Private Credit Secondaries: A Primer

How they work, LP-led vs GP-led, and what you need to watch

The time has come - I need to tell you about private credit secondaries.

You may have seen the headlines:

Ares raised $7.1 billion for credit secondaries

PGIM plans to deploy $1 billion into private credit secondaries over the next two years

And just hours ago, the largest private credit continuation vehicle to date was announced: Crescent Capital secured a $3.2 billion CV.

To rephrase Senator Dirksen, $7 billion here, $3 billion there, and pretty soon we’re talking real money.

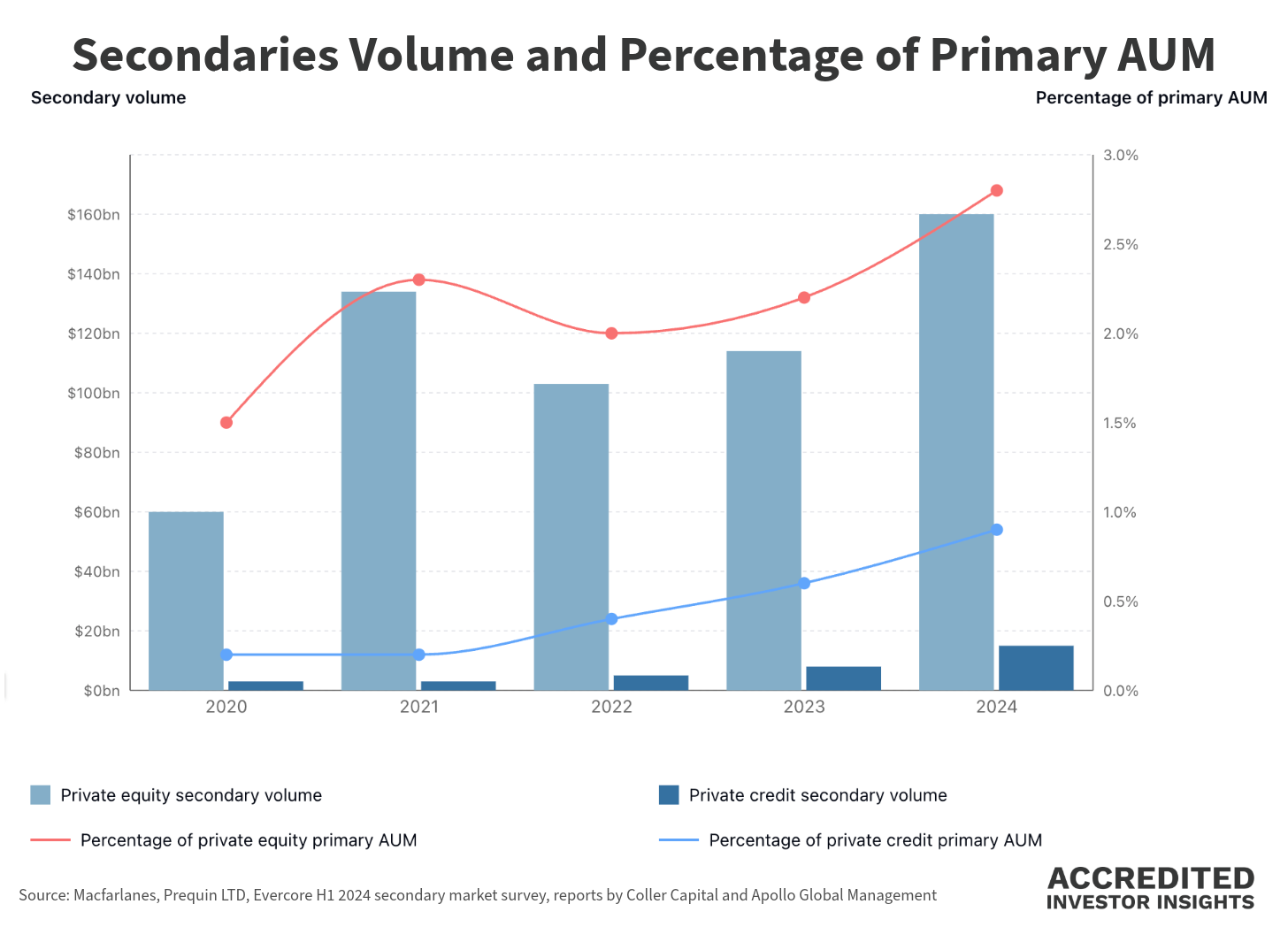

As private credit AUM has scaled into the trillions, - while liquidity across private assets has slowed, - secondary transactions (both LP-led and GP-led) are emerging as a pressure release valve. The growth of evergreen private credit vehicles adds fuel to the fire: these vehicles need immediate deployment, and secondaries provide it.

Today, we’ll cover:

✅ How private credit secondaries work (and the advantages for you, LP)

✅ The difference between LP-led and GP-led transactions

✅ And why continuation vehicles in credit warrant extra scrutiny 🧐

📚 additional reading at the bottom of the post

👉 More on secondaries:

And here are some examples of funds that invest in secondaries in other asset classes:

🔎 What Are Private Credit Secondaries?

Private credit secondary funds raise capital to purchase existing positions in private credit funds and portfolios rather than making new loans directly (i.e., they buy into “seasoned” assets mid‑life).

These transactions can occur at multiple levels of the capital stack and across a range of structures, including:

LP interests in private credit funds

Direct portfolios of loans acquired from funds, banks, or institutional holders

GP-led continuation vehicles

Fund-level liquidity and financing solutions, such as NAV loans, preferred equity, and structured vehicles

Unlike primary private credit commitments (where LPs face blind-pool risk, delayed deployment, and a J-curve), secondary buyers enter portfolios that are already invested, cash-flowing, and at least partially de-risked (or so go the selling points).

That said, not all secondaries are created equal: