Due Diligence on PE Managers: Doing it Like the Best

Look beyond the track record — guest post by Romain Bégramian

On the one hand, 99% of PE managers claim to have outstanding operational capabilities. On the other, only about 25% of funds land in the top performance quartile.

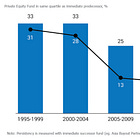

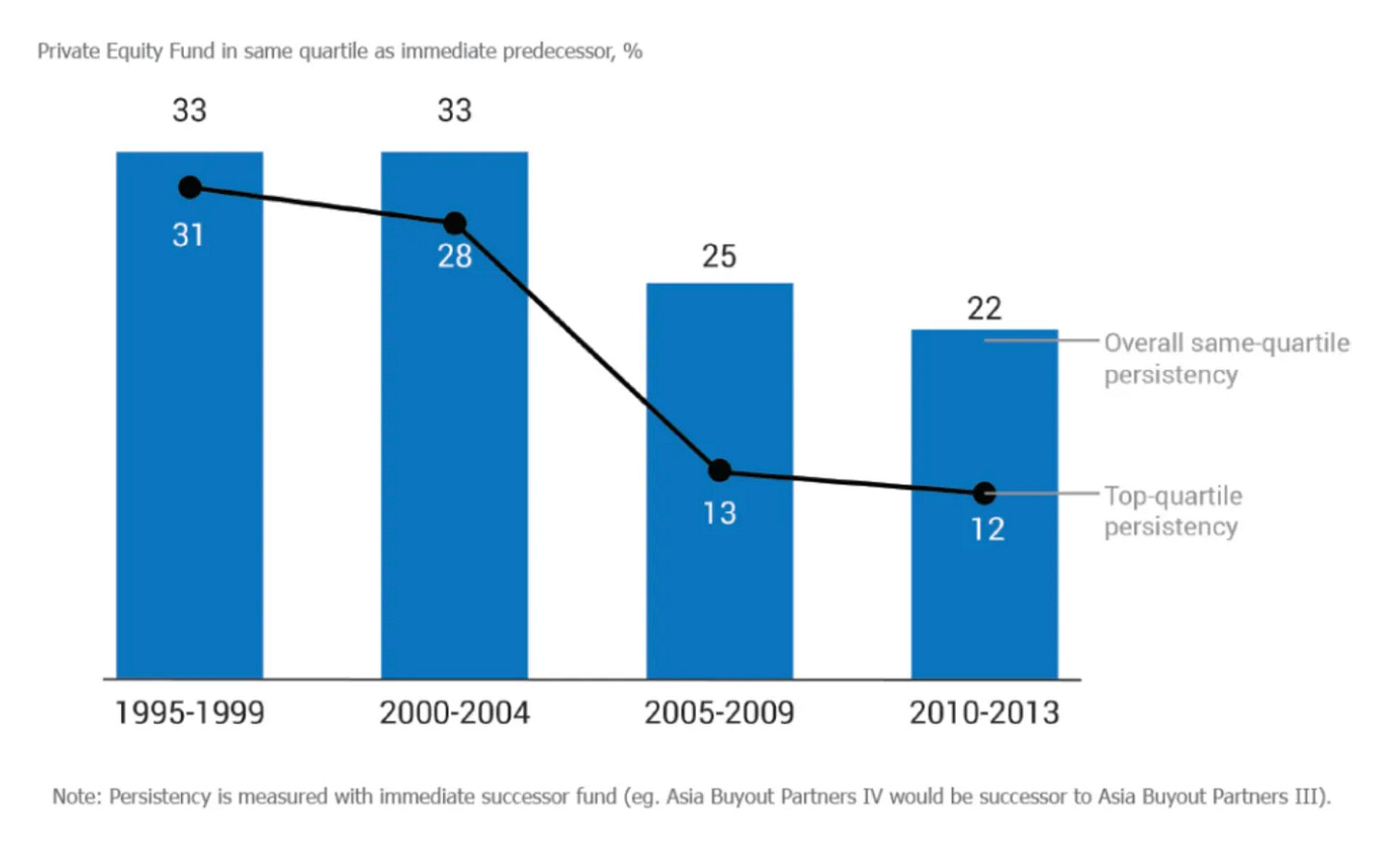

Jokes aside, to make things even more complicated, past performance is not a very reliable shortcut for evaluating fund managers.

So how do you actually select a manager?

You can find more on performance persistence here:

In today’s guest post, Romain Bégramian will break down how LPs can go beyond the pitch deck and buzzwords, and assess a GP’s operational value creation capabilities.

👉 You can download our companion Due Diligence Questions for LPs (PDF) at the end of this post.

About the author

Romain is a managing director at GP-Score, which he co founded with a retired LP and two former seasoned buyout executives.

He brings 25 years of operational experience, both as a performance improvement consultant for portfolio companies (AT Kearney, Alvarez&Marsal, FTI, and others) and as a Comex member in a PE-backed SaaS group. His functional area of expertise is B-to-B Sales and Marketing. You can email him at romain@gp-score.com, or find him on LinkedIn.

Invest in private equity? Start here:

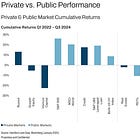

Allocators can’t afford to select GPs with the same frameworks they were using in 2018. Private Equity has become a different world altogether. We all know it: regardless of their past performance, many GPs will not deliver expected returns in the years ahead.

In this article we will explore a few ways LPs can make their due diligence on GPs more robust.

The new core criteria: operational value creation (OVC) capabilities

Past performance is a poor indicator of future performance, and poorer than it ever was. According to SipaMetrics, only about half of historically strong performers achieve similar results in their next fund. That’s the flip of a coin. Relying on track records leaves LPs vulnerable to chance.

Here’s why IRR is not a reliable metric (and the ways it can be gamed):

Because multiples can’t possibly get much higher, the only reliable source of alpha left to private equity lies in operational improvement.

This is why PE firms’ operational value creation capabilities (OVCC) has become the most reliable factor in their future performance. In other words: LPs need to select the PE firms that have built what it takes to operationally improve all kinds of portfolio companies.

The challenge is 99% of PE managers claim to have outstanding operational capabilities. They line up operating partners, show “playbooks”, slick business cases and value bridges. Yet none of this constitutes real evidence.

In order to go beyond marketing claims, differentiate GPs and identify the ones that have really done the hard work, LPs need to implement a more thorough strategy.

First of all, what does great OVC look like?

A GP’s ability to create value is not measured by the number of operating partners or the number of playbooks it presents. Of course it doesn’t hurt to line up resources. But there is plenty of anecdotal evidence showing PE firms with numerous Operating Partners which play little if any real role in value creation (and are more marketing props than anything else).

Conversely, it is a fact that several PE firms have consistently demonstrated strong operational impact with no Operating Partners.

So what does it take for PE managers to maximize chances they can deliver alpha in 2, 5, 7 years from now, with portfolio companies they don’t know they’ll buy?

The short answer is a fit-for-purpose approach.

If a portfolio company is delivering the plan, no significant risks loom, long-term investments in the product / service ensure that it remains attractive, then why should GPs do more than attend board meetings and ask smart questions? No need to be overbearing then. Just ensure management stays the course and have the resources they need to keep delivering.

When circumstances are different, then GPs need to lean more aggressively, challenge, support, advise, provide resources or ideas. A fit for purpose OVC approach implies selecting the appropriate functional areas, the most relevant actions, and the right GP-management interaction model.

Effective value creation depends on factors such as: