🗞️ Sunday Digest: Private Markets Insights 8/2

This week: PE's strange bedfellow, shaky multifamily loans, and PE returns forecast from Vanguard

Happy Sunday! Hope you are enjoying your summer - I, for one, am shocked it’s already August.

Today, we’ll cover three things:

The surprising link between crypto and private equity.

How widespread is distress in multifamily loans right now?

Vanguard’s bold returns forecast from its private equity report.

Before we dive in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective through the LP lens. We cover private credit, private equity, and CRE investing, drawing on thousands of data points and conversations with LPs, GPs, and service providers.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click below to choose your plan:

👉 $10/month or $100/year.

📈 What’s Better than Private Equity? Private Equity + Crypto in Your 401(k)!!

Private equity firms have long salivated over the $9 trillion parked in America’s 401(k)s, and under Trump, they might finally get their wish.

But in a plot twist, the administration is reportedly eyeing a more “expansive” executive order that would open the door not just to private funds, but to crypto too, reports the WSJ.

Some PE firms are privately worried that crypto could be a distraction. They’ve spent years trying to position private equity as a sophisticated, institutional-grade upgrade to the typical retirement portfolio, not a meme-fueled gamble.

But in the end, what better way to diversify your high-fee, illiquid private 401(k) holdings than by adding a zero-fee, highly volatile asset class to the mix? (I’m being facetious, in case you are wondering).

🏢 Commercial Real Estate

I’m breaking my own rule here (note to self: don’t quote stuff from X, Leyla), but I promise there’s a good excuse reason.

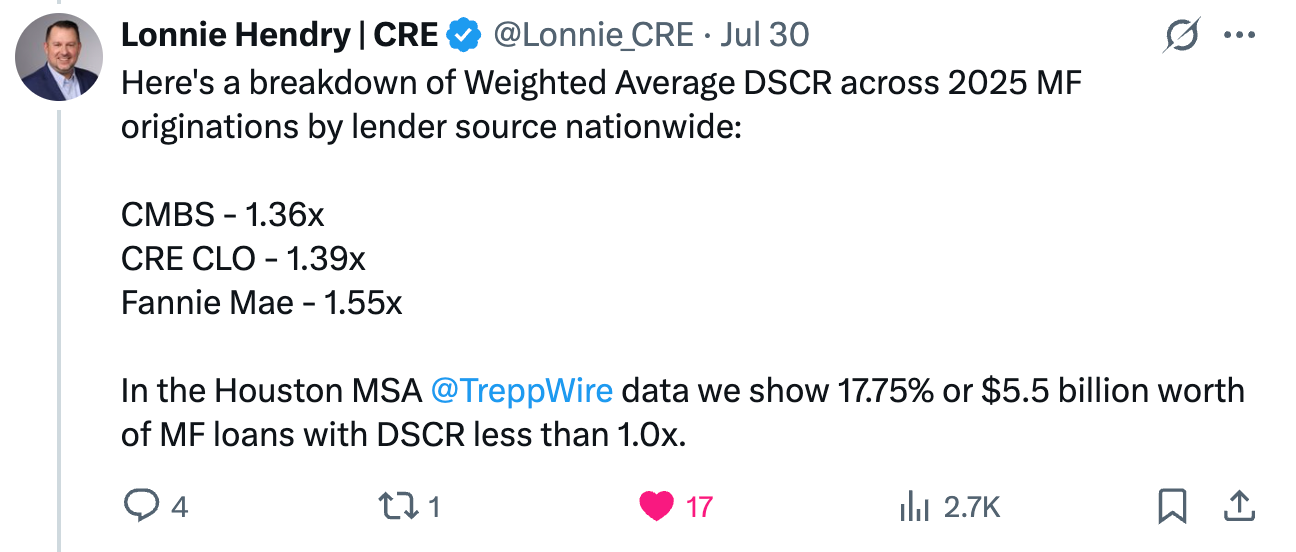

This stat bomb comes courtesy of Lonnie Hendry, Chief Product Officer at Trepp. If you’re not already listening to their podcast, you are missing out. (No, this isn’t sponsored—but hey, my DMs are open 😅).

Some eye-popping numbers for loans with a DSCR below 1.0x (which simply means the property isn’t generating enough cash flow to cover its debt payments):

Houston MSA: $5.5 billion worth of multifamily loans

DFW: $7.2 billion

San Antonio: $2.0 billion

Curious how this all began (yes, including busloads of California dentists syndicating Texas multifamily)? - read this story:

You doing the math? That’s nearly $15 billion in potentially distressed multifamily debt across just three Texas markets. And yes, some of those loans have rate caps (an insurance product that covers interest payments if interest rate on the loan exceeds a certain threshold), but rate caps are not forever.

This is blood all right, just not in the streets yet. The $15 billion dollar question is how long the lenders are going to be willing to extend these loans? 💬Would love to hear what you are seeing - comments are open!

This is a deeper dive, for those curious:

Private Equity Outlook

I’m not exactly subtle about my skepticism when it comes to Vanguard dipping its toes into private markets. Whether illiquid, opaque investments belong in a 401(k) is definitely debatable, but personally, I’m not sold. That said, I’m all for free markets: if consumers want it, they should get it.

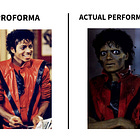

Alright, stepping off my soapbox. What I really want to draw your attention to is Vanguard’s freshly released report on private equity. (You know how it goes: when you’ve got something to sell, a report usually follows). Some highlights:

After a recent slowdown, private equity exit markets are bouncing back in 2025, giving investors better liquidity options (good for investors, but keep in mind a lot of this liquidity is from secondary transactions)

Vanguard forecasts long-term private equity returns to outpace public equity markets by about 3.5% annually (this is the selling point).

Dry powder reserves remain high: expect more deal-making activity and increased competition for quality assets.

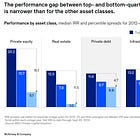

Institutional and sophisticated private investors are placing greater emphasis on manager selection, operational improvements, and value creation levers to drive alpha in the current environment. This echoes the recently published McKinsey report - I talked about it here:

The report highlights the importance of liquidity management and alignment with personal investment horizons, especially for those considering new or increased allocations to private equity in 2025. This is an excellent reminder. Thank you, Vanguard research (or was it legal?) team!

Thank you for reading!

New here?

Check out some of our popular topics to get started:

If you have any questions or suggestions, just hit reply — I’d love to hear from you!

-Leyla

P.S. Can handle more of me? I’m on X and LinkedIn

P.P.S. While not my primary focus, I provide consulting services to both GPs and LPs. You can email me at leyla@accreditedinsight.com