How Private Markets Work

The ecosystem - and the engine that drives it

Behold the center of gravity in the private markets ecosystem:

No, it’s not a black hole (though it might look like one). This is your actual view into the engine that generates all the value stacked above it.

Since we are on the subject of private equity, start here:

The Invisible Engine

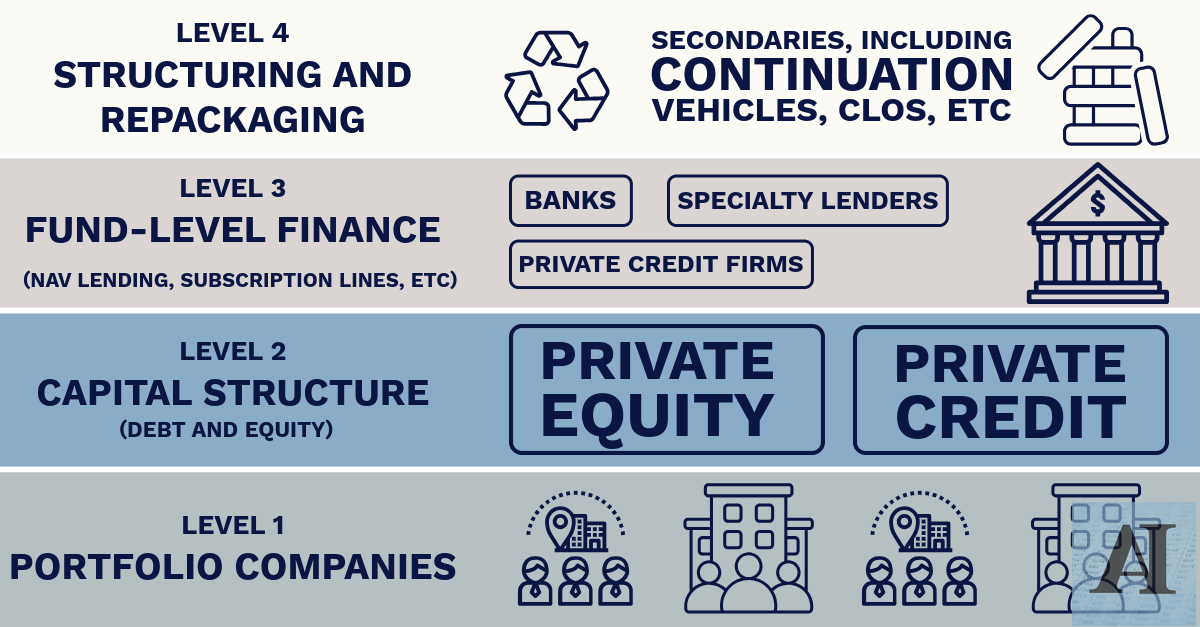

Nearly all the “magic” of private markets ultimately rests on one axis: portfolio company performance. There are many layers on top of the portfolio companies, but don’t get intimidated by the complexity or terminology. It’s the scaffolding. The real engine sits at the bottom.

Today, we’ll take a 40,000 foot view, so that you can see how all pieces fit together.

Why do you need to know this? Because seeing the whole picture will help you understand where the value is created. And you’ll start asking better questions about who’s extracting value (or compounding risk) in each layer.

One of our most popular articles on secondaries:

Layer 1: Portfolio Companies

Let’s start at the bottom, and work our way up. This layer is the engine that sells products and services, and generates tangible value.

What’s in this layer? Everything from boring HVAC businesses to $55 billion leveraged buyouts. The common denominator is ownership: these companies are privately held (and guess what? privately held companies don’t need to file financials with the SEC).

All cash flows from this layer filter upward through interest payments, dividends, refinancing, and exit proceeds.

🔎 What LPs actually see: Almost nothing 😬. Most LPs have minimal line-of-sight into company financials, leverage, or anything else that has to do with fundamental analysis (I know, I know - very old-fashioned of me). With large asset managers, LPs see IRRs and quarterly marks, but even that almost never on the company level.

Here’s an example of what’s reported by a PE fund:

Layer 2: Private Equity & Private Credit

The next layer is capital providers: equity owners and lenders.

Private Equity (PE)

PE funds acquire (or build) these companies, often with a hefty dose of debt to amplify returns. They aim to drive operational improvements, multiple expansion, and eventual exit (sale or IPO). Sale proceeds pay down the debt, and whatever is left flows to investors.

Here’s more on how private equity funds generate returns:

Private Credit (PC) / Direct Lending

Private credit funds lend to these portfolio companies, offering a variety of lending solutions (senior debt, mezzanine, etc.). They expect stable cash flows, covenant protection, and downside buffers.

Private credit is exposed to the same underlying companies as PE. If the business underperforms, both debt and equity take a hit (debt just gets paid first).

📍 Note: Most of these loans are not rated, or rated below investment grade (aka “junk”). That’s why regulated institutions like banks and insurance companies often can’t hold them.

So far simple enough, right? The next layer is where things get more interesting: