Private Credit Interval Fund

What the fact sheet doesn’t show - and where to look instead

If you’ve been reading Accredited Insight for a while, you’ve seen case studies on smaller, niche GPs in private credit. Today, we’re going to flip the script and dissect a $6B+ behemoth. And to keep it interesting, we’ll play a little game: you get to guess the fund.

If you invest in private credit, you need to read this:

Here’s what we will cover:

Loan quality (and how to think about it when you have almost no visibility)

Fees (and what they really tell you about GP incentives)

A quick, back-of-the-envelope look at the income statement (my screening method for deciding if a deeper dive is worth it).

Before we dive in...

Accredited Insight gives you the LP’s perspective on private credit, private equity, and CRE—drawing on hundreds of deals reviewed. Paid subscribers get access to 30+ case studies and our deep-dive series on reading a CRE proforma. If you’re a GP, this is your window into the allocator’s world.

👉 $10/month or $100/year

Deal or No Deal?

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of any affiliated organizations. All examples are illustrative in nature and not guarantees of future outcomes. Readers should conduct their own independent research and consult with qualified professionals before making any investment or financial decisions.

The Pitch

This private credit fund expects to invest primarily in directly originated loans (this means the fund plans to make loans directly to companies, instead of buying loans originated by other lenders).

The loans break down as follows:

Senior secured loans → first in line to be repaid if the borrower defaults, backed by collateral.

One-stop loans (AKA unitranche loans) → a single loan that blends both senior and subordinated debt into one package. About 70% of overall portfolio.

Subordinated and second lien loans → repayment happens after senior debt is fully repaid, may have some collateral, but usually behind the senior loan. ~1% of the portfolio.

U.S. middle market companies → businesses that are too large for small-business lending but smaller than big, publicly traded corporations (average borrower EBITDA ~ $80M).

It’s structured as an interval fund, which makes it quasi-liquid. More importantly for us: it falls under the 1940 Act, meaning we get publicly filed financials (YAY for us!)

1️⃣ Loan Quality

Many many moons ago an old banking mentor once drilled the “3 Cs” into me: Capacity (ability to repay), Collateral (what backs the loan), and Character (borrower’s trustworthiness).

I’m sorry to say, with private credit, you can throw this out to the wind - you see nothing on borrower financials, leverage, or repayment history. The GP has the data, but you don’t.

I’ll get back on my soapbox for a second and highlight the obvious: with publicly traded debt, you can triangulate capacity and collateral from filing and supplement with AI-assisted transcript and news scraping. With private loans? You’re in the dark.

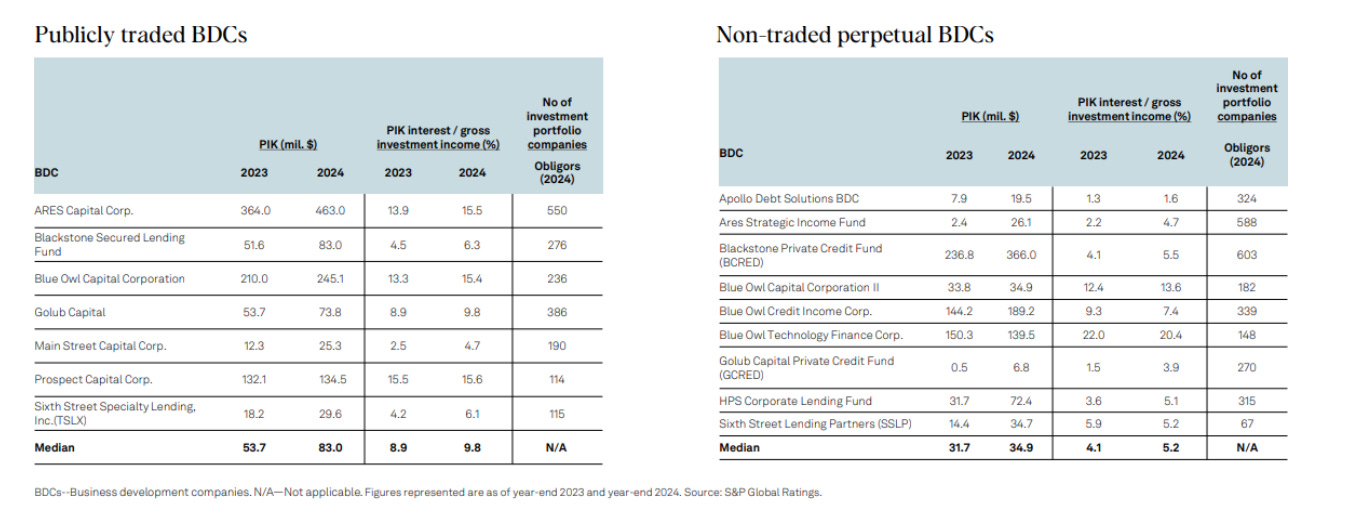

We have one tiny signal: PIK (payment-in-kind) income. I’ll be the first one to admit, it’s not perfect, but it can indicate when borrowers are struggling with cash interest.

In this fund’s case, PIK made up 4% of total investment income for the quarter ended June 30, 2025. Not alarming on its own, but worth tracking over time, and comparing to peers (here’s how you can track it with help of AI from quarterly statements.

Here’s how that compares to other publicly traded and non-traded funds.

2️⃣ Fees

I’m firmly in the camp that fees are not the most important thing - but the structure tells you what the GP is incentivized to do.

Here’s the setup for this fund:

Base management fee: 1.25% of NAV

Income-based incentive fee:

1.25% quarterly hurdle (~5% annualized)

100% catch-up until advisor has 1.25%

Then 12.5% to advisor above 1.43%

Capital gains incentive fee: 12.5% of realized gains (note: realized, not mark-to-market “crystallization”)

That last distinction matters. “Crystallized” promotes mean the GP can get paid on paper gains, even if assets aren’t sold. This fund doesn’t do that - worth noting.

3️⃣ Quick & Dirty Financials

Please note: this is not a comprehensive review of the financials. Read this for a deeper dive:

Here’s my shorthand for scanning an income statement and deciding whether it’s worth digging deeper. The balance sheet tells an equally important (if not bigger!) story, so I can put together a case study on that too if you’d like.

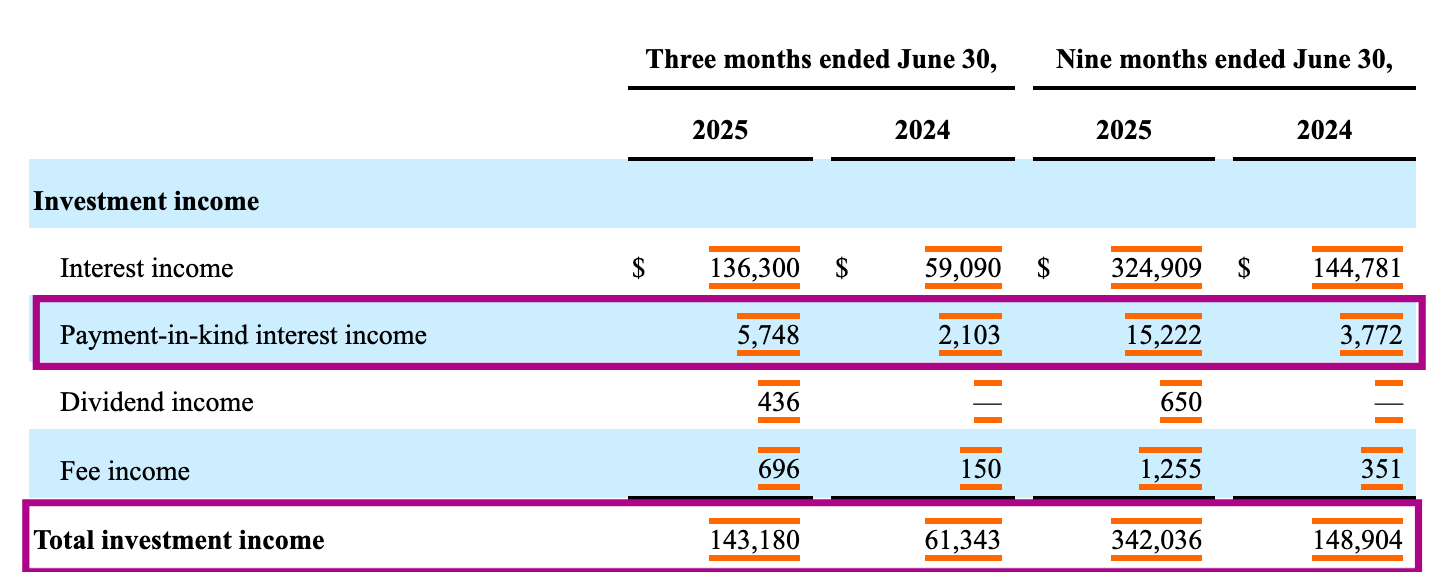

For Q2 2025:

Total investment income: $143.2M

Expenses: $77.9M

Interest/debt financing: $52.5M

Fees & admin: $25.4M

Net investment income (NII): $65.3M

So far so good. This, however, is where most people get stuck, and the screenshot below tells its own story.

Let me translate the story into plain English, and walk you through each of the line items: