🗞️ Sunday Digest: Private Markets Insights 9/14

Risk on in credit, VC valuations climb, and capital is creeping back to CRE

Happy Sunday!

Here’s what caught my eye in private markets this week:

💳 Private Credit: lenders are taking on more risk again.

🚀 Venture Capital: deal activity is stabilizing, valuations keep climbing.

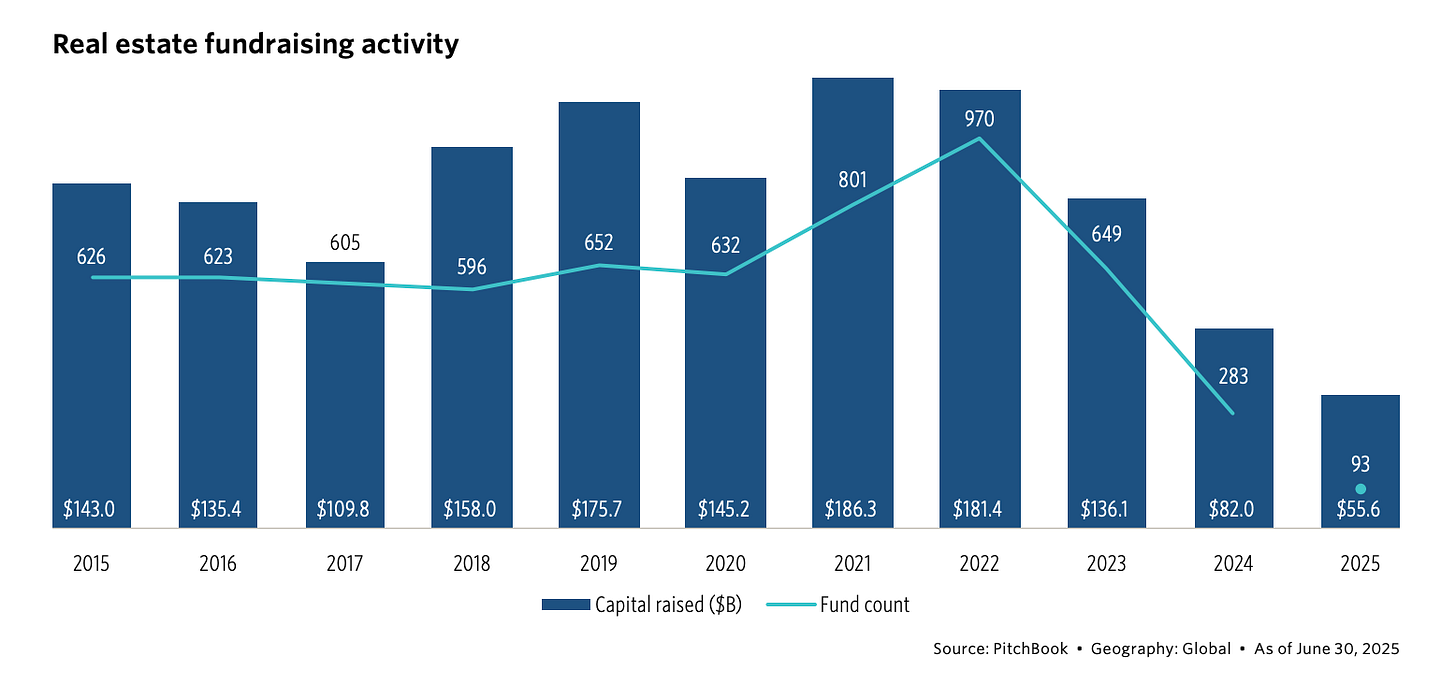

🏢 Real Estate: fundraising hit its lowest point since 2011 in 2024, but tide may have turned.

Chart of the day, folks:

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything you need to become a better investor. GPs, get a front-row look at how capital allocators think.

