♼ The Lending Loop, PE Q3 Update, and CRE: Patient is Alive 🩺

🗞️ Sunday digest: private markets insights 11/2

Happy Sunday! Hope you have sufficiently recovered from the sugar coma after stealing borrowing Halloween candy from your offspring!

Here’s what caught my eye in private markets this week:

💳 Private credit: banks are funding their own competition

📈 Private Equity: deal and exit activity is perking up, fundraising is down

🏢 CRE: slow pricing recovery underway

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything you need to become a better investor. GPs, get a front-row look at how capital allocators think.

💳 When Banks Fund Their Own Competition

Moody’s recently published report maps how traditional lenders are deepening their ties to private credit funds.

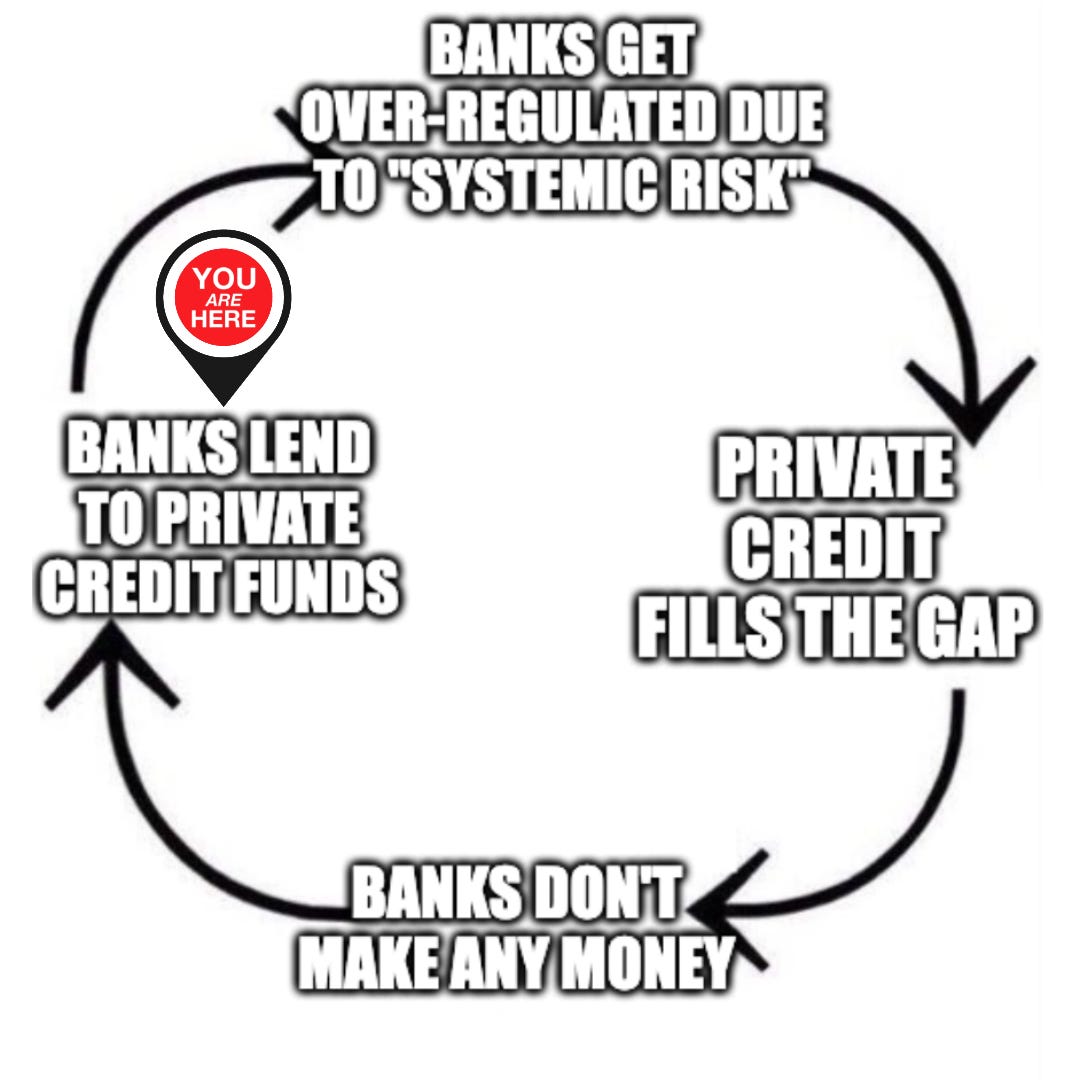

Loans to non-depository financial institutions (NDFIs) now make up 10.4% of all U.S. bank lending, up from just 3.6% a decade ago—roughly $1.2 trillion in total exposure. Nearly half of that comes from loans to private credit (~$300B) and private equity firms (~$285B). I made this chart for you to illustrate the grand lending loop:

⚠️ Moody’s warns that as banks extend credit to private credit providers (through fund financing, subscription lines, and structured vehicles), the system’s interconnectedness grows. Weak underwriting, leverage, and opaque fund structures could amplify stress if markets start to wobble.

