Cash Distributions ≠ Great Investment, CRE Edition

How to tell if your quarterly checks come from operations (with an AI prompt to help)

If there’s one myth I’d love to kill off for good, it’s this:

“If it’s paying regular distributions, it’s a good investment.”

Nothing could be further from the truth.

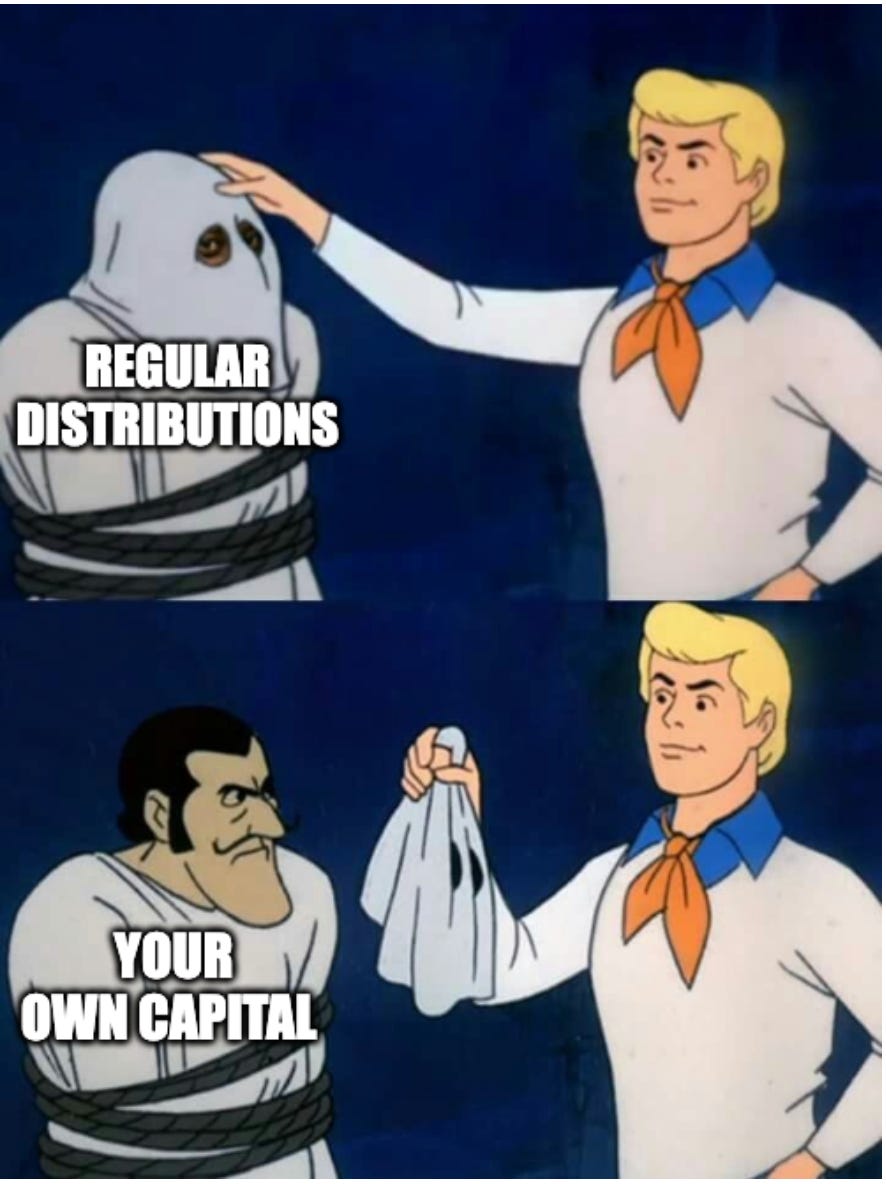

In commercial real estate (CRE) private equity, distributions are often held up as proof that an asset is performing. But distributions can come from many sources (some of which are nothing more than smoke in mirrors). In fact, an investment can be bleeding cash operationally🩸 and still send quarterly checks.

This isn’t unique to CRE. Private credit funds can make distributions from sources other than net cash investment income:

… and so can non-traded REITs:

You heard this before, you’ll hear this again: learn to figure out where cash is coming from BEFORE you invest. I promise you, this isn’t rocket science.

In single-asset syndications, you can usually do it in a few minutes with a calculator. In multi-asset funds, you typically won’t get a proforma, but you can still use financials for the seeded assets as a reality check.

In this article, we’ll focus on the most common scenario of distributions that don’t actually come from operations. I’ll walk you through sample proformas and show you how to spot the difference between true operating cash flow and distributions funded by your own capital.

And while we are on the subject of real estate private equity, check out this post on fees and what LPs should watch out for:

🤖 And for those of you building this into your workflow: I’ll include an AI prompt at the end that you can use to analyze proformas automatically.

Why Cash Distributions Mislead

Cash flow is simple in theory: collect rent, pay expenses, cover debt, and distribute the rest. In practice, cash for distributions can come from:

Operating cash flow (what you want)

Refinance proceeds (fine, but not recurring)

Reserve releases (basically, giving you back your own money)

👉 Not all of these are bad. Development and heavy value-add deals shouldn’t generate yield early on. But if you’re investing in a deal marketed as a “cash-flow play,” you need to confirm that distributions come from operations.

The Tale of Two Deals

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always do your own due diligence or consult a professional before making investment decisions.

Let’s look at two single-asset syndications. On the surface, both advertise steady cash-on-cash returns. Underneath, only one truly delivers.