Private Markets in 2026: What Changes, What Sticks

Trends shaping private equity, private credit, and commercial real estate

Happy Sunday. As we close out 2025, I want to take a brief detour and share top trends for 2026 in private equity, private credit, and commercial real estate.

Quick note: if you’re hoping for macro predictions, this ain’t it.

I’m firmly in the Galbraith camp: “the only function of economic forecasting is to make astrology look respectable“. If forecasts actually worked, economists would be the richest people on the planet (they aren’t).

What follows is a recap of trends already in motion: capital flows, fund structures, and pressure points that have been building over the past few years and are likely to persist into 2026.

Less 🔮 crystal ball, more pattern recognition..

Before we jump in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. We are committed to remaining an independent voice in private markets, with a focus on education, risk awareness, and clear-eyed analysis.

Private Equity: Mega Funds, Secondaries and Tailwinds

⌛️ What happened (2023–2025)

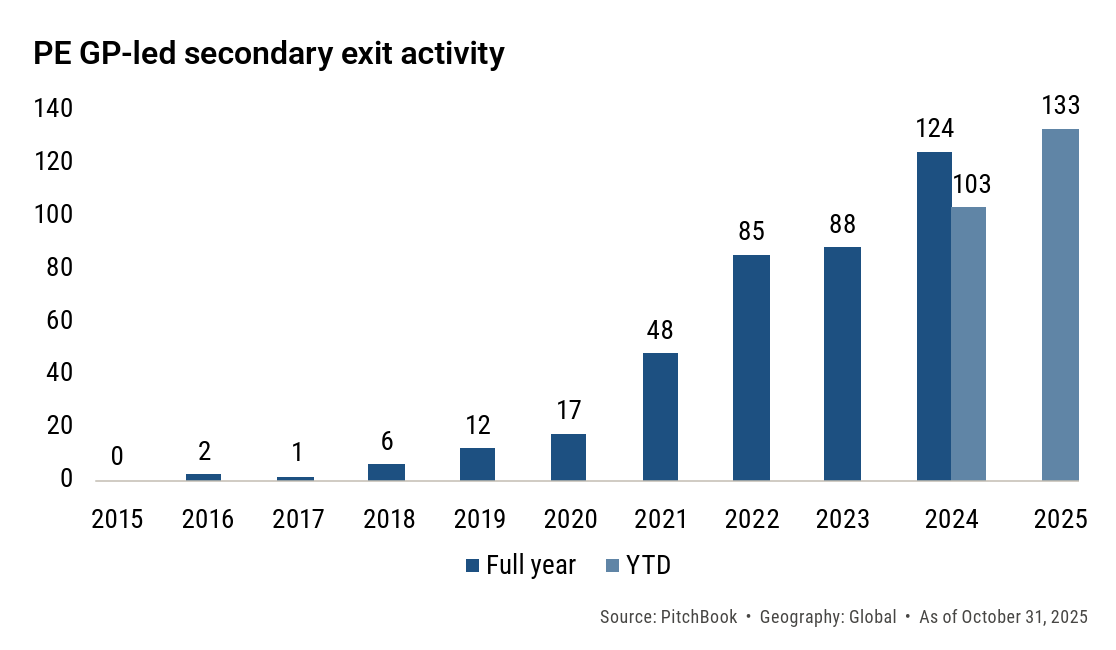

➡️ As traditional exit routes stalled, continuation vehicles became the pressure valve for private equity GPs. With IPO windows effectively shut and M&A (mergers and acquisitions) activity slowed, sponsors leaned heavily on GP-led secondaries to generate liquidity to existing LPs and manage aging funds.

♲ Read the primer on Continuation Vehicles here:

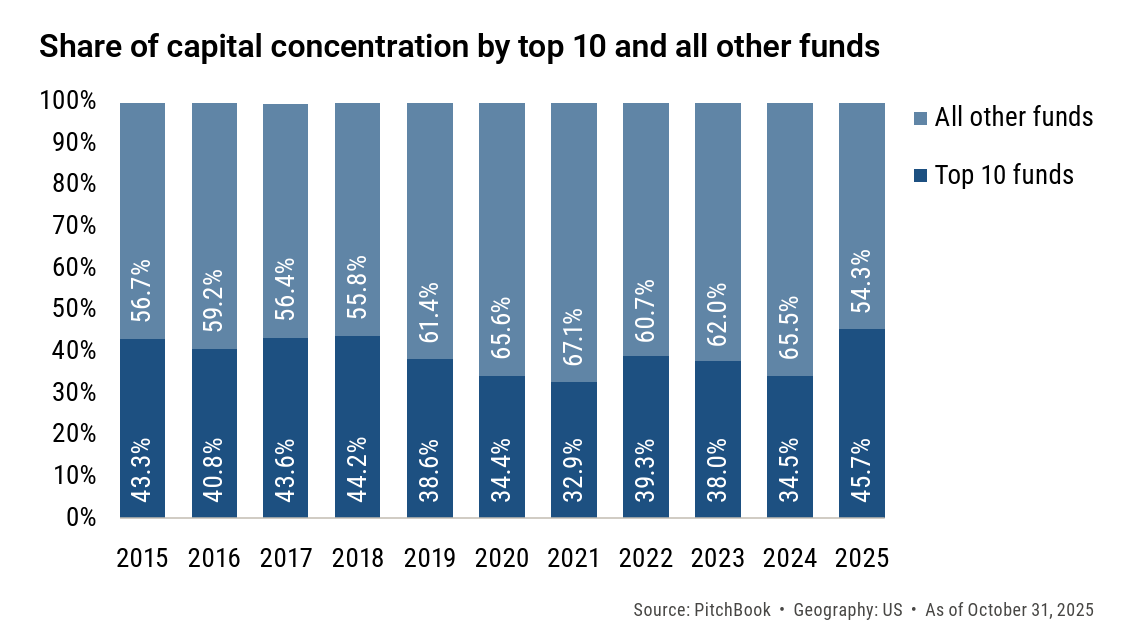

➡️ At the same time, fundraising became increasingly bifurcated. Capital consolidated at the top end of the market, while much of the mid-market struggled to raise at target.

By 2025, the top 10 PE funds captured 45.7% of all capital raised, up from 34.5% in 2024, even as total capital raised across the asset class declined.

What’s changing heading into 2026

PitchBook is making a notable call: continuation fund–related exits are likely to decline in 2026, falling from their 2025 peak. And not because demand is reduced, but because alternatives are improving.

According to HSBC’s Q1 2026 private markets outlook:

Rate cuts are easing financing costs, improving buyout and refinancing economics

IPO markets are reopening, particularly in technology and healthcare

Bid-ask spreads between sponsors are narrowing, enabling more traditional sponsor-to-sponsor exits

In short, what were once headwinds have turned into functional tailwinds, reducing the need to rely on GP-led secondaries as the default exit mechanism.

That said, fundraising dynamics remain uneven. Mega-funds continue to raise, while smaller and first-time managers face a materially tougher environment.

LPs, I’ve said this before, will say it again: due diligence on fund managers matters

Private Credit

What happened (2022–2025)

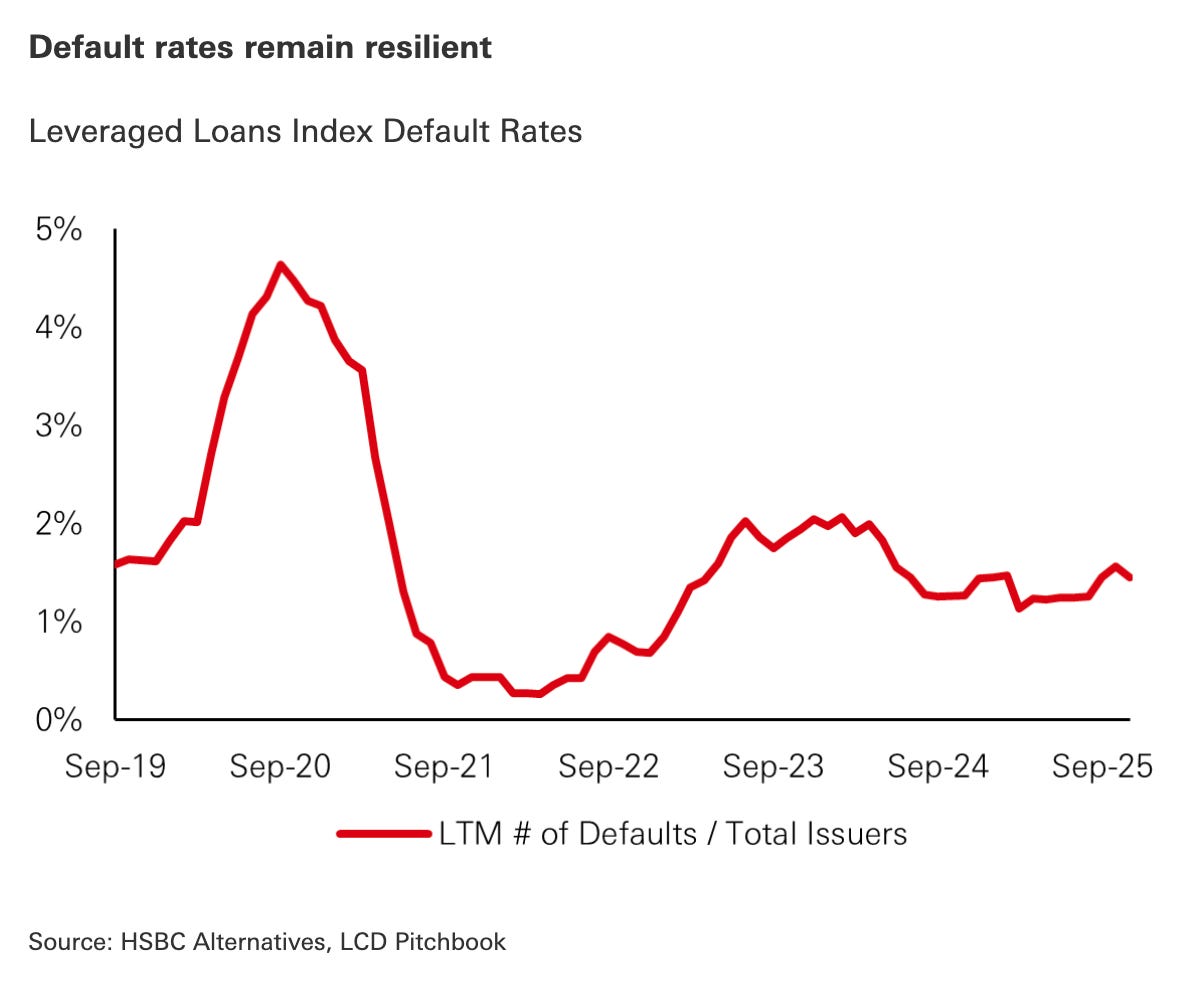

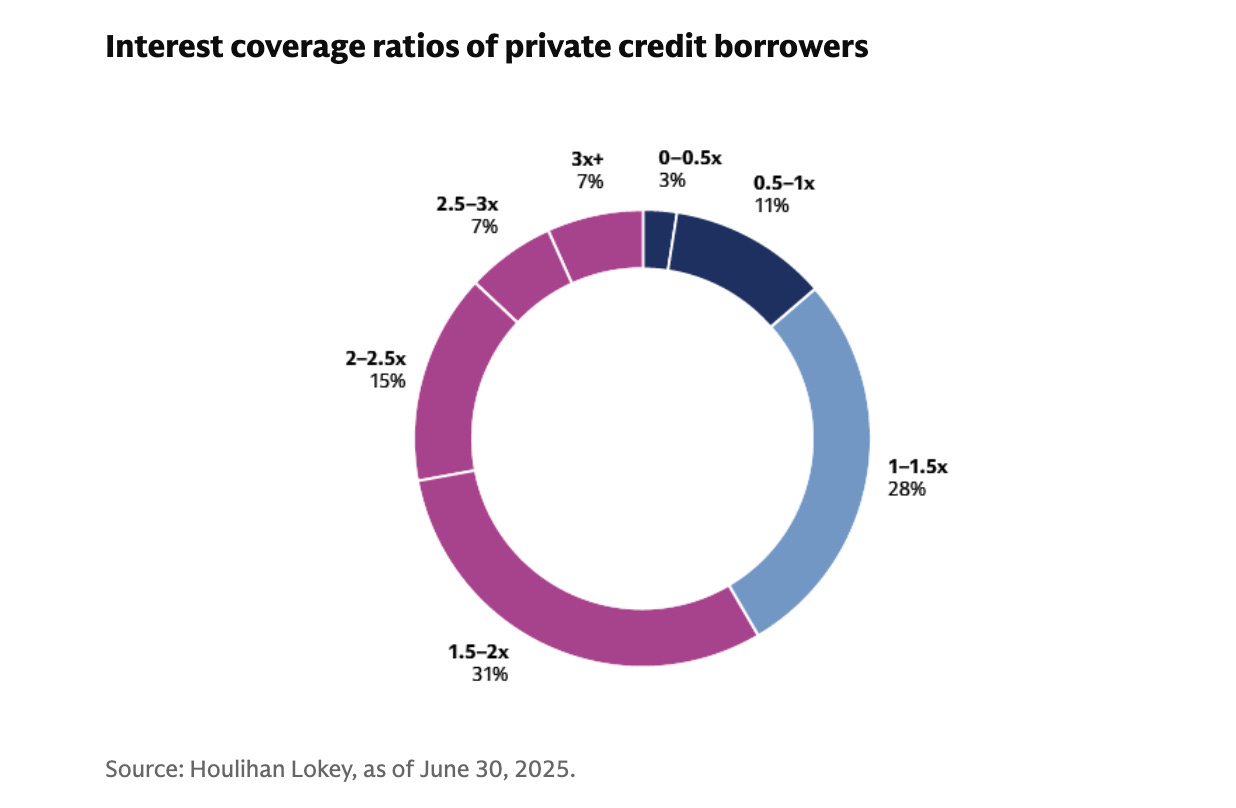

Despite higher rates, defaults in private credit have remained surprisingly muted. Strong aggregate borrower fundamentals and refinancings have extended maturities and kept problems contained.

According to Goldman Sachs, average interest coverage actually improved over the past year.

But the averages hide dispersion.

❗️Roughly 14% of private credit borrowers are not generating enough EBITDA to cover interest, and this is where risk is concentrating.

What’s changing heading into 2026

Rate cuts help, but only at the margin.

Lower base rates provide breathing room for borrowers near breakeven, but they won’t magically fix everything. A borrower at ~0.9x coverage may get back to 1.0x; one materially below that still needs an operational turnaround or new capital.

💣 The 2021 vintage remains the fault line.

Loans originated just before rates surged absorbed the biggest shock. As Goldman Sachs puts it:

“A deal underwritten at ~5.5x EBITDA faced a dramatic jump in interest expense as rates reset—often with no time for EBITDA growth to offset it.”

Many of these borrowers bought time through refinancings or PIK interest. Today, roughly 10% of private credit loans include PIK, and more than half of those were added after underwriting (Lincoln International calls it “bad PIK”). GS calls this out as a signal.

👉 On PIK, and how to screen new PIK in financials:

Maturity is the real stress test.

Even borrowers that look fine today face risk at refinance. Coverage above 1.5x provides meaningful cushion. The problem sits in the middle: borrowers around 1.0x coverage often have limited valuation buffer and will require recaps, hybrid capital, or fresh equity to reset the stack.

Meanwhile, spreads continue to compress

(all that capital is competing for the same deals):

Competition with the broadly syndicated loan (BSL) market has pushed pricing tighter. According to HSBC, In the U.S., S+450 to S+475 is now common, and nearly half of buyout financings price below S+500. Direct lenders captured roughly $37B from the BSL market this year (Bloomberg).

📌 Evergreen funds: know what you own

LPs in evergreen vehicles need to understand the legacy portfolio: some 2021-vintage loans may remain on the books. Diligent underwriting and manager selection are more critical than ever. From GS: “All else equal, lower exposure to 2021 is a meaningful risk mitigant.”