On the heels of Moody’s report, this article from Bloomberg captured the unease rippling through credit markets after several high-profile blowups.

After years of easy money and double-digit returns, some analysts say private credit is due for a reckoning.

Even with default rates still near historical averages, warning signs are flashing beneath the surface. Borrowers are increasingly deferring cash interest and rolling it into principal (aka PIK, or payment in kind), a trend that NYU’s Edward Altman says signals companies are getting “stretched.”

Not all PIK is created equal. Read this:

Adding to the concern: valuations.

Duke Law’s Elisabeth de Fontenay points out that private lenders often mark the same loan at vastly different values, raising questions about whether assets are really being reported “at their actual correct fair value.”

Well, well, well.. haven’t I told you this already? Here’s an example of how a loan to the same borrower shows up with different valuations across lenders’ books:

📈 Private Equity Is Finding Its Way Out

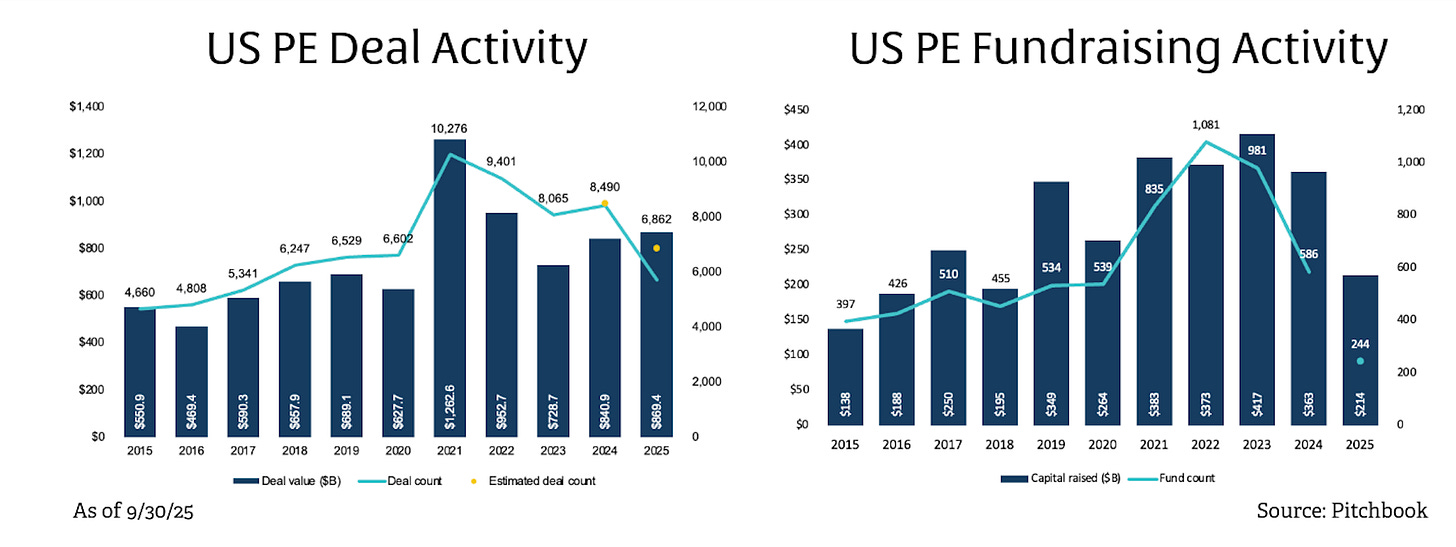

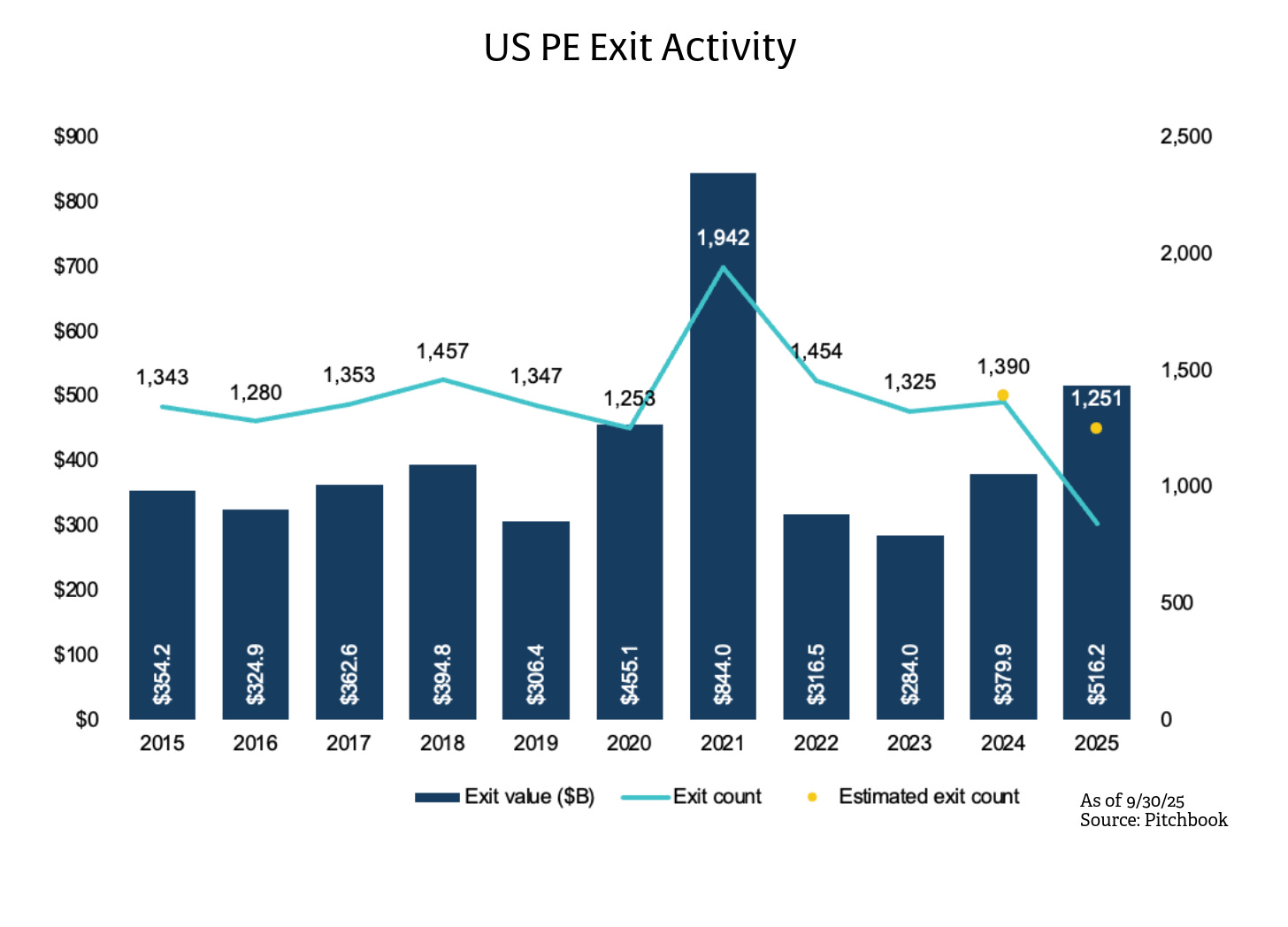

After two years of gridlock, the latest PitchBook Q3 2025 report shows signs of rebounding activity: dealmaking and exits are creeping higher (by volume), though fundraising is still down.

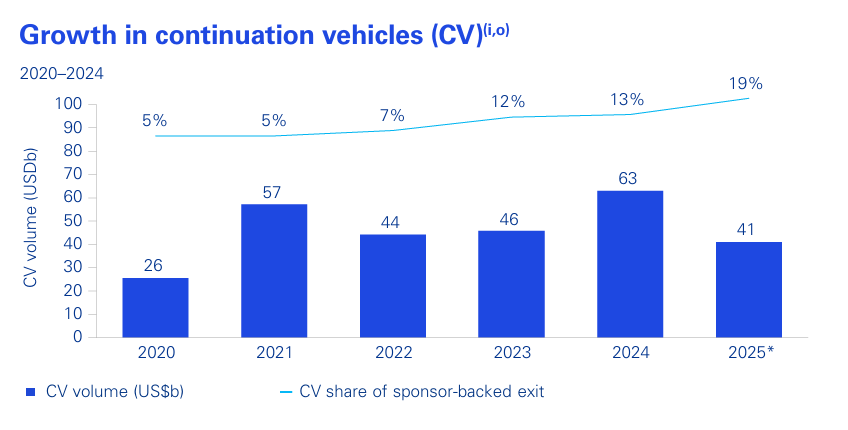

Speaking of PE exits, KPMG estimates 19% of PE exits now come via continuation vehicles, as firms increasingly sell portfolio companies to themselves amid sluggish IPO and M&A markets:

Here’s your primer on continuation vehicles, I really doubt this trend will reverse any time soon, so might as well read up:

🏢 Commercial Real Estate: the Patient is Alive! ✅

Colliers’ Q3 2025 U.S. Capital Markets Snapshot offers some rare good news.

