🗞️ Sunday Digest: Private Markets Insights 8/17

Data centers, private credit defaults, and creative PE exits

Happy Sunday!

This week’s digest covers three areas:

📊 CRE: data centers surge as AI drives demand and rents hit double-digit growth.

👉 GPs: We’re running a short, anonymous survey on terms in your most recent raise. Participants will receive the full results once it closes.💳 Private Credit: institutional appetite cools, while defaults in middle-market loans reach record highs.

📈 Private Equity: one in five exits now via continuation vehicles - raising a new set of questions for LPs.

Before we dive in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective through the LP lens. We cover private credit, private equity, and CRE investing, drawing on thousands of data points and conversations with LPs, GPs, and service providers.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click below to choose your plan:

👉 $10/month or $100/year.

📊 Commercial Real Estate: Data Centers, AI & Real Asset Demand

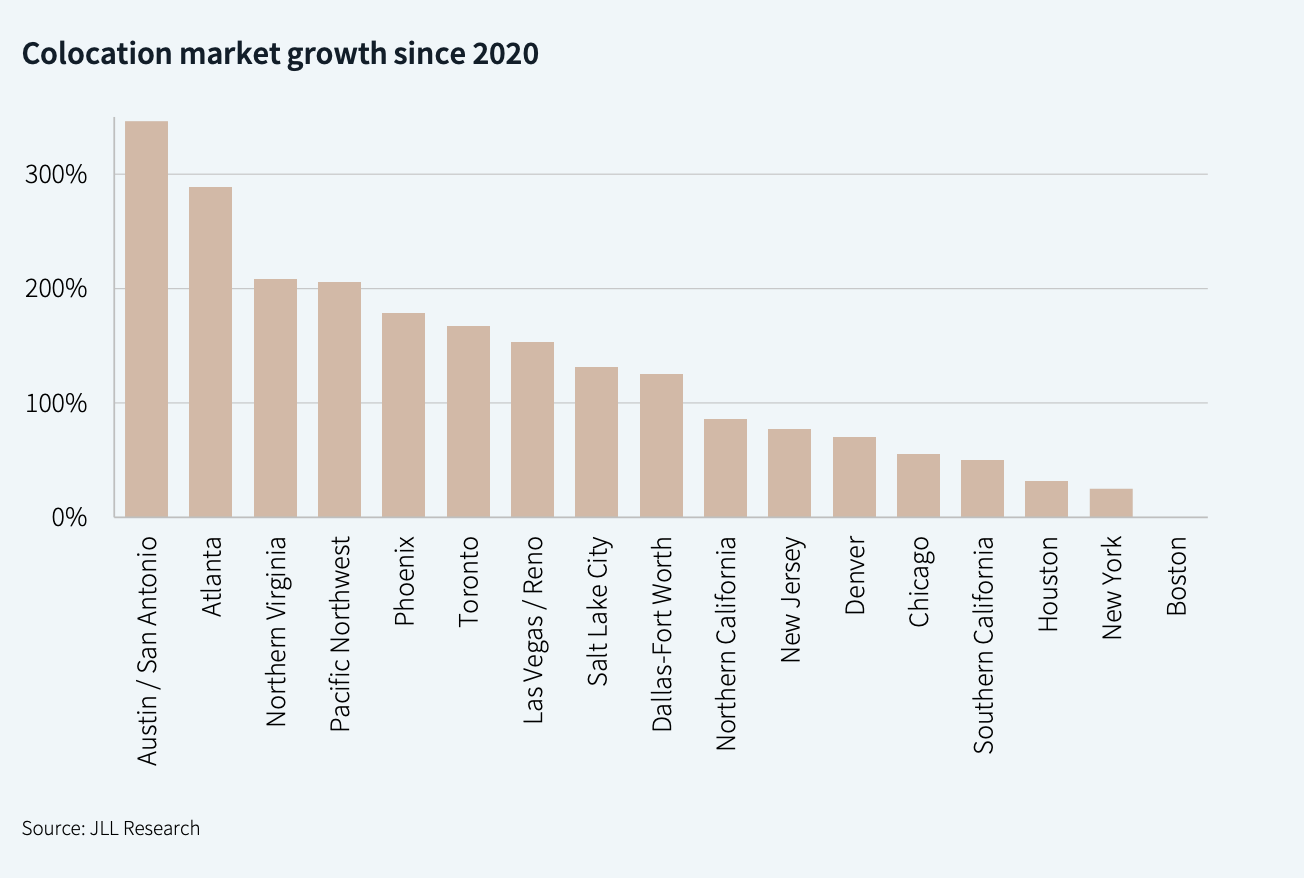