And while we are on the subject of evergreen funds, 5 of the top 10 posts we published this year are deep dives on evergreen vehicles.

Commercial Real Estate

What happened (2021–2024)

According to Markets Group, commercial real estate materially underperformed over the past cycle. Rising rates, falling values, and negative headlines drove sharp allocation pullbacks, even as prices began to stabilize in parts of the market by late 2024.

Importantly, capital didn’t leave because real estate stopped being useful. It left because losses were large, visible, and slow to resolve.

At the same time, the sector entered this phase with less new supply than prior cycles, particularly outside of office. This is the good news for this asset class, friends.

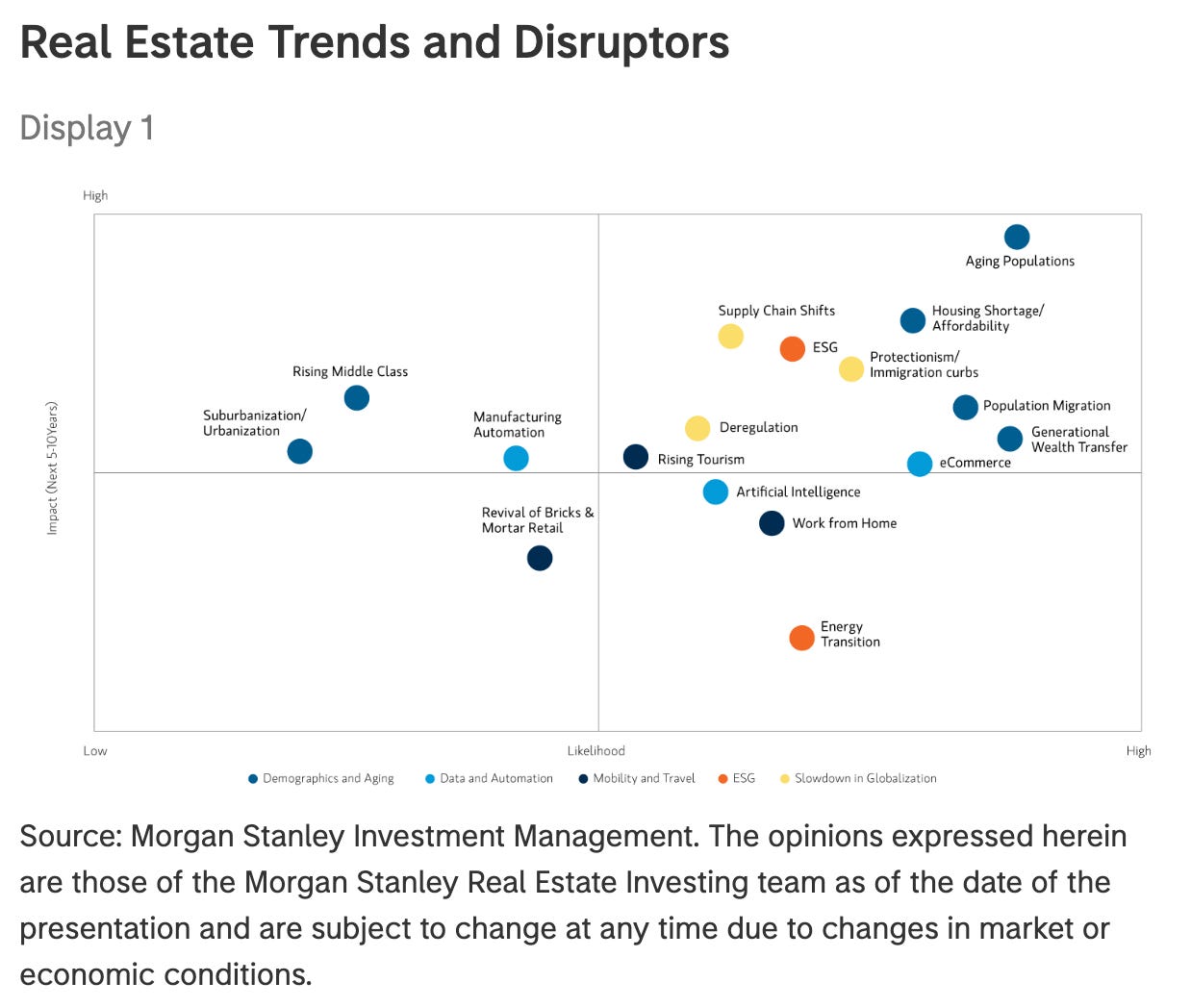

What’s changing heading into 2026

This cycle may be more durable than the last.