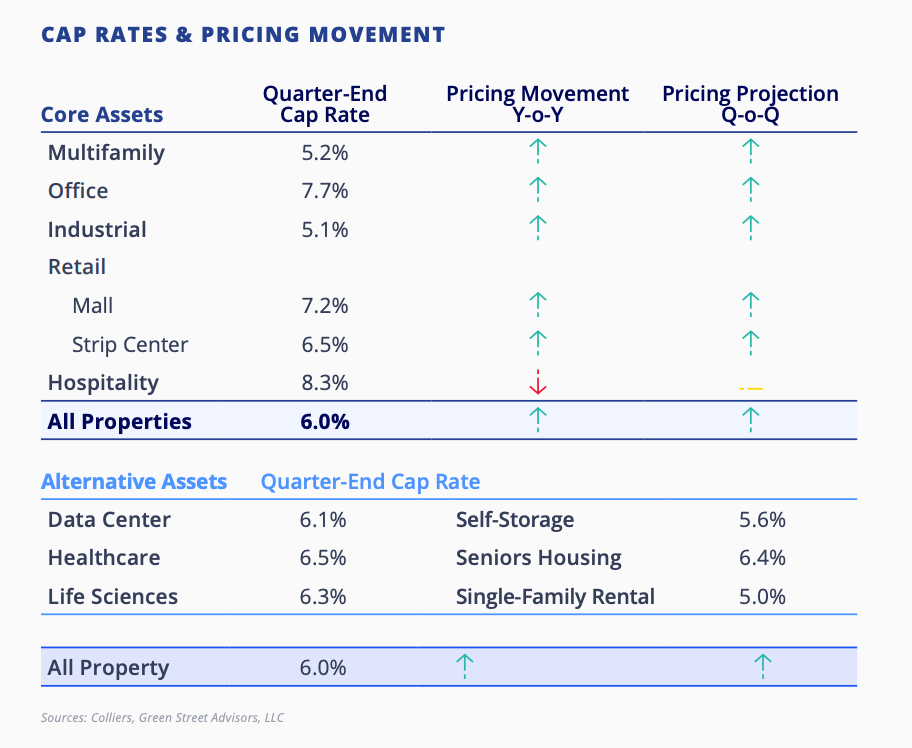

Early-stage recovery underway: modest pricing gains and steady cap rates, with operational efficiency becoming the primary driver of returns over cap rate compression.

Here’s a deep dive on how cap rate movements impact returns:

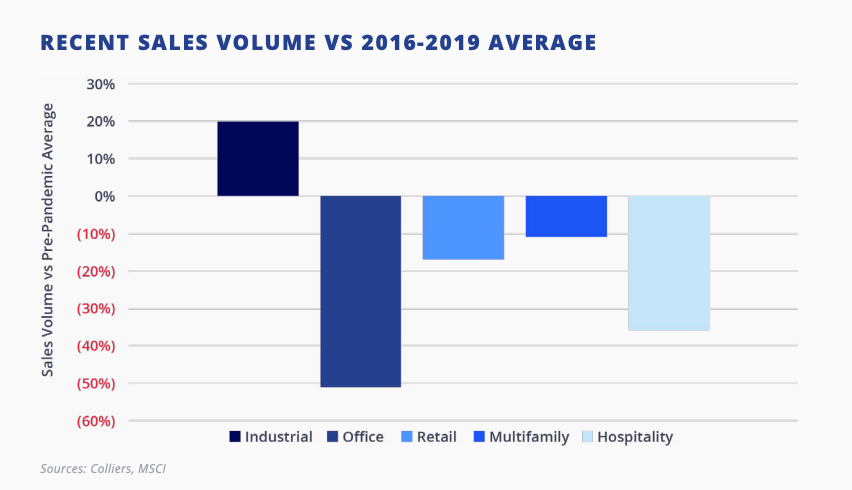

By sector:

Multifamily remains dominant, supported by tight housing supply and unaffordable homeownership.

Office is stabilizing; “trophy” assets are drawing bids again, though distress lingers below the surface.

Industrial continues to post the strongest fundamentals. The only asset to surpass pre-pandemic volume.

Retail has quietly rebounded, with resilient occupancy and limited new supply.

Hospitality remains uneven, split by market and income segment.

Outlook:

Fundamentals are improving as absorption rises and rent growth resumes. While recovery will be gradual rather than “V-shaped,” disciplined investors focusing on operations and market fundamentals are positioned to benefit from renewed liquidity and selective repricing.

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading, and have a great week. If you have any questions or suggestions, just hit reply. I’d love to hear from you!

-Leyla

Another fun lending loop:

Fintech (e.g. Sofi) lends to consumer -> not on their balance sheet -> BlueOwl -> creates funds and sells equity tranche to Fintech (e.g. Yieldstreet)