👉 $10/month or $100/year

💳 Private Credit – Proskauer Survey 2025

Proskauer’s annual survey of lenders across the US, UK, and Europe shows one thing clearly: risk appetite is back, with lenders voicing “strong signs of optimism for the coming year”

Invest in private credit? You’ll want to read this:

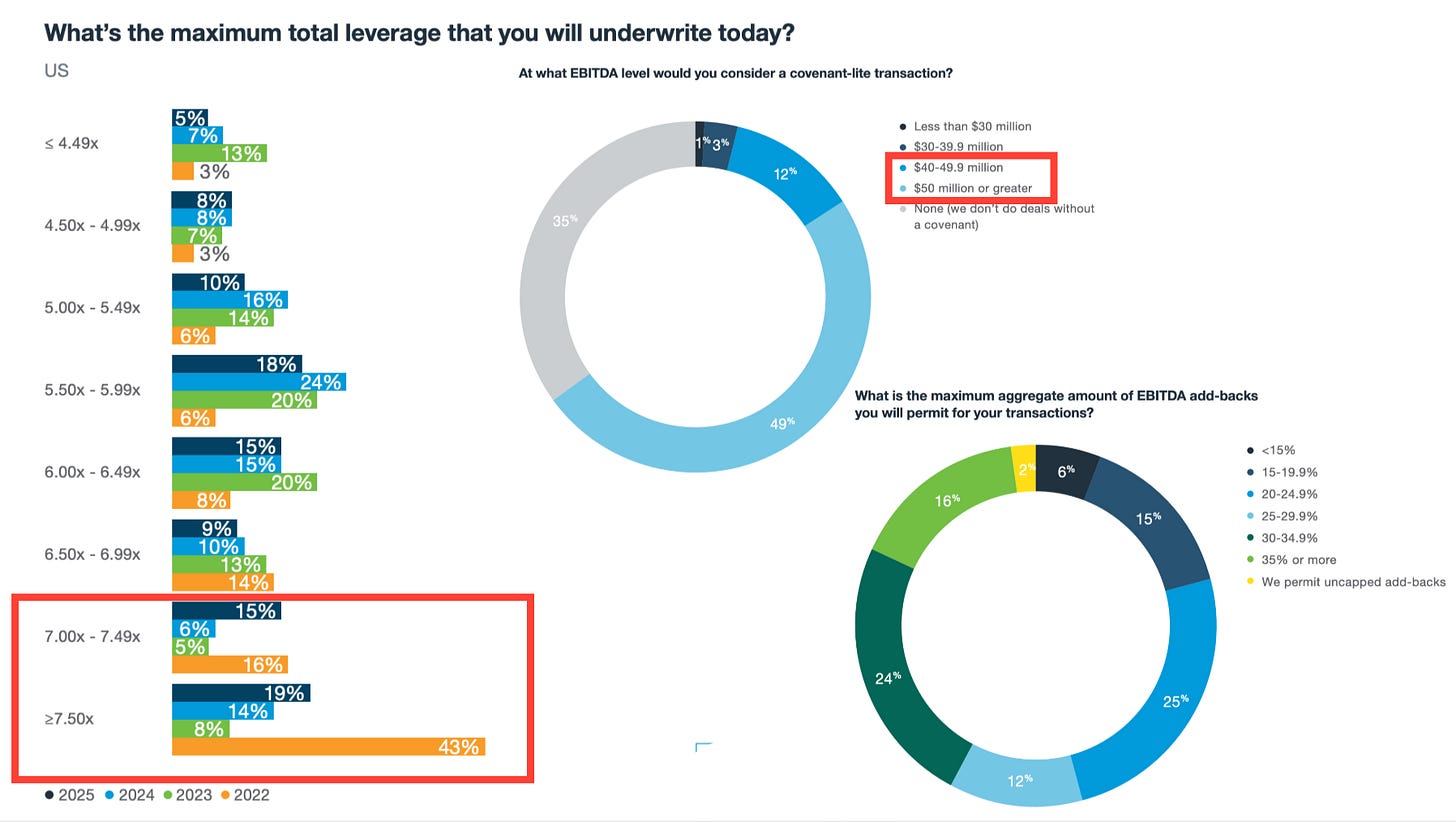

Leverage is creeping up – 36% of lenders now comfortable underwriting 7.0x+ deals (a sharp reversal from the post-2022 caution).

Speaking of leverage in private credit:

Covenants are getting lighter – only 35% of US lenders refuse covenant-lite transactions (down from 52% last year). Nearly half allow it for EBITDA >$50M.

