🗞️ Sunday Digest: Private Markets Insights 8/31

CRE trends, private credit risks, and the discounts GPs would accept in private equity

Hope you having a great Labor Day weekend!

This week’s digest covers three areas:

📊 CRE: excellent report from Altus Group

👉 GPs: We’re running a short, anonymous survey on terms in your most recent raise. Participants will receive the full results once it closes.💳 Private Credit: JPMorgan’s latest analysis on risk and opportunity (and what it would take to trigger negative returns).

📈 Private Equity: EY highlights rising LP pressure (and pricing discounts GPs are willing to accept for liquidity).

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything you need to become a better investor. GPs, get a front-row look at how capital allocators think. Treat yourself this Labor Day 🎁

👉 $10/month or $100/year

📊 Commercial Real Estate: Q2 Snapshot

Excellent report from Altus Group on investment trends and transaction volume. Some highlights:

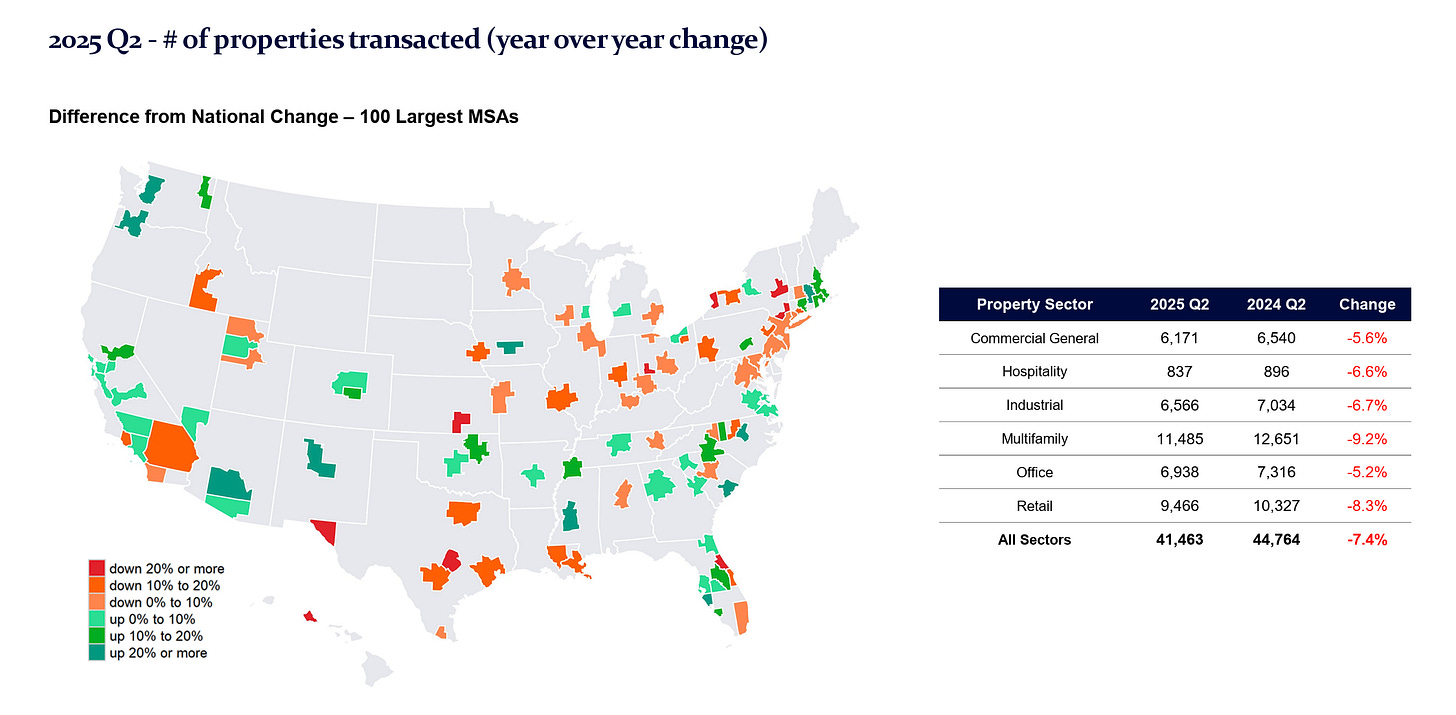

Transaction volume: $115B in Q2, up 3.8% YoY. Multifamily (+39.5%) and office (+11.8%) drove nearly half of all activity.

Markets: Coastal metros generally outperformed (with two notable exceptions: New York and San Francisco lagged national averages by as much as 10%).