If you’re not already thinking about data centers, you’re behind. JLL’s latest report highlights a North American market on an absolute tear as hyperscalers (Google, Amazon, Microsoft) and AI startups devour space to power their chips and models.

Demand in primary markets is running well ahead of supply, rents are surging (up 12% year-over-year, with an 11% CAGR since 2020), and new construction can’t keep pace with power and zoning bottlenecks. For investors, data centers now rival prime logistics properties as preferred allocations, especially with inflation-adjusted leases offering downside protection.

What’s fueling this? The AI boom, of course: Elon Musk’s xAI just raised $6B to expand GPU clusters that no conventional office or warehouse can host.

💳 Private Credit: Institutional Demand Slows, Defaults Tick Up

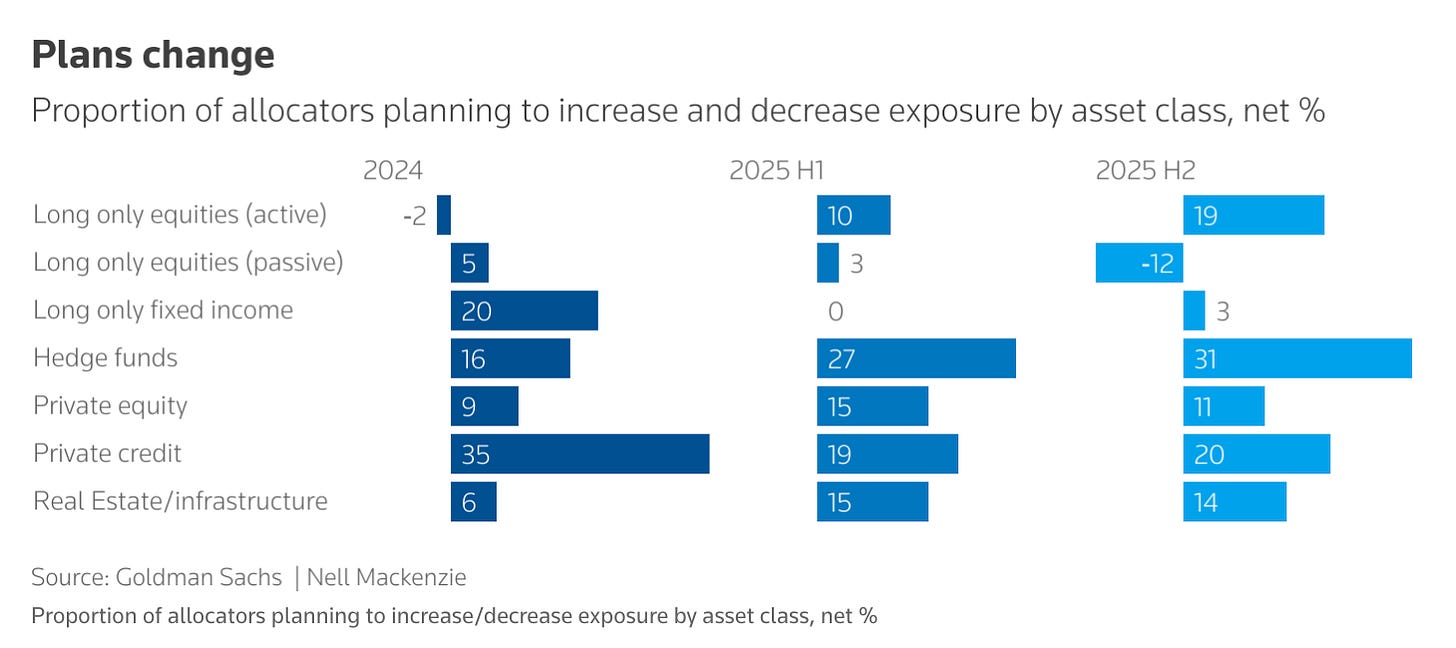

Goldman Sachs’s latest survey offers a warning sign: investor appetite for private credit cooled in 2025, with only 31% of allocators planning commitments versus 41% a year ago (Reuters).

