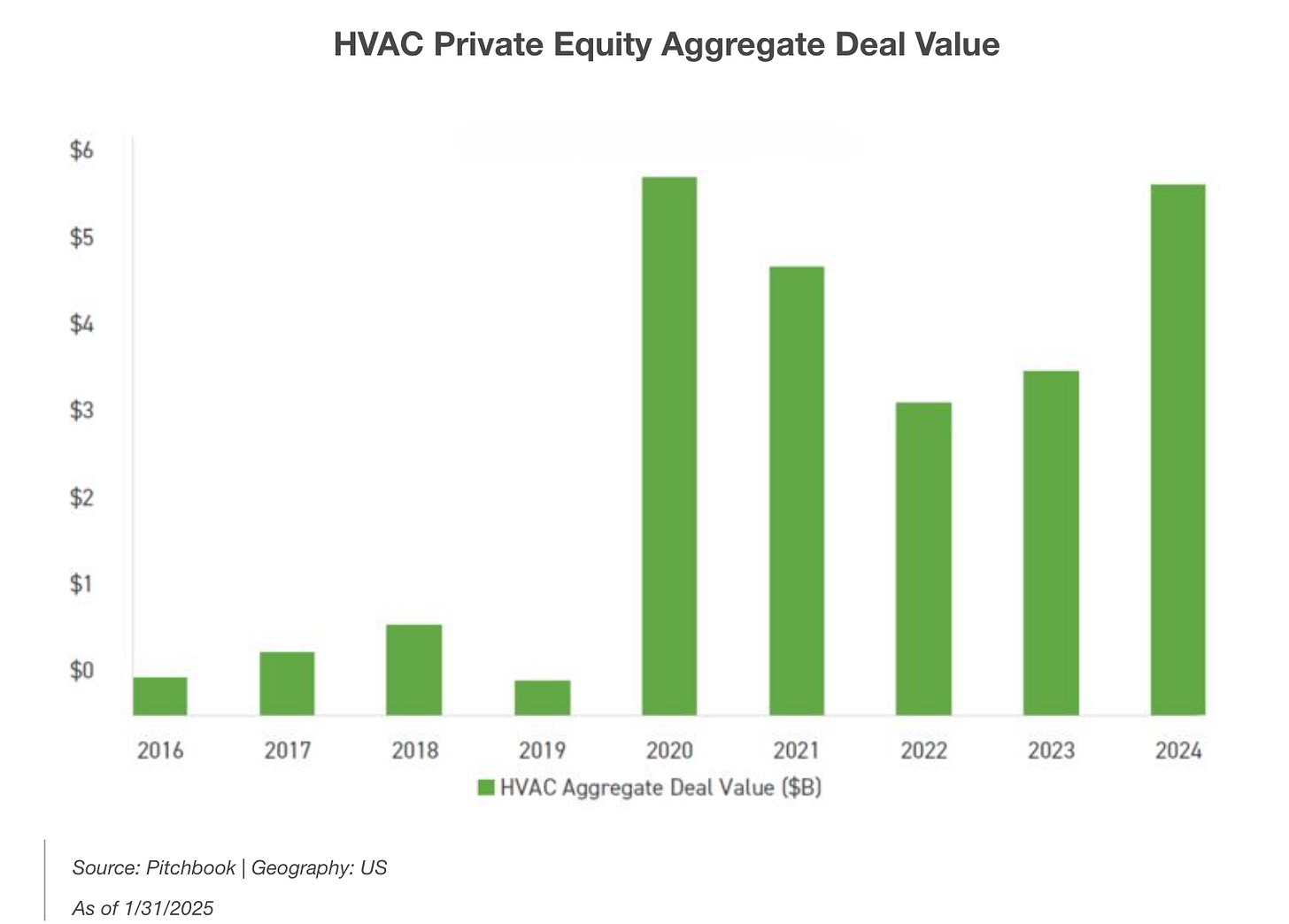

Chart of the day (source)

(in case you somehow missed it: PE is on a spree rolling up field services businesses.):

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything you need to become a better investor.

💳 Private Credit

Is it stress, or is it not?

Bank of America warns that stress is building in the $1.7 trillion private credit market, with defaults rising, borrowers increasingly deferring cash interest (hello, darkness PIK, my old friend) and realized losses across BDCs topping $1 billion in Q2, the highest since the pandemic.

About PIK:

Unrealized losses of $1.3 billion, tied largely to 2021’s low-rate vintages, point to further pain as higher rates persist. The report flags “bad” PIK loans (borrowers deferring interest mid-loan, which we covered here) now making up 2.5% of BDC holdings.

Refinancing risk is also mounting: $170 billion in debt matures over the next two years, including nearly a third of PIK loans. On the upside, $160 billion in direct lending dry powder could help soften the blow.

Where did the defaults go?

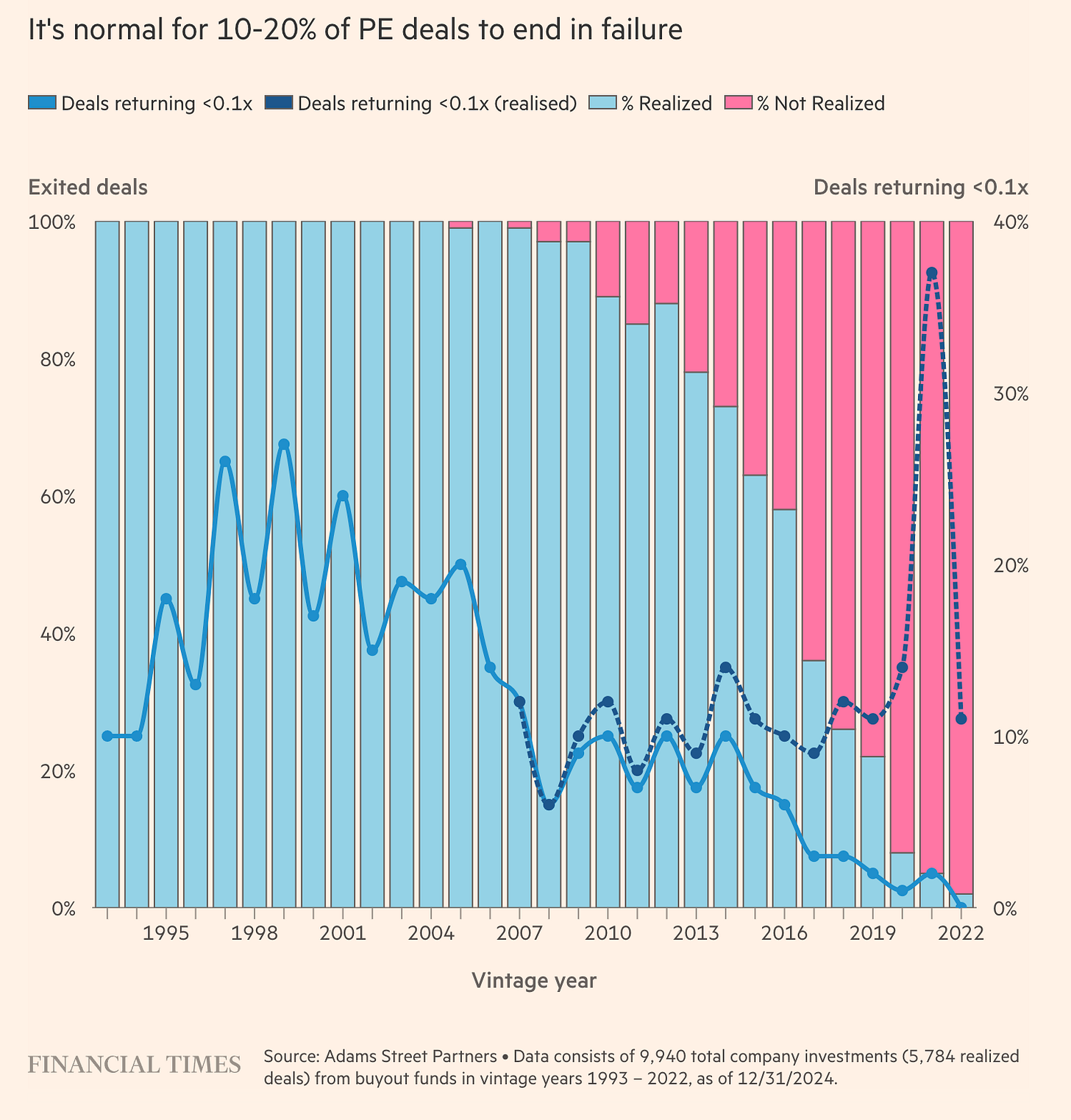

The FT ran an excellent piece by Toby Nangle that challenges the headline numbers in private credit. The industry often cites a default rate of just ~1%, but Nangle argues that this figure may be artificially low because private equity sponsors are simply holding on to struggling portfolio companies rather than exiting and realizing the losses.

Historically, 10–20% of PE-backed companies fail (the light blue in the chart below). Defaults have plunged in recent years, but if you assume even a 10% failure rate spread over five years, the implied default rate would be closer to 1.5–2% once you adjust for private credit AUM growth. If the true failure rate is 25%, the math pushes default rates up toward ~7%.

Anyone interested in an updated write up on Cliffwater’s CCLFX? Drop a comment

🚙 Private Equity - They Keep on Rolling

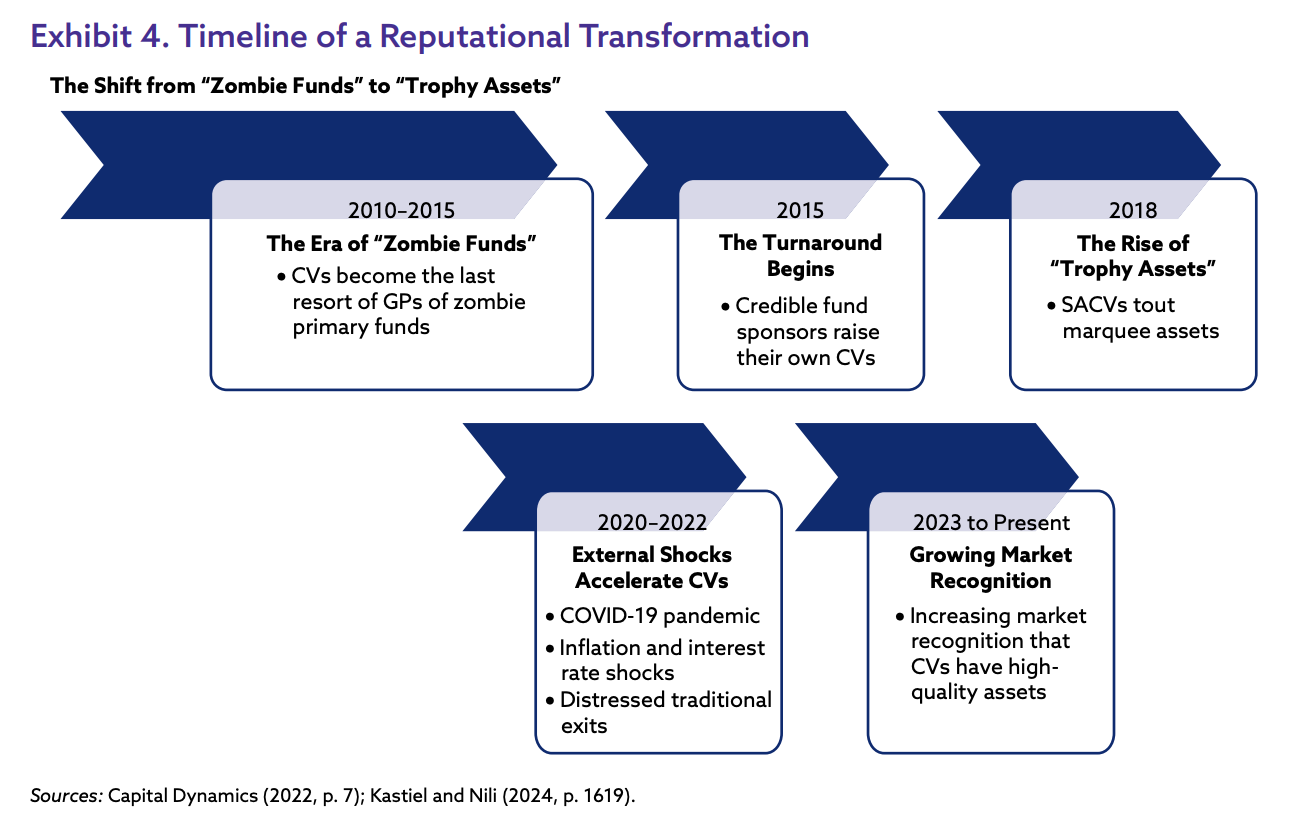

The FT highlights how private equity firms, unable to exit via IPOs or trade sales, are increasingly selling companies back to themselves through continuation vehicles.

These GP-led deals hit a record $41B in the first half of 2025, nearly 20% of all PE exits, underscoring how clogged exit markets have become despite rising stock indices.

The CFA Institute’s recent report on continuation vehicles adds weight here, stressing conflicts of interest and governance challenges LPs must navigate when sponsors effectively “buy from themselves.”

From the report, the evolution timeline of “Zombie Funds” into “Trophy Assets”:

Here’s a deep dive on continuation vehicles:

🏢 Real Estate

DOGEgoneit

For the CRE nerds: Yale SOM’s study on DOGE’s unprecedented federal lease cancellations shows that the sudden termination of nearly 800 leases disrupted both the commercial real estate market and CMBS debt tied to those properties.

Investors quickly repriced risk: junk-bond–rated CMBS linked to DOGE-terminated leases dropped roughly 4% more than comparable properties, while nearby buildings also saw income and valuation declines. Estimated losses in the D.C. market alone could reach $575 million over the next five years.

There are a number of funds (including KKR’s Real Estate Finance Trust, Cerberus Funds, Blackstone Mortgage Trust) that hold collateralized securities on their books. Learn more about those wonders of finance here:

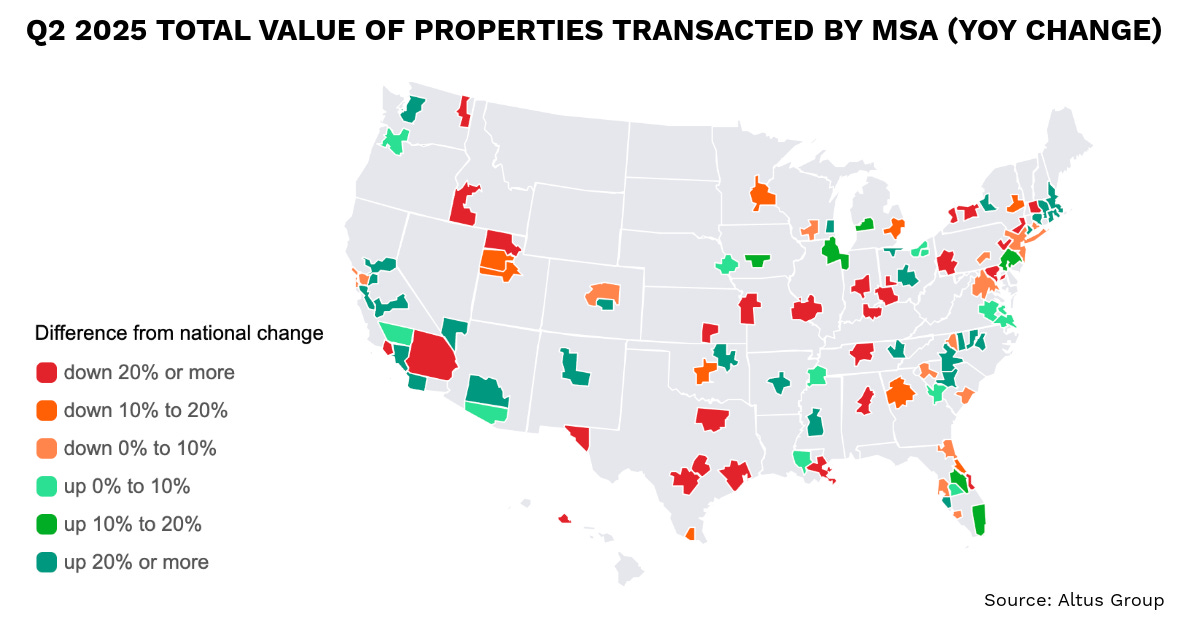

Altus Group US CRE Transaction Analysis

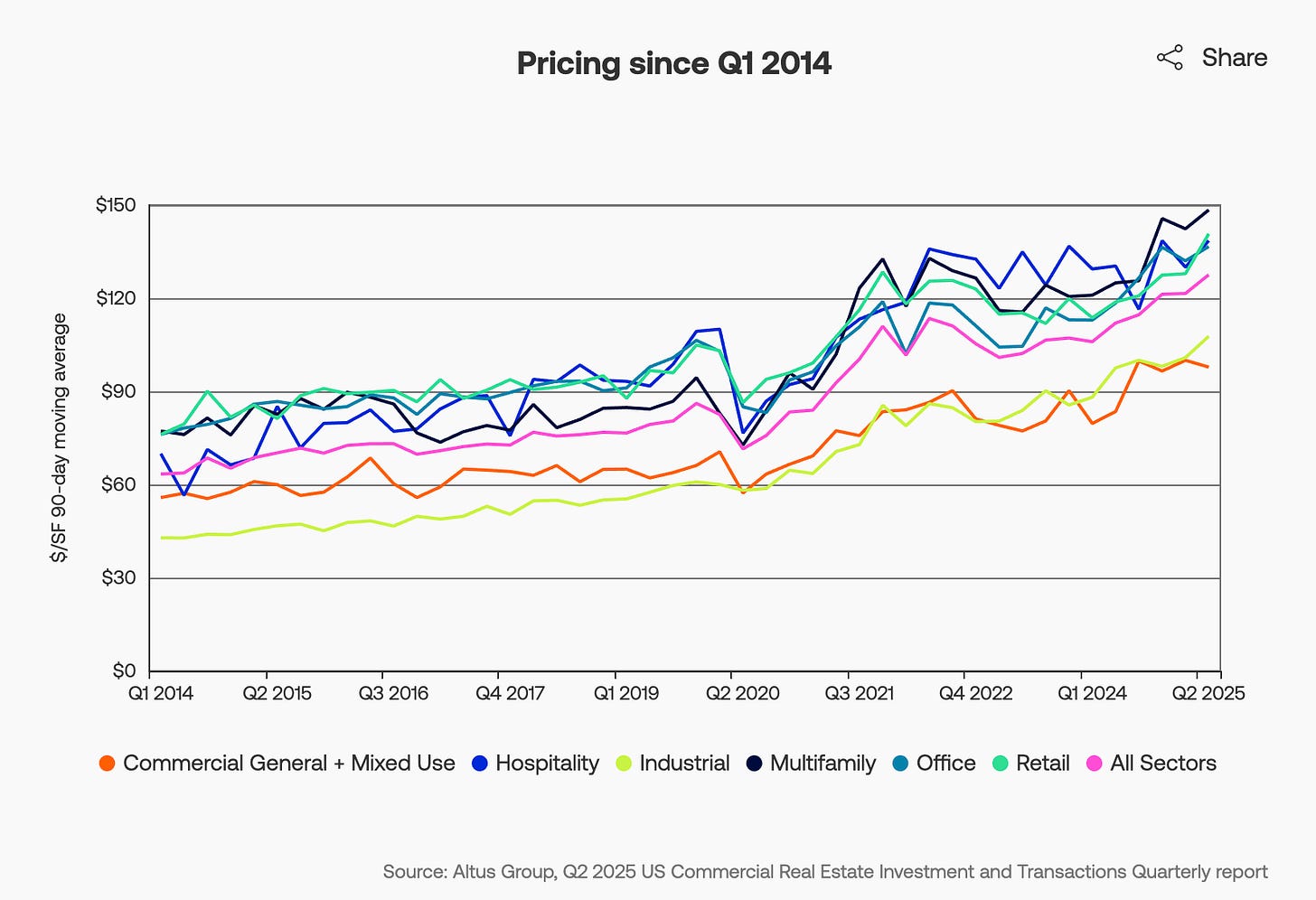

And finally, if you made it this far: I have some good news. Pricing per sf is starting to move up, according to this report (tons of great visuals there, I’m a fan)

Aggregate CRE transaction volume rose 3.8% YoY, totaling $115 billion in Q2 2025.

Multifamily sector transaction volume increased 39.5% YoY.

Office sector transaction volume increased 11.8% YoY.

Median price per square foot for single-property transactions: +5.0% QoQ, +13.9% YoY across all sectors.

New York and San Francisco underperformed compared to national trends.

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading. If you have any questions or suggestions, just hit reply — I’d love to hear from you!

-Leyla