Inside Blackstone's Private Equity Strategies Fund (BXPE)

Layered private equity fund: the structure, the fees, and how the $$ is made

I have a high degree of conviction that very few people have ever dug into the financials of this fund (aside from the Big 4 associate tasked with preparing them).

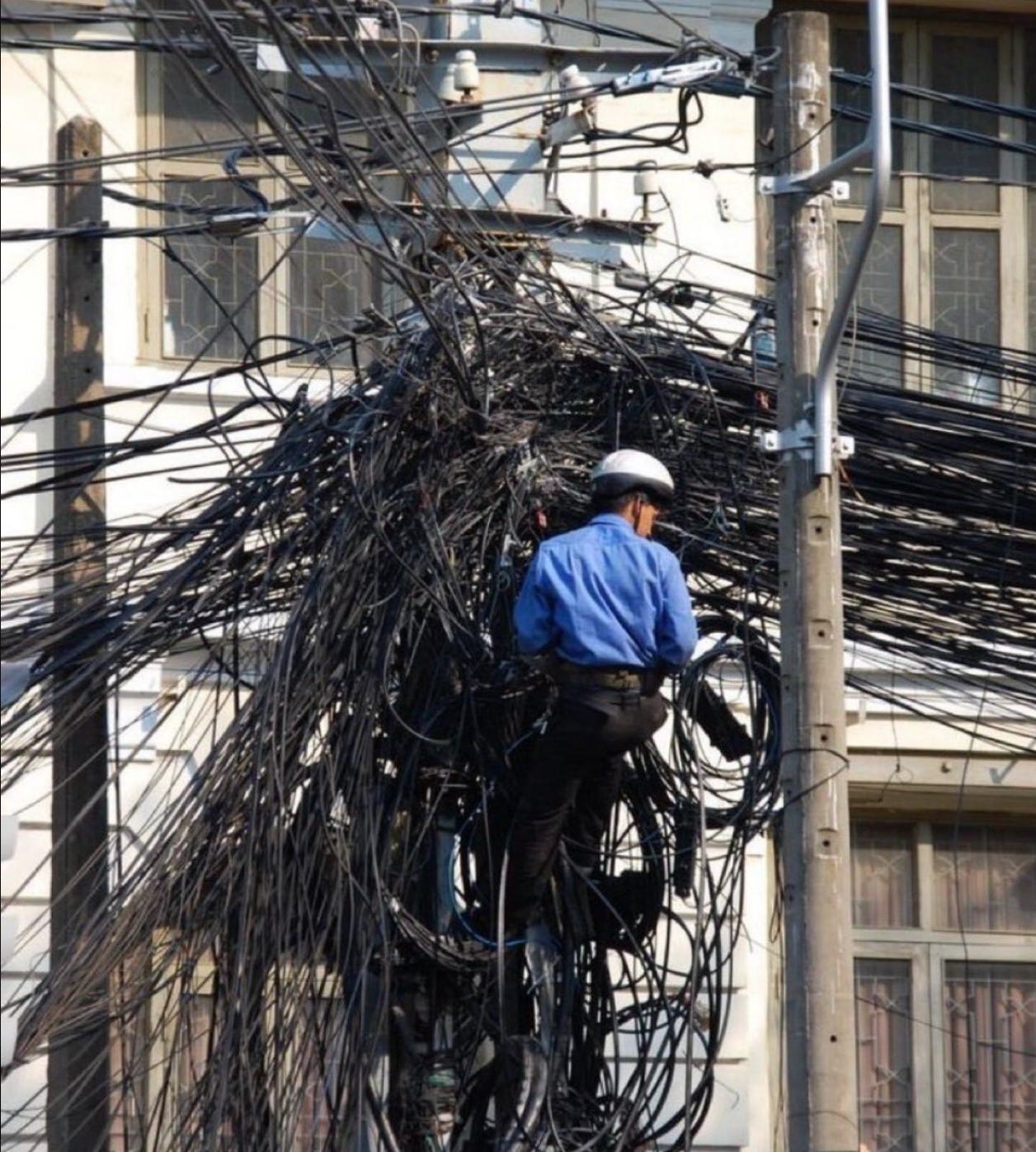

The image below sums up the first three hours of my experience going through said financials (for context, I am not an accountant):

