Inside Carlyle AlpInvest Private Markets Fund (CAPM)

What's inside, how the money is made, and what it'll cost ya

Remember continuation vehicles (CVs)?

(“Leyla, have you lost your marbles? You were just telling us about Carlyle AlpInvest.”)

Bear with me.

The reason CVs are back on the agenda is simple: Carlyle AlpInvest has four of them on its books. Yes, they represent only ~8% of total NAV, but the point is notable: retail investors now have exposure to continuation vehicles, a structure that was once the domain of institutional capital.

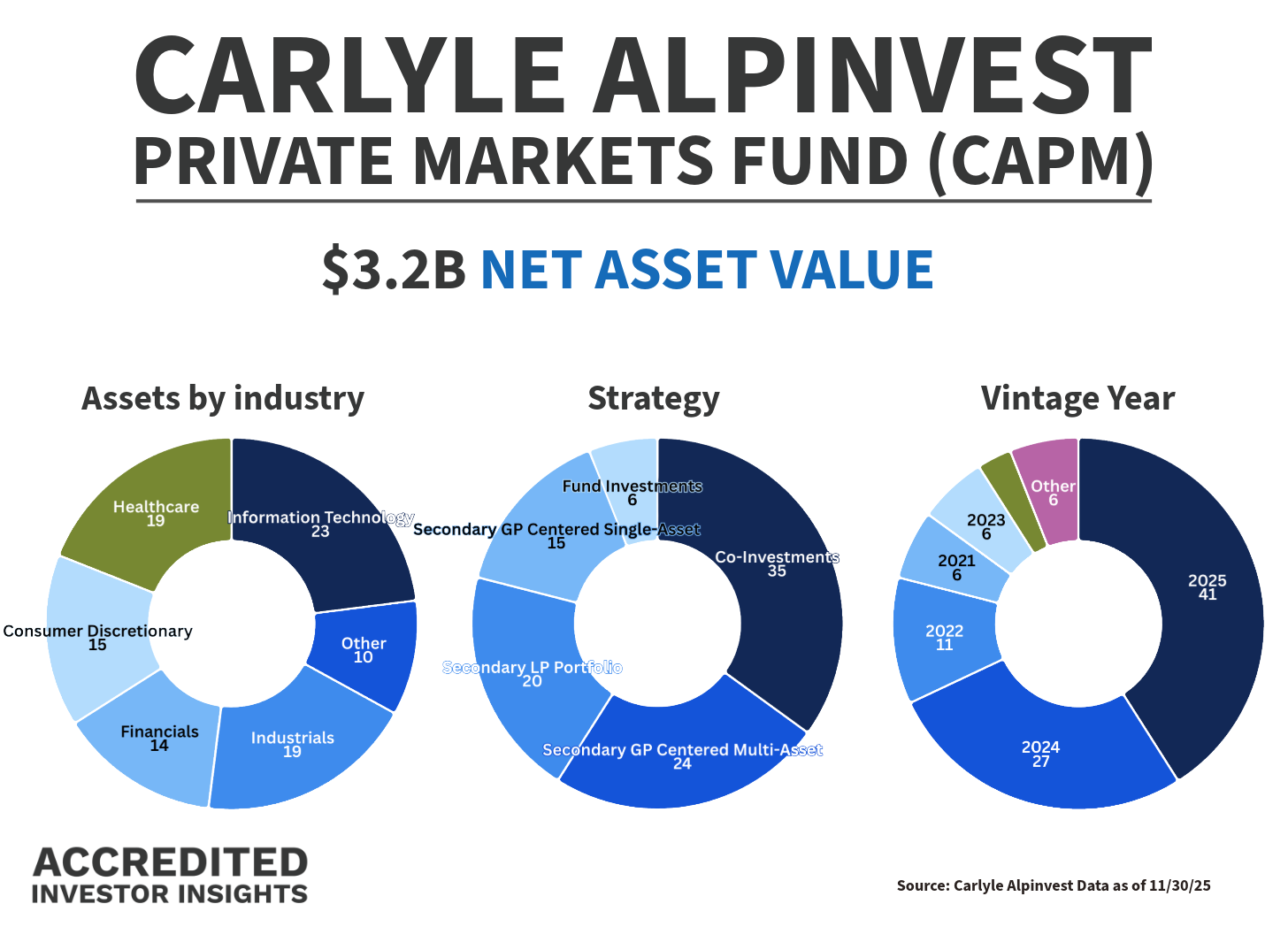

Today’s case study looks at another private equity evergreen fund, one that raised $1.2 billion in the six months ended September 30, 2025.

👉 If you missed the evergreen primer, I recommend reading it first:

In today’s case study we will:

1️⃣ Look at the fee structure

2️⃣ Dive into what’s actually in the fund (and how those assets are valued)

3️⃣ Explore how the fund generates returns

👉 Secondary funds are everywhere. Here’s what you need to know:

👉 And here’s what matters when it comes to pricing (and marks!) in secondaries:

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author. All examples are illustrative in nature and not guarantees of future outcomes. Readers should conduct their own independent research and consult with qualified professionals before making any investment or financial decisions.

The Pitch

The Carlyle AlpInvest Private Markets Fund (CAPM) is a 1940 Act, non-diversified, closed-end fund, formed in December 2021 and launched in January 2023.

AlpInvest Private Equity Investment Management serves as investment adviser and manages day-to-day operations. Carlyle Global Credit acts as sub-adviser, overseeing the liquid credit sleeve (primarily broadly syndicated loans). Both advisers are SEC-registered and wholly owned subsidiaries of Carlyle.

The fund’s objective is long-term capital appreciation. Under normal conditions, at least 80% of net assets (including leverage) are allocated to private markets, including:

Direct co-investments

Secondary purchases of fund interests and portfolio companies

Primary commitments to private equity funds

Select private credit investments

Purchase and Tender of Shares

Liquidity: periodic tender offers, typically quarterly, for up to 5% of net assets (subject to board approval). Early repurchases (<1 year) subject to a 2% penalty.