According to Morgan Stanley, muted new supply sets the stage for a longer, steadier recovery (provided investors focus on income).

Cash flow > cap rate compression.

The next leg of returns is likely to come from operating performance, not falling cap rates. Rent growth, expense control, and demand-supply mismatches matter far more than financial engineering.

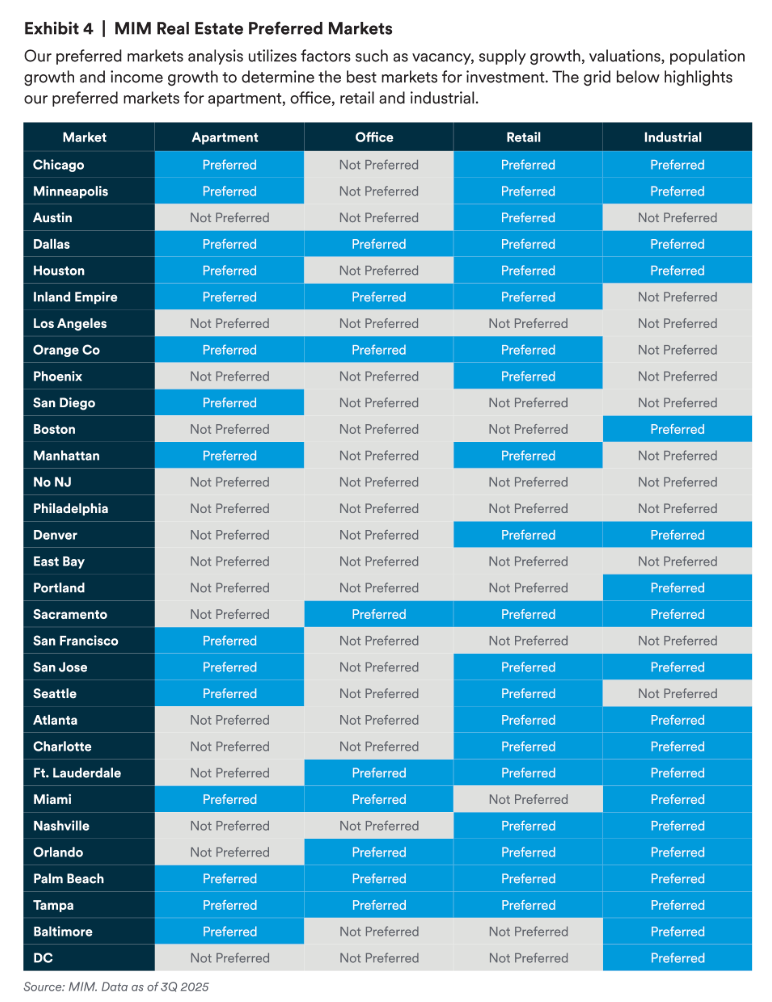

Dispersion is widening across sectors and geographies:

Residential: tailwinds from K-shaped income growth and demographic demand, particularly in select multifamily and senior living segments. That said, Sun Belt multifamily margins may remain compressed through late 2027.

Industrial: broad stability, but pricing differs sharply. Infill assets and constrained logistics nodes look fundamentally different from regional warehouses.

Office & Retail: still challenged, but increasingly mispriced in select markets. Risk remains, but blanket avoidance is no longer a strategy—granularity matters.

Data centers: valuations look stretched in places.

📌 Bottom line:

Commercial real estate in 2026 is less about timing a bottom and more about owning the right assets in the right places. LPs should prioritize managers who can execute at the property level, not those relying on macro tailwinds or cap rate miracles - we aren’t likely to see miracles any time soon.

Thank you for reading, and for your continued support. Wishing you and your loved ones a very happy and healthy 2026!

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

-Leyla