No Smoke, No Mirrors: A Plain-Jane Multifamily Case Study

LP takeaways from a deal that could've been dressed up (but wasn't)

Today’s case study stands out because the deal is so very boring. This, folks, is a market beta deal for Sunbelt multifamily of a certain size (100+ units).

What’s remarkable here is that the GP has presented it honestly, without playing any games. But don’t worry, I’ll compensate for that by showing you how this could have been spruced up to look better on paper (without improving the outcome for LPs).

Here’s what we’ll cover:

✅ Underwriting on this deal

✅ Key assumptions and where they fall short

✅ How this GPs could have “enhanced” optics without improving performance

Before we dive in...

Accredited Insight gives you the LP’s perspective on private credit, private equity, and CRE—drawing on hundreds of deals reviewed and thousands of conversations with LPs, GPs, and service providers. Paid subscribers get access to 30+ case studies and our deep-dive series on reading a CRE proforma. If you’re a GP, this is your window into the allocator’s world.

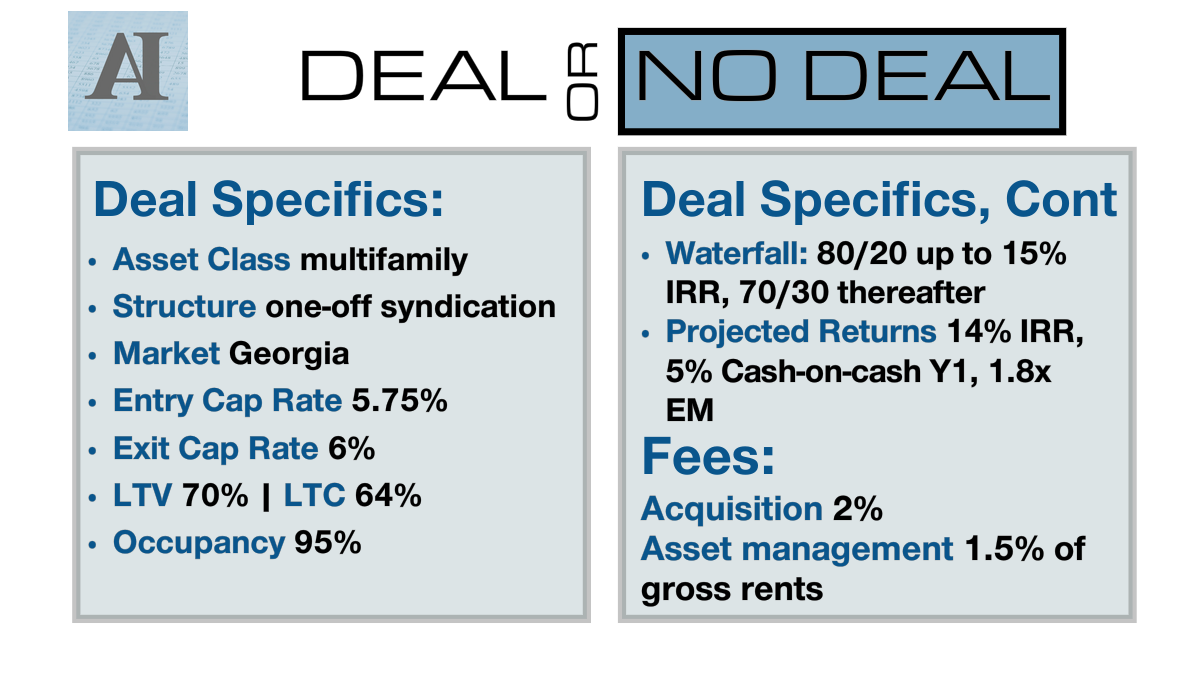

Deal or No Deal?

Disclosure: This case study is provided for educational and informational purposes only and should not be construed as investment, legal, tax, or financial advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of any affiliated organizations. All examples are illustrative in nature and not guarantees of future outcomes.

The Pitch

The property is a 300-unit multifamily built in 2001 and located in Georgia.

Business plan: “light value-add.” Roughly $10K per unit, with most of the renovation budget going toward exterior improvements (parking lot, roof repairs, landscaping, etc)

Most rent growth comes from burning off loss-to-lease (L2L), i.e. bringing existing rents up to what newer tenants already pay upon renewal. The L2L gap is about $100/month.

The deal includes a loan assumption (5.25% interest rate vs. a 5.75% acquisition cap rate).

Hold period: 6 years.

Refinance: Projected for year 3, returning 30% of capital.

Yellow-ish Flags

Let’s walk through what stands out.

1️⃣ Assumptions

On a six-year hold, the sponsor underwrote 25 bps of cap rate expansion.

That’s not very conservative. Ideally, you’d want to see at least10 bps per year (or ~60 bps over six years).

Yes, cap rates are a shot in the dark, and no one knows what they’ll be in 2031. But all else equal, you want deals that can handle higher cap rates on exit (because you need to worry about the downside, the upside will take care of itself).