EBITDA add-backs stretch further – just 2% still allow uncapped add-backs, but 54% now permit 25%+ caps, up from 38% in the last survey.

Check out this case study on BCRED and this one on Golub’s non-traded private credit fund, also read about PIK:

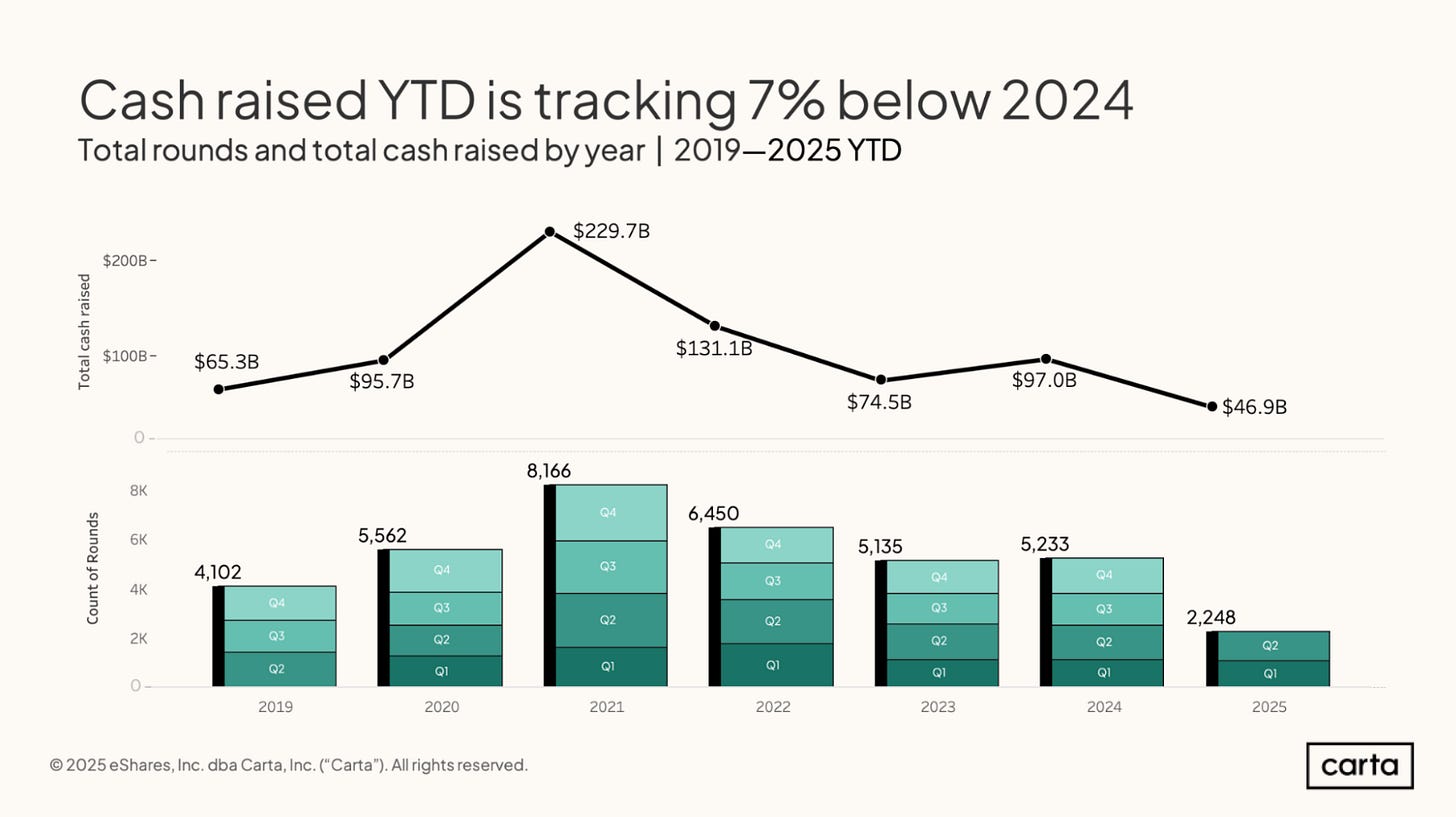

🚀 Venture Capital – Carta Q2 2025 Report

Excellent report from Carta on the state of venture capital (and let’s be honest: visually appealing reports are a joy to read.)

Rounds smaller, but steady – deal count up from Q1, though still down 13% YoY. Average Series A–D round size fell 3–9%.

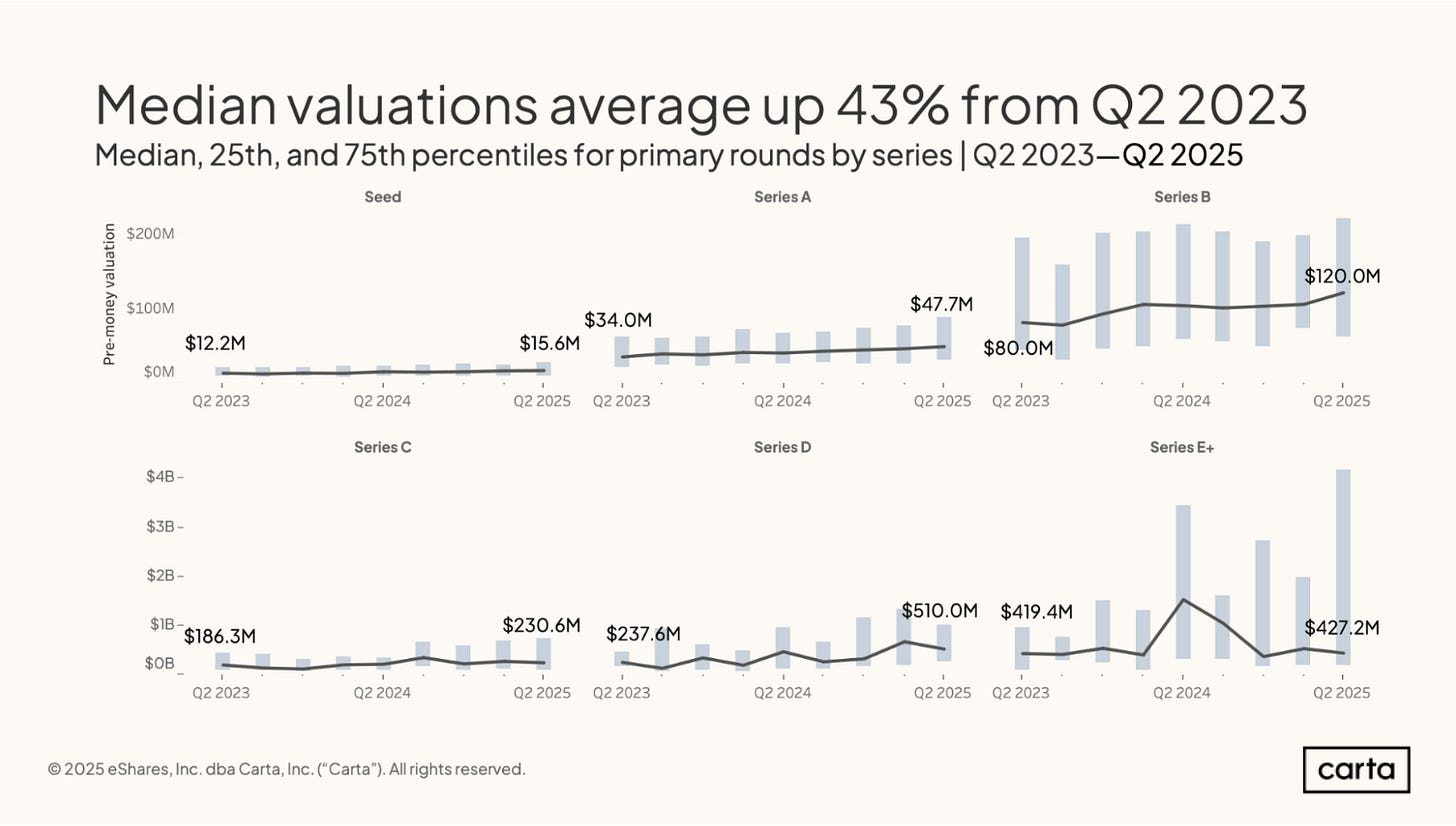

Valuations up – Series A medians jumped 20% YoY. Across all stages, medians are 43% higher than two years ago (Series D +115%).