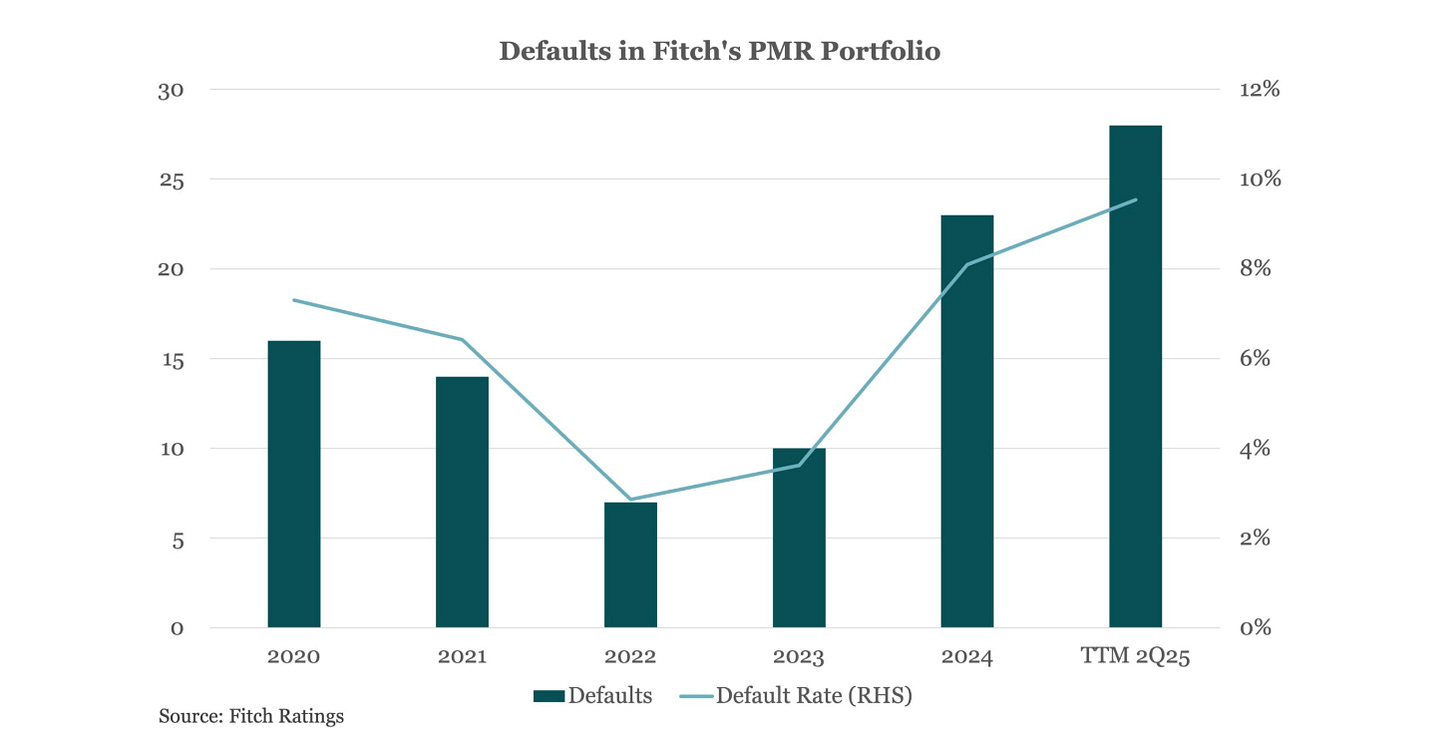

Meanwhile, cracks are emerging in U.S. middle-market lending. Fitch’s privately monitored ratings show defaults climbing to 9.5% in Q2 from 7.8% in Q1 (the highest since tracking began). Smaller issuers are straining under floating-rate debt and high interest costs.

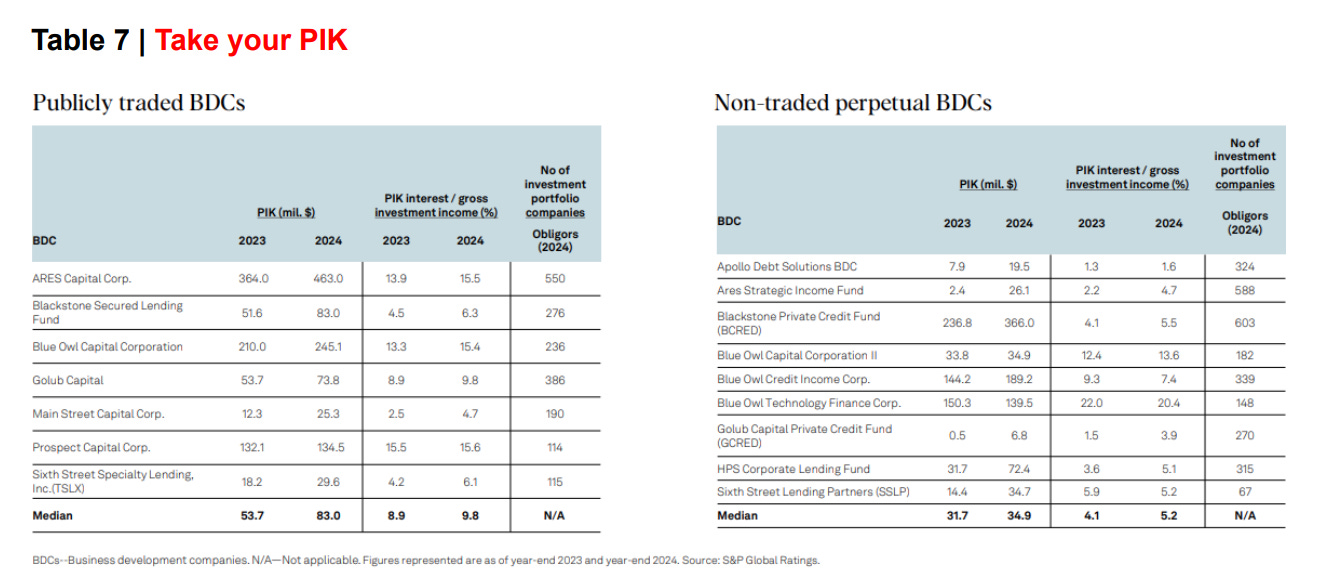

The main triggers of 2024 defaults? PIK/interest deferral (44%) and stressed maturity extensions (26%), per Fitch.

And speaking of PIK, take a look at the recent data in publicly traded and non-traded BDCs:

For more on what PIK signals, see our recent deep dive:

📈 Private Equity: The Era of “CV Squared”

Bloomberg reports that nearly 20% of PE exits in the first half of the year flowed through continuation vehicles (CVs), with a growing subset now “CV-squared,” where one continuation fund sells an asset into another. This surge comes as distributions fall to just 7% of fund value (down from ~25% in 2015–2019), according to MSCI.

Read this to learn more about secondary funds, and stay tuned for a deep dive into continuation vehicles:

The mechanics are straightforward: GPs shift a company from an aging fund into a new vehicle, often backed by secondaries capital, to extend the hold. For existing LPs, CVs provide liquidity without tapping the secondary market.

But the bigger signal is about exit health: IPOs remain thin, sponsor trades are muted, and multiples are compressed. CV-squared amplifies this: if an asset couldn’t clear the market the first time, what’s really changed the second?

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate

Thanks for reading. If you have any questions or suggestions, just hit reply — I’d love to hear from you!

-Leyla

Thanks, Leyla. The enthusiasm for data centers looks bubble-like to me. AI in the form of LLMs is vastly overhyped (see the substack by Gary Marcus). It also seems to me that improved approaches will likely be less compute-intensive. If Nvidia is your style, then data centers are too. If you want to be more conservative, stay away.