👉 For more on cap rates, read this:

2️⃣ Fees:

They’re on the high end (not as egregious as some, but not LP-friendly either). That said, the investor-friendly waterfall helps offset it. GPs need to make money; otherwise, they wouldn’t be doing deals.

👉 What you, LP, need to think about is the incentive various fees/waterfall structures create.

3️⃣ Value-Add ROI

The value-add plan is what I’d call “skinny”. A $100/month rent lift on a $10K renovation budget equals roughly a 12% ROI on cost. To me, this is too low.

On true value-add deals, you want a more meaningful increase in yield on cost, because that’s what gives investors a margin of safety.

👉 More on yield on cost:

4️⃣ Refinance

Y’all know IRR is easily manipulated, right?

Ok, back to our deal at hand: showing an early refinance with a return of capital will increase IRR (but won’t necessarily increase equity multiple).

To be clear, there’s nothing wrong with a refinance. In fact, returning capital early de-risks a deal for LPs. But it’s important to understand how it affects reported returns: it increases IRR. (Thus, if you wanted to boost projected returns, you’d underwrite a nice big return of capital early in the life of the deal).

📌 If you see a deal with a projected refinance, start with these questions to gauge whether assumptions are reasonable:

What are the assumed loan terms at refinance?

What’s the LTV, DSCR, interest rate and assumed valuation cap rate?

How dependent is IRR on that refi actually happening?

Most importantly, ask the sponsor to stress-test various scenarios around refinance.

If you’ve been reading this newsletter, you know how much I value transparency. Invest Clearly helps LPs research sponsors and deals through verified investor reviews. If you’re investing in private real estate (or thinking about it), check it out.

(this is not sponsored: I genuinely think it’s a tool every LP should know about)

Games That Could’ve Been Played (But Weren’t)

I’ll give credit where it’s due: the GP didn’t enhance optics to make this deal look better than it is.

But (for educational purposes only) here are the three most common ways it’s done:

1. Use More Aggressive Assumptions.

The easiest lever to pull: lower the exit cap rate, or assume more capital is returned at refinance. LPs, ALWAYS stress-test assumptions.

👉 Here’s how to do it with AI:

2. Create Two Classes of Equity.

Less common today, but still around: Class A (preferred equity) and Class B (subordinated). Class A gets a fixed priority return, while Class B takes the upside risk.

3. Over-Subscribe the Deal, and Pay Investors from Reserves.

This one boosts ongoing cash-on-cash yield, making the deal more appealing to investors who are looking for yield.

Terrible practice, in my opinion - but partly driven by investor demand (plenty of investors don’t care about the source of distributions).

Bottom Line

This deal is pretty standard for today’s market. The entry cap rate isn’t exciting, and there’s not much value-add to write home about. Positive leverage (cap rate > loan interest rate) helps a little, but it doesn’t transform the economics.

The GP could have spruced it up to look sexier on paper, but they didn’t. And for that, my fellow LPs, let’s raise a glass.

Not enough money in this deal. Not enough upside.

Also I used to be looking for lower management fees until I found that some of my best paying investments had high management fees. So if the sponsor has a history of charging higher management fees and getting results that justify the higher fees this is a buy indicator.

Over subscribe and pay from reserves?- sounds like a PONZI scheme...

This below from AI -

Oversubscription in private equity is not inherently illegal; it is a common indicator of high demand for a fund. It becomes illegal when it involves fraudulent or deceptive practices that violate securities laws and investor protection regulations.

Key situations in which oversubscription could become illegal include:

Misrepresentation and Lack of Transparency: If a private equity firm uses "incomplete or inaccurate information" about the fund's costs, potential returns, or capacity to "attract investment from outside investors," it could be considered a violation of transparency requirements and potentially fraud.

Charging for Unperformed Services or Undisclosed Fees: It is illegal for fund managers to "wrongfully charg[e] fees and expenses for unperformed services" or charge fees on a non-pro-rata basis without proper disclosure.

Undisclosed Preferential Treatment: Providing certain investors "preferential treatment" (e.g., better redemption terms or special access to information) without disclosing these arrangements to all other current and prospective investors can be a violation of regulatory rules designed to ensure fairness.

Violations of Fund Agreements: A fund must adhere to the terms and conditions outlined in its offering documents (e.g., private placement memorandum or limited partnership agreement). Raising capital beyond the stated maximum capacity without proper investor consent and amendments could violate contractual obligations and potentially be illegal.

Breaching Securities Laws: All offers and sales of securities, including those by private companies, must be either registered with the SEC or conducted under an exemption from registration. Failure to comply with these rules (e.g., rules under Regulation D) when managing oversubscription could lead to legal penalties.

Broker Misconduct: A broker convincing investors to invest in overly risky private placement offerings that are unsuitable for them may face regulatory action, such as a settlement with the Financial Industry Regulatory Authority (FINRA).

In general, the key is the manager's adherence to regulatory requirements for disclosure, transparency, and fair dealing with investors. Failure to do so, especially in the context of high demand, is where the practice crosses into illegality

Really solid analysis Leyla. I wouldn’t invest in this deal. Georgia is terrible with evictions right now.