This is not a criticism of BXPE, by the way. This is the nature of private markets: even 1940 Act funds are not all that transparent. Accounting rules don’t make the complex structure of the vehicle itself any easier to understand - and mere mortals give up on page 3 of the quarterly report (if they get that far).

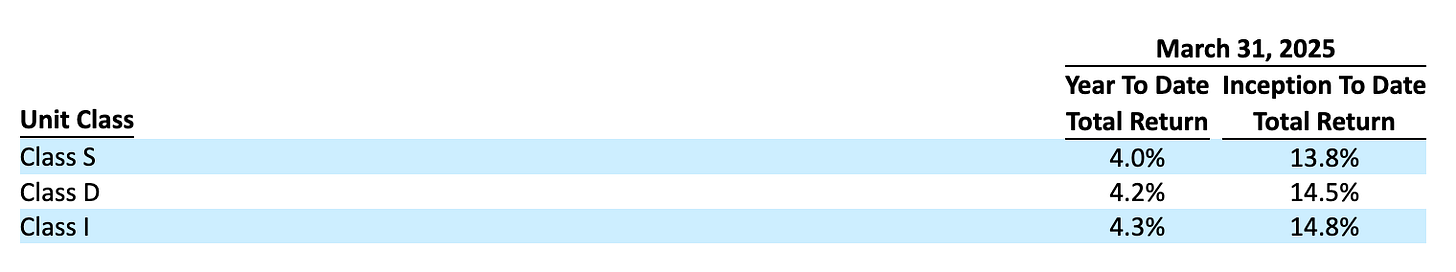

Not that any of it kept investors away: the fund raised $2 billion dollars in the first half of 2025. Returns help explain why:

For those who prefer to understand what you are investing into, this post will be an interesting case study in a layered vehicle. I’ll explain it simply, I promise.

If you invest in private markets, start here:

In today’s case study we will:

1️⃣ Break down the fund and fee structure

2️⃣ Examine what the fund holds

3️⃣ See how the fund generates returns

This would make a good comparison:

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author. All examples are illustrative in nature and not guarantees of future outcomes. Readers should conduct their own independent research and consult with qualified professionals before making any investment or financial decisions.

BXPE U.S. Structure

BXPE U.S. is a perpetual-life private equity fund available only to qualified purchasers (who are also accredited investors). Investors can subscribe monthly and have periodic opportunities to redeem units.

The fund allocates across Blackstone’s major private equity strategies, including Corporate Private Equity, Opportunistic, Growth, Life Sciences, and Secondaries. As of 3/31/25, Corporate Private Equity accounted for 69% of the portfolio, Opportunistic 23%, Growth 5%, and Secondaries just 4%.

Speaking of secondaries, here’s a case study:

Here is the flow of capital:

Certain tax-exempt and non-U.S. investors enter through a Feeder Fund

U.S. taxable investors who qualify enter through BXPE U.S.

Both vehicles then invest all of their capital into a Cayman Aggregator, which holds the portfolio assets

Investors → Feeder or BXPE U.S. → Aggregator → Private equity investmentsBlackstone controls the entire structure through its subsidiaries. The General Partner oversees fund governance. The Investment Manager executes the strategy and actively manages the investment portfolio.

So why create multiple layers instead of one simple fund?

This allows the fund to accommodate investors with different tax and regulatory needs, and avoid operational complexity by consolidating assets at the Aggregator level.

💸 BXPE U.S. Fee Structure

BXPE U.S. investors pay four main fees (there is only one layer of fees, at the Aggregator level):