AI drives sector divergence – SaaS (+91%) and hardware (+110%) have surged, while education (–89%) and energy (–85%) have cratered.

Protections tick up slightly – 14.5% of Q2 rounds included investor protections (still below 2019–22 averages).

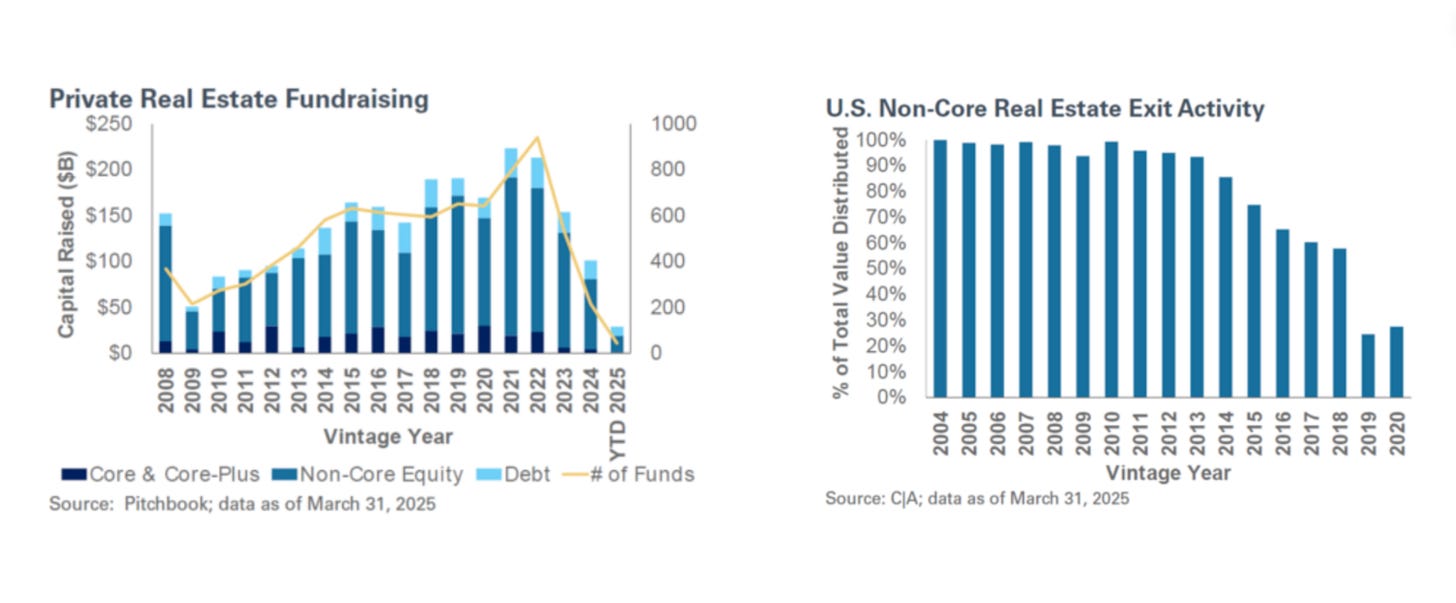

🏢 Real Estate – NEPC Private Markets Report

Signs of recovery, but with plenty of nuance across property types and strategies:

Trends & sectors

Alternative property types (student housing, senior housing, medical office) gaining traction.

Data centers: ~3% vacancy, fundraising oversubscribed. (Do we call a bubble yet?)

Office: surprisingly, transaction volume up ~70% YoY.

Liquidity & Fundraising

ODCE (open-end diversified core equity) redemption queues improving (13% of NAV vs. 18% peak).

Gross inflows back ($2B in Q1 2025), though net flows still negative.

2024 was weakest year for opportunistic/value-add fundraising since 2011 (~$100B).

Early 2025 slow, but momentum building.

Industrial still the only sector with sub-5% cap rates.

Invest in real estate? You’ll want to read this:

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading. If you have any questions or suggestions, just hit reply — I’d love to hear from you!

-Leyla

that Proskaer chart is interesting - looks like 2022 was pick leverage