Source: Altus Group Pricing trends:

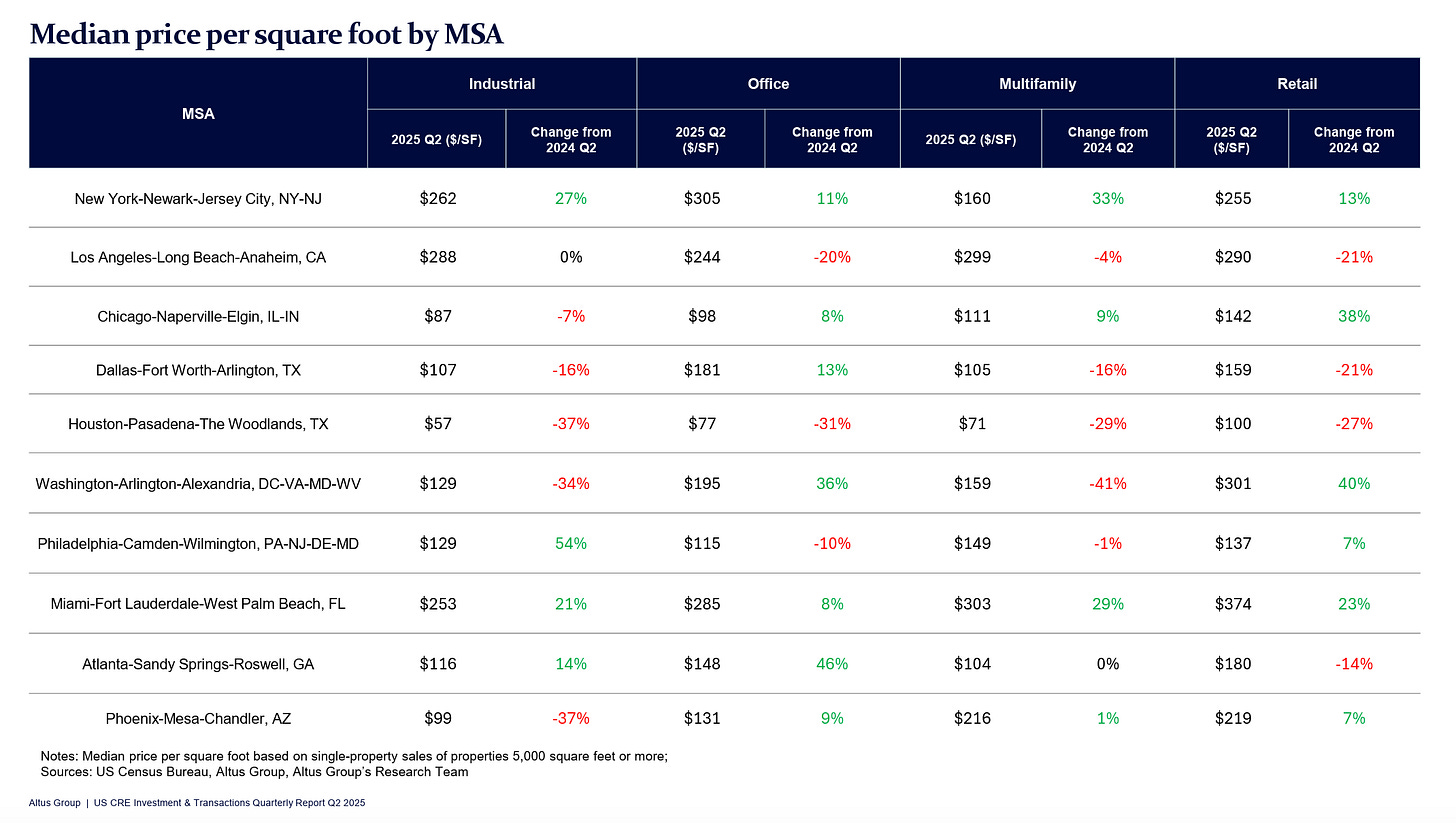

Median price per SF rose 5.0% QoQ and 13.9% YoY.

Biggest YoY gainers: multifamily (+18.8%), retail (+18.5%), general commercial (+17.1%), office (+15.3%), industrial (+10.4%).

Weak spot: Manufacturing was the lone sector in decline, down -3.3% QoQ and -14.6% YoY.

💳 Private Credit

Jamie Dimon has drawn headlines with his mixed messaging on private credit. On one hand he’s cautioning that the fast-growing, lightly regulated market hasn’t been tested by a major downturn, and if mismanaged, could be a “recipe for a financial crisis.”

On the other hand, JPMorgan has doubled down on this asset class, committing more than $50 billion to private credit, despite its own checkered history in the space.

Last month, the firm’s research desk published a note that reads a little bit like damage control reassurance. The key arguments:

Systemic risk fears are overstated. Private credit AUM at $1.2T is just 9% of all corporate borrowing - not large enough to threaten the broader economy.

To see negative total returns, we’d need a major economic downturn. With 10% starting yields and seniority, defaults would need to exceed 6% with recoveries <40% to produce negative returns. Current defaults: 2.4% in private credit, 1.5% in high yield bonds.

Check out this post about “selective” defaults in private credit, also read about PIK:

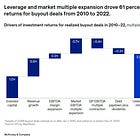

Sponsor selection is key (duh - sorry, couldn’t help myself). Private credit fundamentals trail public markets (coverage 2.1x vs. 3.9x; leverage 5.6x vs. 4.6x), but private credit has outperformed high yield by ~150 bps over the past decade. “As the market expands, manager dispersion is expected to increase, emphasizing the need for careful selection.”

❗️Question for readers: As an individual investor, how can you tell which mega-fund managers are more willing to take on riskier loans (or offer the most generous covenants)? Drop a comment below 💬

Invest in private credit? You’ll want to read this:

📈 Private Equity

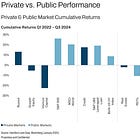

And finally, here’s an interesting tidbit from EY’s Private Equity Pulse.

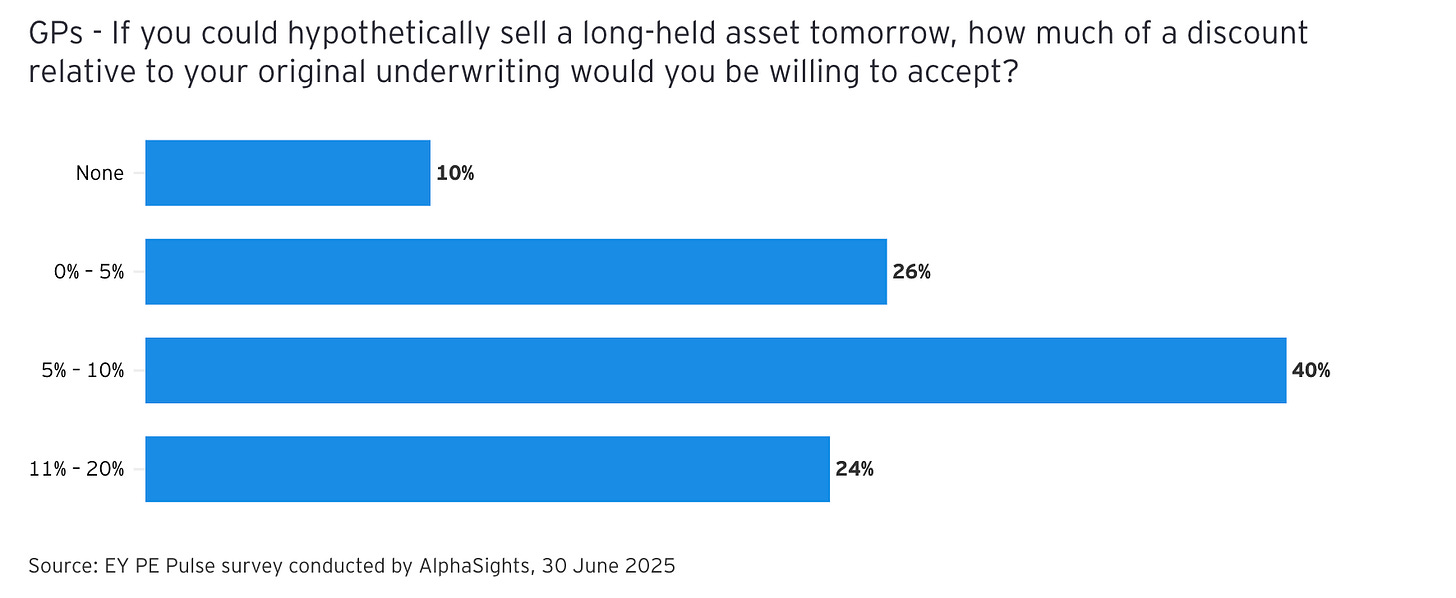

It’s no surprise PE firms are under growing pressure from LPs to sell older portfolio companies (many of which were acquired in the low-rate era at higher valuations).

👉 With over 30,000 assets waiting to be monetized (35% held for six years or more) funds are pushing toward liquidity as maturities approach.

In EY’s survey, 40% of General Partners said they’d accept a 5%–10% haircut for immediate liquidity, while nearly a quarter would take a 10%–20% discount.

Invest in private equity? Read this:

And this:

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading. If you have any questions or suggestions, just hit reply — I’d love to hear from you!

-Leyla

Watch the trending (several years by quarters) for watch list, default rates, PIK, cash coverage of dividends and compare them to the other top 50 BDCs (Cliffwater's data). Only invest in those that are historically and now in the top 20%

Hi we really enjoy reading your piece of work, we do similar articles for example, due diligence on single companies, investment 101s, and so much more. Here is a piece of our article, we are always open to discuss and learn from you!