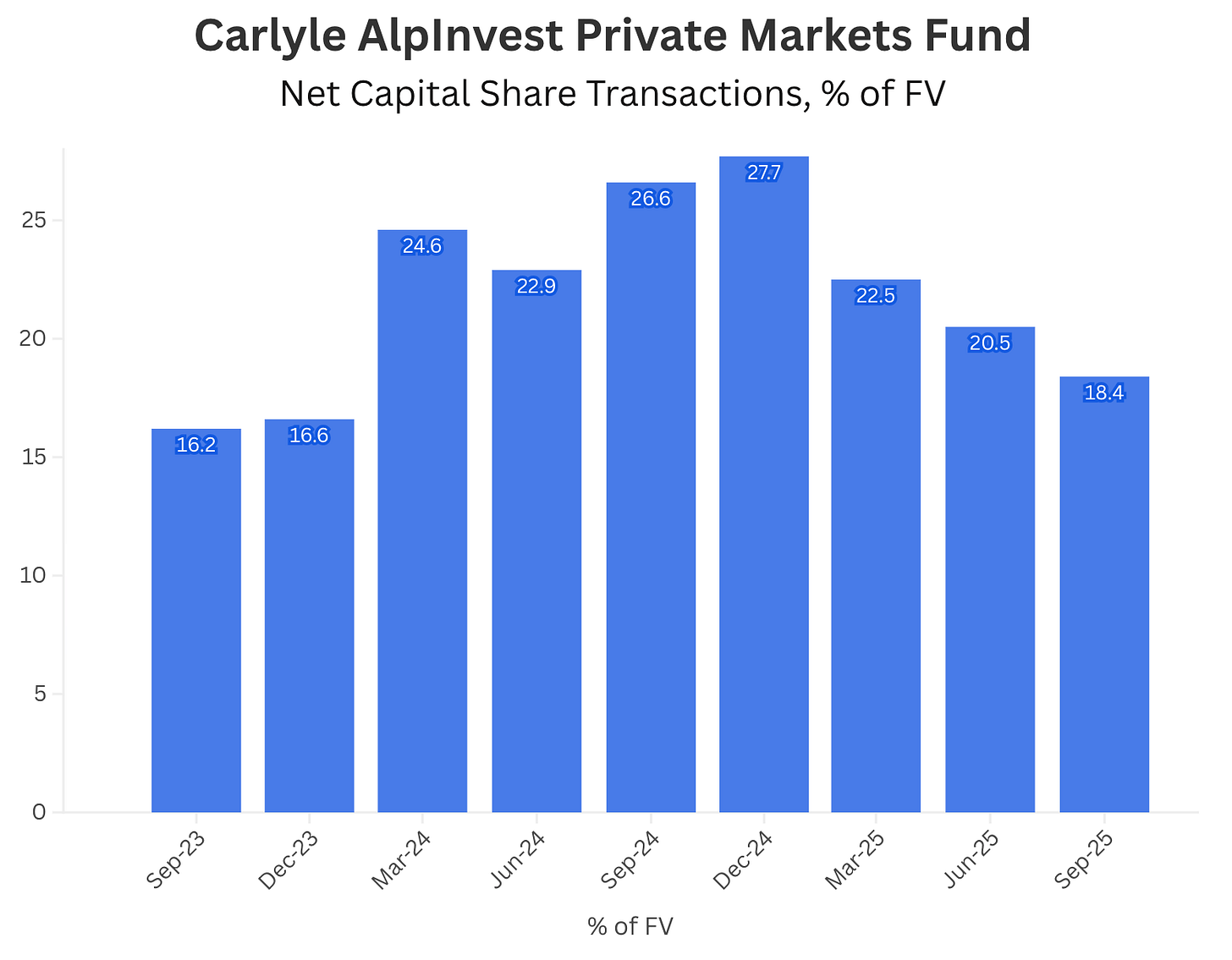

So far, fundraising is going really well:

Why?

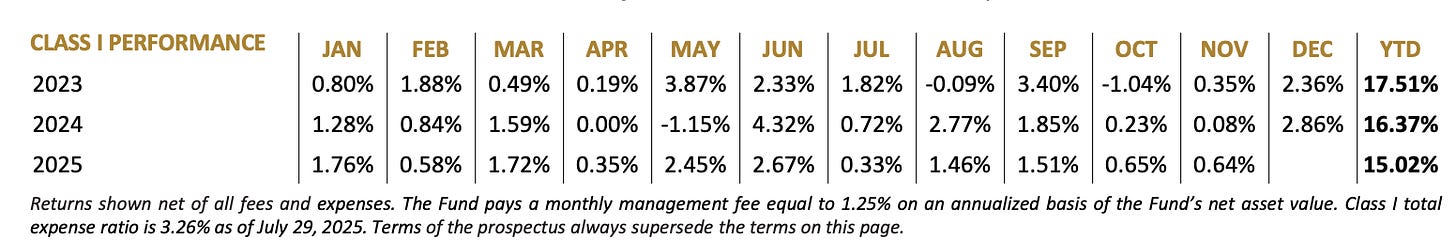

Because the fund is showing strong annualized returns (we’ll unpack where those returns are coming from in a moment).

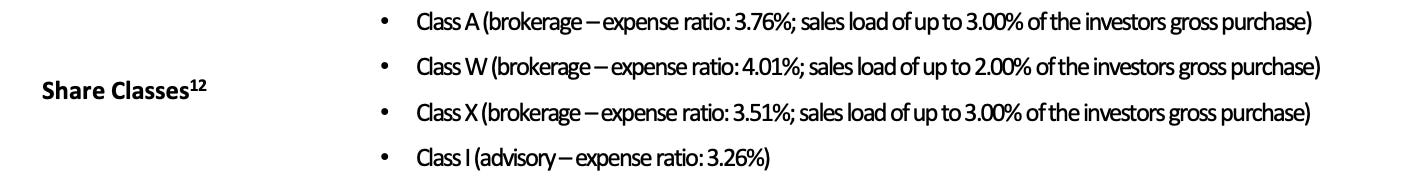

Expense ratios:

Fees

The fee structure is very similar to this fund:

1️⃣ Management Fee

1.25% annually, calculated on NAV

Calculated before deducting any fees or expenses (including management and incentive fees)

For the six months ended September 30, 2025:

👉 Management fees totaled ~$16.3 million

2️⃣ Incentive Fee

10% of net profits

Subject to a Loss Recovery Account

No clawback

No hurdle rate

❗️Two things I need you to pay close attention to: