🗞️ Sunday Digest: Private Markets Insights 6/29

What happens when underperformance gets packaged for scale?

Happy Sunday!

A few developments caught our eye this week:

📉 State Street’s fresh report on private market trends

🎥 A podcast you will find interesting

💼 BlackRock’s move to bring private assets into 401(k)s

Before we dive in, I wanted to share a chart I came across while writing this article on Hamilton Lane. The data runs through the end of 2023 - and spoiler alert: relative performance of private assets didn’t improve in 2024. (This digest includes a chart from FT that drives that point home).

Before we dive in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective through the LP lens. We cover private credit, private equity, and CRE investing, drawing on countless deals we’ve seen.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click below to choose your plan:

👉 $10/month or $100/year.

📊 State Street’s 2025 Private Markets Outlook

“The majority of respondents (55 percent) now believe that in as little as two years’ time, at least half, if not more, of private markets fundraising will come through semi-liquid retail-style vehicles, marketed to individual investors.”

State Street’s 2025 Private Markets Outlook draws on a global survey of nearly 500 senior buy-side investment professionals (your institutional LPs) revealing a major trend: fundraising is increasingly expected to come from retail investors, even as the rate of growth of institutional allocations to private markets is flatlining.

It worth noting, State Street itself is at the forefront of this shift, with its PRIV ETF bringing private credit exposure directly to individual investors (DEEP DIVE on $PRIV, anyone? - vote in the poll below)

Some highlights:

GPs see a wide blue ocean: the growing bullishness on democratization is being driven more by general partners (GPs) than by limited partners (LPs), with GPs especially anticipating parity or dominance of retail-style fundraising.

Flight to quality: institutional investors are moving from broad exposure to a stronger emphasis on due diligence, risk assessment, and high-quality deal selection—signaling a clear pivot from quantity to quality.

AI adoption: yours truly is not the only LP who is increasingly using AI. 83% of institutions see generative AI and LLMs as key to unlocking value from unstructured data, streamlining operations, and supporting better investment decisions.

Product innovation: the industry sees product innovation (oh, you know, things like ETF wrappers for illiquid assets) as the most important driver for expanding retail access, alongside regulatory changes and technology-driven improvements in data access.

🎥 Tokenizing the Future: Apollo’s Push for Private Asset Liquidity

Speaking of private asset access and liquidity, this podcast is a must-listen. Apollo, in collaboration with Securitize, is pioneering the tokenization of its first private credit fund across several blockchain protocols.

Their goal is to unlock daily, around-the-clock trading for private assets - addressing the surging demand from wealth clients for private market access and paving the way for a more liquid, transparent private investment landscape.

The irony is not lost on me: after spending years convincing investors that illiquidity was a feature, not a bug, some of the brightest minds in finance are now racing to make those same assets liquid.

🎯 BlackRock's Target-Date Fund with Private Assets

And another contender enters the race: BlackRock has unveiled a new 401(k)-eligible target-date fund that will direct up to 20% of younger participants’ allocations into private equity and private credit.

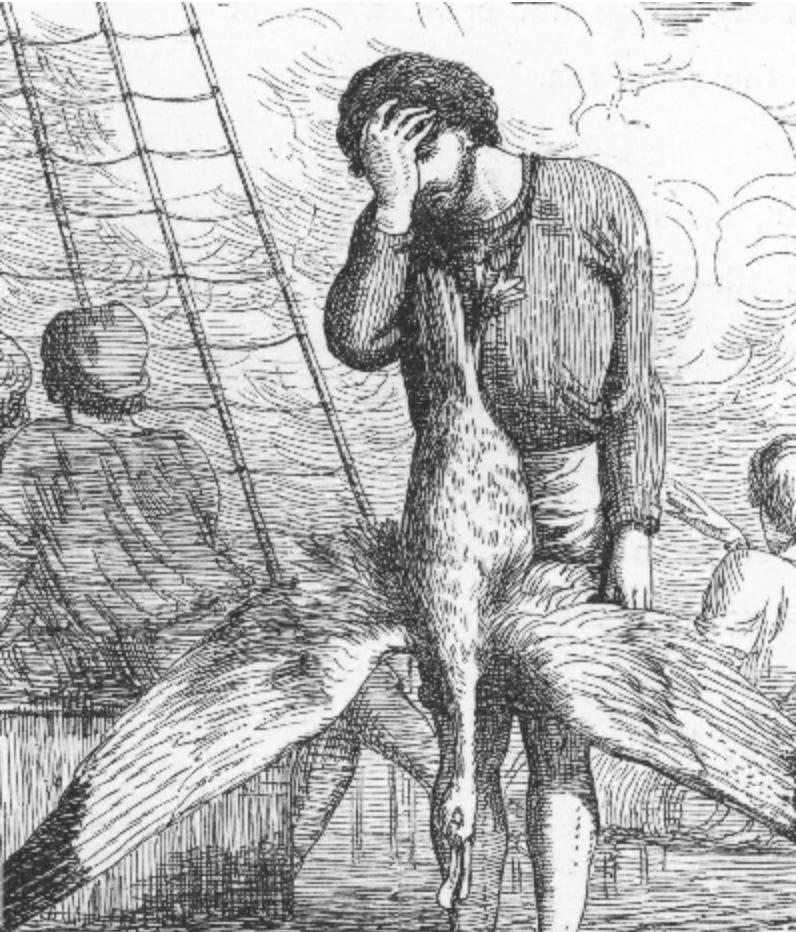

The goal? To improve long-term performance by “introducing higher-returning private assets earlier in the glidepath” - a phrase that conjures visions of majestic, soaring birds. (Gosh, I love that imagery!)

But before you get carried away, a word of caution: watch out for the albatross of illiquidity that may weigh on your glidepath.

💬 Would You Read This?

State Street’s PRIV ETF, one of the more visible attempts to turn private equity into a public market experience, deserves its own breakdown. Let me know if that’s of interest - and if you have other suggestions, please reply to this email.

New here?

Check out some of our popular topics to get started:

Thanks for reading. If you have any questions or suggestions, just hit reply — I’d love to hear from you!

-Leyla

Would love a dive into using AI for analysis

You were in fine form today, Leyla. I laughed a lot. Thanks.

Can't resist taking a shot at that Hamilton Lane plot. A few years ago everybody was showing 10-year performance. Now it's 15 years. Why? Cherry picking. June 2008 was barely above the low and now we see all-time highs. Since the peak in 1999, the total return on the S&P 500 drops to 8%. No clue here about PE returns over time, though.